Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: June 2013

Bernanke’s Exit Strategy Is a Bluff (Video)

Peter Schiff appeared on Business News Now to explain how the US economy housing and stock markets will crumble under the weight of the Fed’s QE and why this is an excellent prospect for gold.

“Unless Ben Bernanke comes clean and admits there’s no tapering, that there’s no exit strategy, that he is going to increase – not diminish – QE, then the markets are going to keep falling… The whole thing is a bluff. There is no exit strategy, there is no tapering, but he can’t admit that.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Videos

Comments Off on Bernanke’s Exit Strategy Is a Bluff (Video)

Today’s Key Gold Headlines – 6/24/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 6/24/13

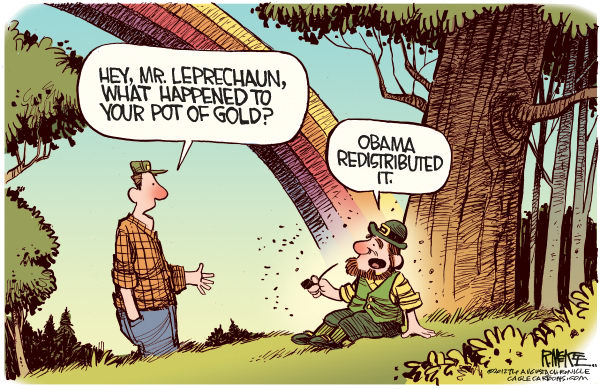

Redistribution Woes

Looks like this leprechaun only had fiat cash – real gold and silver can’t be redistributed. TGIF!

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on Redistribution Woes

Today’s Key Gold Headlines – 6/21/13

- China’s Gold Consumption Poised To Surpass India’s This Year, South China Morning Post

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 6/21/13

Peter Schiff: Phony Recovery Evaporates at Hint of Less QE (Video)

Peter Schiff appeared on Fox Business Markets Now this morning to discuss his reaction to the Federal Reserve’s announcement on interest rates and on Ben Bernanke’s press conference.

“This whole recovery that the Fed believes it created with the QE is evaporating before it even dials it back. I think the that the next thing the Fed is going to do is add to the QE. … They are going to put more crack into the pipe.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Videos

1 Comment

Peter Schiff: The Real Economy is Deteriorating Beneath Our Feet (Video)

Peter Schiff appeared on Yahoo! Breakout yesterday for reaction to the Federal Open Market Committee’s announcement on interest rates and the economy. Peter argued that Fed induced recovery is only making things worse.

“Are we richer or we poorer? Are we growing our liabilities or are we growing our assets? America is getting poorer. We are consuming our way into poverty. We’re borrowing from the rest of the world. We’re trying to reflate a phony economy based on assets prices like real estate and stocks. Meanwhile, the real economy deteriorating beneath our feet.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Videos

Comments Off on Peter Schiff: The Real Economy is Deteriorating Beneath Our Feet (Video)

Today’s Key Gold Headlines – 6/20/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 6/20/13

Ron Paul: Paper Money Always Self-Destructs (Video)

Former Congressman Ron Paul appeared on CNBC.com’s Futures Now yesterday afternoon to discuss why he believes gold “always goes up.” He noted that even five years after the economic crisis, the so-called economic recovery was failure.

“What happens now when the next recession starts under these conditions, where you still have … 20 some million people underemployed, 47 million people on food stamps, and you have a downturn? All they can do is spend more money and print more money – and there’s a limit to this. And I think we’re at that point. … Eventually the market will rule, and it won’t be a happy scene.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Uncategorized, Videos

1 Comment

Today’s Key Gold Headlines – 6/19/13

- Gold Edges Higher as Bernanke Update Nears, MarketWatch

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 6/19/13

Tapering the Taper Talk

In his latest commentary, Peter Schiff tears apart the suggestion that the Fed might start tapering QE this year and reminds us that all the media’s assumptions about the effects of tapering are way off base.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog