Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: December 2013

Today’s Key Gold Headlines – 12/31/13

- America in 2013, as Told in Charts, NY Times

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 12/31/13

The System Is Insolvent – Buy Gold (Audio)

Chris Waltzek interviewed Peter Schiff on Gold Seek Radio last week. Peter spoke about the debt ceiling debates and how gold will perform with Janet Yellen at the helm of the Federal Reserve.

“Right now, gold is trading as if the crisis is the debt ceiling… [But I think] the only thing standing between gold and higher prices is the debt ceiling, because the debt ceiling would mean no more debt – no more big government, no more spending. Washington would have to act responsibly. Those are negative things for gold. What gold needs is reckless spending, borrowing, and money-printing. Once they’ve raised the debt ceiling, that’s what we get.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews

Comments Off on The System Is Insolvent – Buy Gold (Audio)

Stocks: A Bubble Too Big to Pop? (Video)

Fox Business interviewed Peter Schiff about the stock market’s strong performance following Christmas. Peter elaborated on the problems with the Fed’s upcoming taper and why he thinks it will be forced to increase QE in the future.

“If the Fed did the right thing for the economy and let interest rates go up, the stock market would come crashing down. But I don’t believe the Fed is going to do the right thing. They’re going to keep doing the wrong thing. This bubble is too big to pop. The Fed knows it, so they’re going to keep on supplying air. So…the dollar’s going to go down a lot more in real terms. And yes, gold is going to go up.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Videos

Comments Off on Stocks: A Bubble Too Big to Pop? (Video)

Today’s Key Gold Headlines – 12/27/13

- Many Americans Feel Economy Isn’t Improving, CNN Money

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 12/27/13

3-D Printed Nanosilver & Other Silver Industry News

Enjoy the December 2013 edition of the Silver Institute’s Silver News. This issue includes articles on silver’s use in 3-D printing electrical componenets, testing for cystic fibrosis, and drone cloud seeding to control weather in California.

“Jennifer Lewis, a materials scientist, has developed inks that solidify and become batteries or printed circuit boards. The ultimate end product might be a tiny device, such as a hearing aid or under-the-skin biomedical sensor, that is produced along with its own battery instead of having it inserted later. This battery would not only be smaller than a conventional cell but rechargeable as well.

To make the dream a reality, Lewis has not only produced special inks – many with silver nanoparticles that allow electrical conductivity — but also unique nozzles and other extruders that are attached to 3-D printers. Once ejected by the printer, according to a piece of software’s design, the inks harden and become wires, batteries and other electronic components.”

Read the Full Silver News Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on 3-D Printed Nanosilver & Other Silver Industry News

Today’s Key Gold Headlines – 12/26/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 12/26/13

Cheer Up, Goldbugs – You’re In Good Company!

Some goldbugs might be feeling glum this holiday season after a rough year for the yellow metal, but there are still plenty of contrarian voices advocating gold investment. Casey Research has published a valuable article highlighting the long-term gold bulls who haven’t lost faith. Besides renowned investors like Jim Rogers and Marc Faber, persistent goldbugs also share the company of global central banks and even major commercial banks that have been talking down gold while secretly buying.

“It’s been one of the worst years for gold in a generation. A flood of outflows from gold ETFs, endless tax increases on gold imports in India, and the mirage (albeit a convincing one in the eyes of many) of a supposedly improving economy in the US have all contributed to the constant hammering gold has taken in 2013.

Perhaps worse has been the onslaught of negative press our favorite metal has suffered. It’s felt overwhelming at times and has pushed even some die-hard goldbugs to question their beliefs… not a bad thing, by the way…

This is why it’s important to balance the one-sided message typically heard in the mainstream media with other views. As you break for this holiday season, we’d like to leave you with some of those contrarian voices, all of which have put their money where their mouth is…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Cheer Up, Goldbugs – You’re In Good Company!

Today’s Key Gold Headlines – 12/24/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 12/24/13

Taper Lite & Gold – An Opportunity to Buy (Video)

When does a taper really mean more stimulus? When zero percent interest rates are pretty much guaranteed for the foreseeable future. Peter Schiff explains why the “taper lite” is simply an admittance that the economy is addicted to artificial stimulus. Peter also shares his opinion on gold’s sell-off and why investors should be using the opportunity to buy before it’s too late.

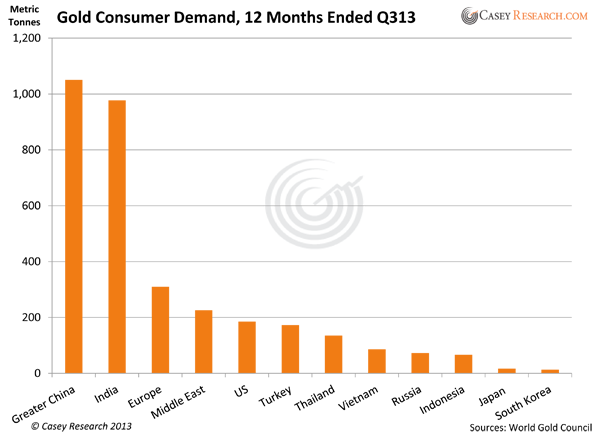

“There’s plenty of legitimate support for gold all around the world. Yes, all the speculators who were convinced that everything is great (the same people who thought it was great in 1999)… are convinced that there’s no reason to own gold and so they’re going to sell it and they’re going to short it. But there’s a larger community around the world, particularly emerging markets, central banks – China in particular – that see it differently. And they’re using this opportunity to buy as much gold as they can…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries, Videos

Comments Off on Taper Lite & Gold – An Opportunity to Buy (Video)

China Is Redefining Global Gold Markets as Supplies Dwindle (Video)

Based upon his recent visit to European gold refiners, Jim Rickards explains the alarming trend of physical gold being gobbled up by China in preparation for the day when the US dollar finally collapses. This short Bloomberg interview with Rickards, author of Currency Wars, is well worth watching.

Watch the Interview Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!