Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: September 2013

Today’s Key Gold Headlines – 9/17/13

- Gold Rises on Modest Fed Tapering Expectations, Fox Business

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 9/17/13

Gold Could Easily Hit $2,000 with Black Swan Event (Video)

Last week, Vanessa Collette of GoldSeek.com interviewed global market strategist Dan Popescu at the Toronto Resource Investment Conference hosted by Cambridge House International. Popescu spoke about the role gold plays in the currency war that is pitting Asia and emerging markets against developed Western nations. Given the uncertainty of the US dollar’s stability, he thinks gold could easily surge beyond $2,000 before the end of the year, if an unpredictable “black swan” event should occur.

“Gold is a hard currency, one that most of the central banks are buying now. Even the major developed counties, which used to sell it – now they are not selling it anymore, but they might start also buying it. And China has its own strategy, which is to use gold to give credibility to their currency.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

Comments Off on Gold Could Easily Hit $2,000 with Black Swan Event (Video)

Today’s Key Gold Headlines – 9/16/13

- China Stocks Up on Gold as Price Tumbles, Australian

- Cooling Economy Complicates Fed Plans, MarketWatch

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 9/16/13

Latest Silver News from the Silver Institute

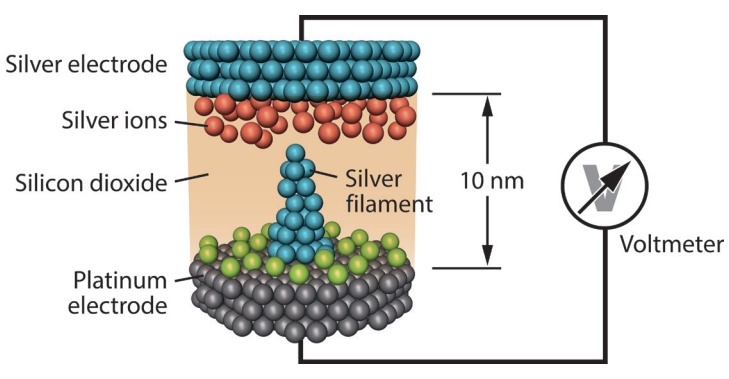

The Silver Institute’s August Silver News was released this week and is full of updates on the ever evolving world of industrial and technological silver applications. Silver might hold the key to letting our smart phone batteries last a whole week, while silver’s antimicrobial properties are garnering attention from large universities. Silver News also explains the differences between the various types of silver that are created around the world.

“You may not have heard the acronym ReRAM, but you will soon. Resistive Random Access Memory or ReRAMs (sometimes written as RRAMs) operate like tiny battery cells and store data through changes in the electrical resistance of the cell. The presence or absence of an electrical charge can be used to store bits of information. Although there are different types of ReRAMs, those using silver ions show excellent promise, according to industry officials.”

Read the Full Silver News Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Latest Silver News from the Silver Institute

Today’s Key Gold Headlines – 9/13/13

- HSBC Lifts 2013 Gold Price Forecast on Higher Physical Demand, Economic Times

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 9/13/13

QE Will Continue until Dollar Collapse (Video)

Peter Schiff appeared on the Business News Network last week to talk about the latest jobs numbers. He spoke about the horrible consequences of quantitative easing and the false recovery that is building to another crisis. Whether the Fed tapers or not, QE is not going to stop until the dollar collapses. Peter tells us what he thinks investors should buy to avoid disaster.

“You don’t want to own paper, you don’t want to own things that governments can print… I’ve been stepping into gold for over ten years… I think we’ve been having a sale on gold, it’s been going on for a few months. I definitely think that if people aren’t in that market, if you don’t own any gold or silver, what are you waiting for? Buy some of it now… What’s going to stop the party is a collapse of the dollar…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews

Comments Off on QE Will Continue until Dollar Collapse (Video)

Choosing Fed Candidates is Like Choosing How to Be Executed

In a post on The Tell, MarketWatch contributor Saumya Vaishampayan summarized Peter Schiff’s analysis of the upcoming replacement of Ben Bernanke as chair of the Federal Reserve. If you agree with Peter that the Fed can’t prevent the coming economic crisis, then he recommends avoiding dollar-denominated debt and investing in hard assets like physical gold and silver.

“It doesn’t matter who takes over as the next chair of the Federal Reserve because the central bank isn’t going to slow its monthly asset purchases.

‘It’s like choosing how you want to be executed,’ said Peter Schiff of Euro Pacific Capital in an animated address ahead of an investment banking conference held by his firm in Manhattan Tuesday.

Schiff’s remarks come as investors brace for a reduction in the Fed’s asset purchases as soon as next week, and as investors also anticipate President Obama will name the next Fed chair by December. That decision, which analysts say is likely down to front-runner Larry Summers, a former Obama Administration adviser, and Fed Vice Chair Janet Yellen, has taken on new urgency because of the impending shift in monetary policy.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Choosing Fed Candidates is Like Choosing How to Be Executed

Today’s Key Gold Headlines – 9/11/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 9/11/13

Peter Schiff: Don’t Hold Breath for Fed to Taper

In an exclusive interview with IndexUniverse.com, Peter Schiff talked about the inevitable crisis that will result from the Fed’s quantitative easing and the eventual collapse of the dollar. Peter explained how important physical gold is as a safe haven asset in times of uncertainty, and why he doesn’t expect the Fed to taper the stimulus anytime soon.

IndexUniverse.com: Do you view the debt ceiling as a potential new crisis, and how do you see it playing out?

Schiff: I don’t see the debt ceiling as the crisis, that’s part of the solution. The crisis is the debt, and the crisis is that we’re going to raise the debt ceiling. We’re going to keep raising the ceiling so we’re going to keep piling more debt on top of the debt that we have.

And, eventually, the crisis comes not because we don’t raise the debt ceiling, but because lenders don’t raise the lending ceiling because they recognize that we’re broke. They won’t want to throw good money after bad, they don’t want to keep lending money to a country that can’t pay back what has already been loaned to it. (more…)

Posted in Interviews

Comments Off on Peter Schiff: Don’t Hold Breath for Fed to Taper

Tapering QE Won’t Prevent Crisis (Video)

On CNBC’s Futures Now, Peter Schiff shared his expectations for gold and the Fed’s tapering announcement on Wednesday. Peter defended his long-term positions in physical gold and argued that the next big thing the Fed is going to do is increase QE.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!