Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: July 2013

Peter Schiff: “All Evidence Points to Recession”

In an exclusive interview with Jimmy Mengel of Outsider Club, Peter Schiff talks about the inevitability of another major recession thanks to the Fed’s unending stimulus. Enjoy.

“I think [the Fed will] step on the gas and roll [QE] up to 125 billion or 150 billion. Because it’s like drugs and a tolerance. The economy is so addicted to QE, that the more you maintain it, the more the economy needs to stay high. As the bubble gets bigger, the more air you need to sustain it.

So I don’t think $85 billion is enough. They’re going to have to take it to $125, $150, $200 billion, $250 billion… They’re going to have to do it bigger and bigger. The minute they stop, it’s going to implode.

The more easing we do now, the bigger the government gets, as the national debt gets bigger and bigger. The Fed has to monetize more debt.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Peter's Commentaries

Comments Off on Peter Schiff: “All Evidence Points to Recession”

Today’s Key Gold Headlines – 7/17/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/17/13

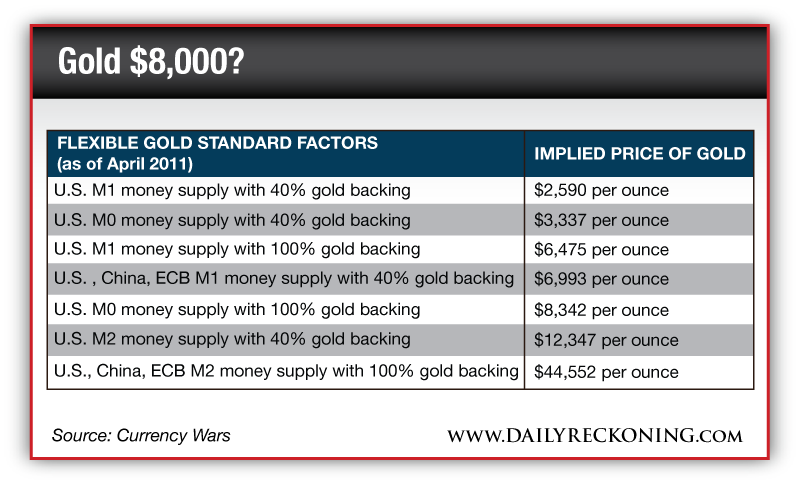

Jim Rickards: Your Personal Gold Standard

Jim Rickards, author of Currency Wars, published an interesting article over at The Daily Reckoning about why you don’t need to wait for central banks to adopt a gold standard before adopting your own.

“There isn’t a central bank in the world that wants to go back to a gold standard. But that’s not the point. The point is whether they will have to.

I’ve had conversations with several of the Federal Reserve Bank presidents. When you ask them point-blank, “Is there a theoretical limit to the Fed’s balance sheet?” they say no. They say there are policy reasons to make it higher or lower, but that there’s no limit to the amount of money you can print.

That is completely wrong. That’s what they say; that’s how they think; and that’s how they act. But in their heart of hearts, some people at the Fed know it’s wrong. Luckily, people can vote with their feet.

I always tell people who say we’re not on the gold standard that, in a way, we are. You can put yourself on a personal gold standard just by buying gold. In other words, if you think that the value of paper money will be in some jeopardy, or confidence in paper money may be lost, one way to protect yourself is by buying gold, and there’s nothing stopping you.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

3 Comments

Today’s Key Gold Headlines – 7/16/13

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/16/13

Phony Government Statistics and Gold’s Role in the Coming Crisis

John Williams, founder of ShadowStats.com, published an excellent commentary with Casey Research last week. Williams compares his truthful, adjusted economic data with the nominal data that the US government points to as signs of recovery. He paints a very clear picture of how close we are to another dramatic economic crisis and emphasizes the importance silver and gold will play in protecting investors from the inevitable inflation and collapse of the dollar.

“Nothing is normal: not the economy, not the financial system, not the financial markets and not the political system. The financial system still remains in the throes and aftershocks of the 2008 panic. A number of underlying problems of that time, tied to the risks of a near-systemic collapse and the related, extreme economic downturn, were pushed into the future—not resolved—by the extraordinary liquidity and systemic-intervention actions taken by the Federal Reserve and federal government. Further panic is possible, and severe US dollar debasement and inflation remain inevitable.

Nonetheless, several major misperceptions appear to have developed in the last month or two concerning an end to the Federal Reserve’s quantitative easing, the level of crisis posed by US fiscal imbalances, and an unfolding recovery in the US economy.

Contrary to currently hyped expectations in the popular financial media, chances are negligible for any serious, near-term reduction in the Federal Reserve’s purchases of US Treasury securities. The Fed has locked itself into ongoing quantitative easing, with fair prospects of expanded, not reduced accommodation in the year ahead. Separately, the long-term solvency issues of the United States should return to the center of attention for the global financial markets by early September 2013. At present, prospects of the US government meaningfully addressing its extreme fiscal imbalances are nonexistent.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on Phony Government Statistics and Gold’s Role in the Coming Crisis

Today’s Key Gold Headlines – 7/15/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/15/13

Santelli & Peter Schiff: The Fed Will Lose Control (Video)

Peter Schiff had a friendly conversation with Rick Santelli this morning on CNBC’s Squawk on the Street. They discussed how the Fed’s quantitative easing has become uncontrollable and why this will make the next crisis even worse than the last.

“I think eventually you’re going to see a real attack on the dollar and the US Treasury market and the Fed’s ability to maintain artificially low interest rates without destroying the dollar… Eventually the Fed is going to lose control of this. And I think the biggest danger is when you start to see the bond market and dollar selling off simultaneously. You throw in a rally in gold and that’s basically the triple threat – you’ve got all the warning bells that the end is near.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Videos

Comments Off on Santelli & Peter Schiff: The Fed Will Lose Control (Video)

Today’s Key Gold Headlines – 7/12/13

- Shanghai Gold Premiums Remain High, Supply Tight, Reuters

- India’s Gold Demand Likely to Rebound From August, Wall Street Journal

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/12/13

Today’s Key Gold Headlines – 7/11/13

- Gold Leaps on Dovish Fed Remarks, Fox Business

- Bullion Demand from China Will Fuel Gold Price Rebound, The Australian

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/11/13

New Report: The Powerful Case for Silver (Video)

Peter Schiff has just released a new research report – The Powerful Case for Silver. The report gives an in-depth analysis of silver’s fundamentals and its unique potential to grow your wealth. Watch Peter introduce the new report in the video below, or:

Download The Powerful Case for Silver Now

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog