Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: November 2013

Today’s Key Gold Headlines – 11/27/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 11/27/13

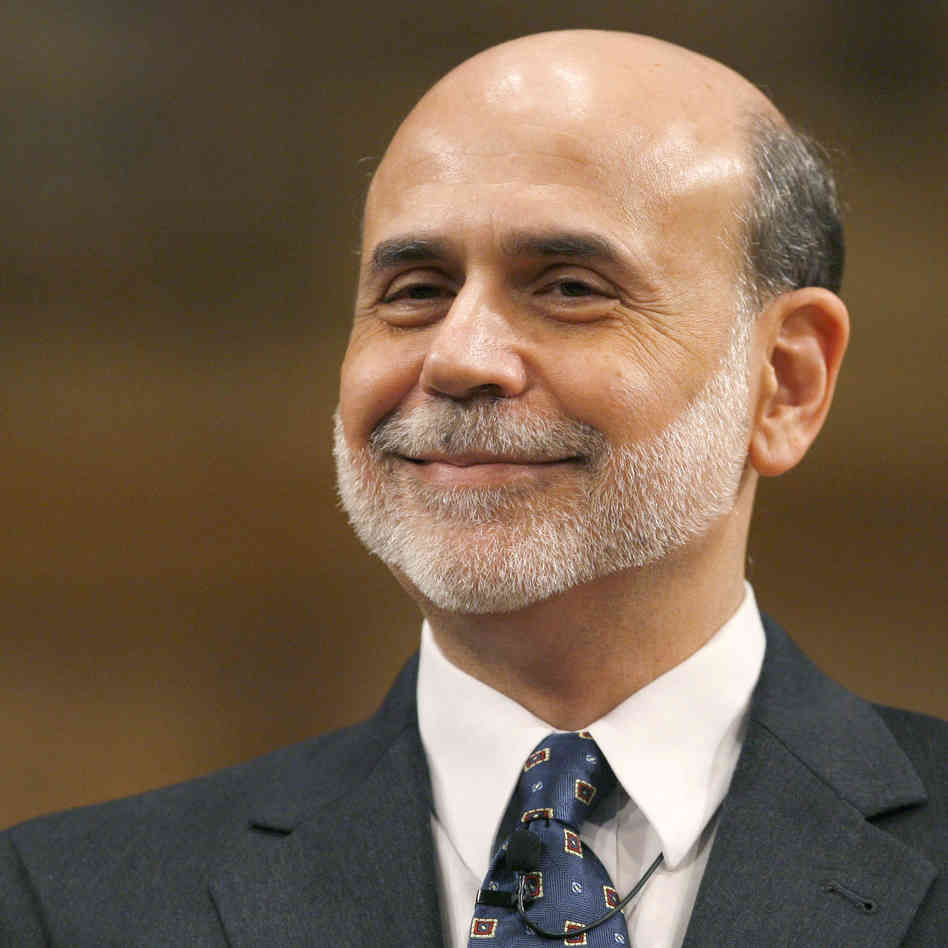

Ben’s Rocket to Nowhere

Peter Schiff released a new commentary yesterday, demolishing Ben Bernanke’s metaphor that likens quantitative easing to the first stage of a rocket being shot into space. Unlike a rocket that can jettison its spent fuel tanks, the economy is going to be dragged down by the lingering effects of QE for years to come.

“Herd mentality can be as frustrating as it is inexplicable. Once a crowd starts moving, momentum can be all that matters and clear signs and warnings are often totally ignored. Financial markets are currently following this pattern with respect to the unshakable belief that the Federal Reserve is ready, willing, and most importantly, able, to immediately execute a wind down of its quantitative easing program. Although the release last week of the minutes of the Fed’s last policy meeting did not contain a shred of hard information about the certainty or timing of a “tapering” campaign, most observers read into it definitive proof that the Fed would jump into action by December or March at the latest. The herd is blissfully unaware that the Fed may not be able to reverse, or even slow, the course of QE without immediately sending the economy back into recession.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries

1 Comment

Today’s Key Gold Headlines – 11/26/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 11/26/13

As Fed Only Talks Taper, China Prepares to Do It (Video)

In his new video blog post, Peter Schiff shares his opinion on the Federal Reserve’s latest press release. He points out that the media has completely misinterpreted the Fed’s message – the FOMC minutes contain no assurance that a December tapering of QE is likely. Peter goes on to talk in depth about how China’s potential exit strategy from its foreign currency reserves will affect the US dollar and the price of gold.

“The truth is, if China means what it says, the Fed is going to have to back up the truck. I mean, not just not taper, but they are going to have to significantly increase the amount of monthly QE that they do in order to pick up China’s slack. That’s what is going to happen in 2014.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries, Videos

1 Comment

Today’s Key Gold Headlines – 11/25/13

- US Banks Warn Fed Interest Cut Could Force Them to Charge Depositors, Financial Times

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 11/25/13

David Stockman: Fed Has Taken Itself Hostage (Video)

Fox Business’ Neil Cavuto spoke with Ronald Reagan’s former budget director, David Stockman, about the rising stock market and taper talk from the Federal Reserve. Stockman, like Peter Schiff, sees bubbles forming throughout the economy and blames the easy money policies of the Federal Reserve. Like Peter, Stockman warns of a massive crash that investors should be preparing for.

“I say it’s [2007], [2008] all over again. Party time. We have bubbles breaking out everywhere and almost a repeat patter… We’re in the fourth bubble created by the Fed with easy money and printing press expansion in this century… This is the biggest one yet.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries, Videos

1 Comment

Today’s Key Gold Headlines – 11/22/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 11/22/13

Bitcoin vs. Gold (Video)

For More Information on Investing in Gold

Call 1-888-GOLD-160 (1-888-465-3160)

Talk now to a Precious Metals Specialist who will be happy to answer your questions.

Request a Callback

Click Here and a Specialist will call you back at your convenience.

Chat Online

Click Here to chat with a Specialist right from your web browser.

Summary: In his latest video, Peter Schiff shares his thoughts on the bitcoin mania that is sweeping the world. After rising from less than $20 to more than $600 in one year, many investors are wondering if bitcoin might be worth the risk. Early adopters pitch bitcoin as “gold 2.0” – a digital currency that cannot be manipulated like fiat money. Bitcoins are even “mined,” similar to physical gold and silver. However, Peter explains why bitcoins still fail as a substitute for gold and strongly urges investors to avoid this risky new currency. Bitcoin could very well have already hit its top, but Peter is confident gold is still well below its future record highs.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries, Videos

29 Comments

Today’s Key Gold Headlines – 11/21/13

- 4 Reasons Gold is Poised for a Comeback, MarketWatch

- Anxiety over Asset Bubbles from Homes to Internet Rising, Bloomberg

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 11/21/13

Ex Fed Governor: What Is QE Really Doing for Americans? (Video)

Kevin Warsh is a former member of the Federal Reserve’s Board of Governors. In an interview on CNBC yesterday, Warsh slams the Federal Reserve for their poor economic models and horrible track record of economic predictions. He goes on to point out that the Fed’s stimulus program does nothing for Main Street and is really just a stimulus program for those with big balance sheets on Wall Street. More and more mainstream economists are following in the footsteps of Peter Schiff and beginning to question the value of the Fed’s stimulus programs.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!