The World Gold Council just released Volume 4 of its Gold Investor. The latest research from the WGC addresses misunderstandings about gold’s value as a long-term hedge against inflation and protector of purchasing power.

“The merits of gold as an investment receives a lot of attention. Investors and market commentators fervently debate whether it could or should be used to protect against inflation, to hedge US dollar exposure, or even tail risk events. And while there is enough literature for and against gold’s roles in a portfolio, or what measures should be used to assess its effectiveness, they are quite often inadequately defined.

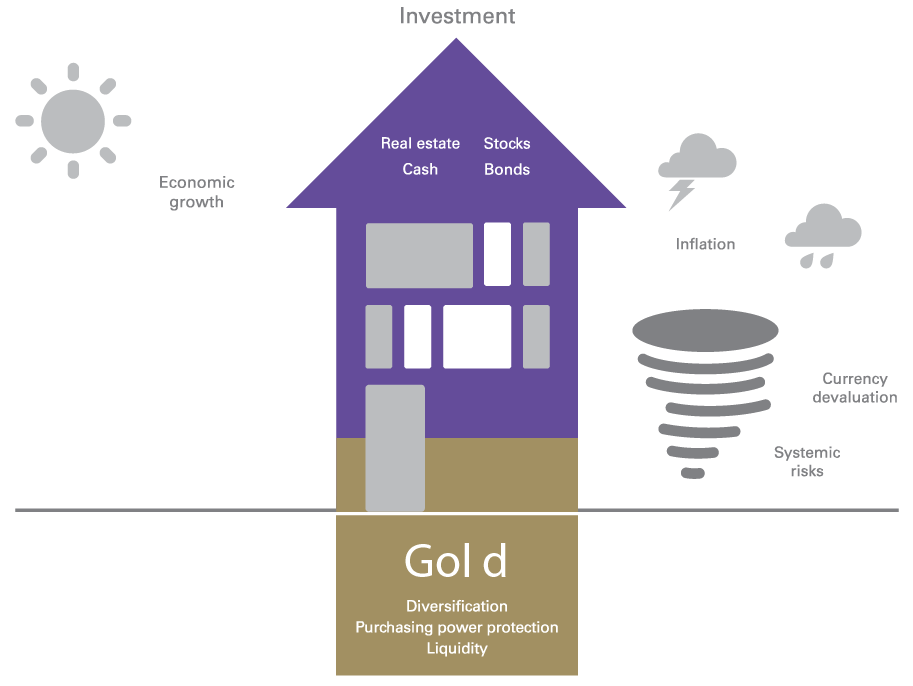

Misunderstandings about gold’s properties have led to multiple articles contesting gold’s role as an inflation hedge, currency hedge, and tail risk hedge, among others. We contend that by properly defining these functions and using appropriate measures, gold’s purchasing power preservation qualities and risk management characteristics become apparent. While gold’s ability to hedge inflation or protect against a very specific kind of risk could be replicated by including securities constructed specifically with that objective, these can often be costly and add an additional set of risks, such as credit or counterparty risk exposure.

Gold is a well rounded, cost effective strategic asset, which held even in a modest amounts (typically 2%-10% of a portfolio) can help investors reduce risk without sacrificing long term returns.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Gold’s Long-Term Risk Management Value

The World Gold Council just released Volume 4 of its Gold Investor. The latest research from the WGC addresses misunderstandings about gold’s value as a long-term hedge against inflation and protector of purchasing power.

Download and Read Gold Investor Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!