Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: March 2014

Today’s Key Gold Headlines – 3/31/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

1 Comment

Gold for the Long Run

In a new commentary on MarketWatch, Cody Willard explains his reasoning for holding physical gold and silver for the long-term. In spite of short-term bearish sentiment, Willard has to admit that precious metals are an important part of his portfolio for the next 10 to 50 years!

“That doesn’t mean that I’m selling any of my own holdings of physical gold and silver coins and bullion. Far from it. I’d welcome yet another opportunity to scale into more physical gold if there were to be another near-term crash in its prices. I plan to own my own physical gold basically for the next 10 to 50 years. Let’s discuss…

We know that the developed world’s governments here and around the world are actively engaging in broad-reaching currency wars, mostly trying to keep their currencies weak in the name of spurring export growth and helping transnational conglomerates maximize their reported earnings. We know that the Fed is in way uncharted (and frankly, un-”chartered“) territory using all kinds of tools like 0% interest rates and QE and so on to artificially repress interest rates and force people to take on excess risk in search of yield.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Gold for the Long Run

Gold Keeps Politicians Honest (Video)

RT’s Boom Bust interviewed Peter Schiff at length this week. They spoke about overvaluation of the stock market, America’s debt problem, under-reported US inflation, and the power of gold.

“[When the dollar collapses,] hopefully we learn our lesson from this and we go back to real money. We go back to a gold standard and stop trying to think of another government gimmick that is going to work better. It won’t. The politicians want these gimmicks because they can exploit them. They can’t get around gold. Gold forces politicians to behave honestly, which is what they don’t want to do.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Videos

Comments Off on Gold Keeps Politicians Honest (Video)

Today’s Key Gold Headlines – 3/27/14

- Gold Imports by India Seen Rebounding by Billionaire Jeweler, Bloomberg

- World Heading for Bust ‘Unlike Any Other’, says Jeremy Grantham, Sidney Morning Herald

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 3/27/14

Don’t Wait for Yellen to Pause Taper to Buy Gold (Audio)

Kerry Lutz of the Financial Survival Network interviewed Peter Schiff about Janet Yellen and the likelihood that she will eventually pause and reverse quantitative easing. It will be very bullish for gold when the Federal Reserve is forced to admit that the US economy isn’t improving.

“I think we’re just getting started in this [gold] bull market. The catalyst is going to be when Janet Yellen has to fess up. She comes clean and announces the pause. She doesn’t even have to announce that she’s ratcheting up the QE, just that she’s pausing with the taper… The minute they do that, it’s a green light to buy [gold]… But I wouldn’t wait for that… I would be buying in advance. A lot of people are going to be surprised by that announcement and they will buy gold.”

Listen to the Full Interview Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries

Comments Off on Don’t Wait for Yellen to Pause Taper to Buy Gold (Audio)

Today’s Key Gold Headlines – 3/26/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 3/26/14

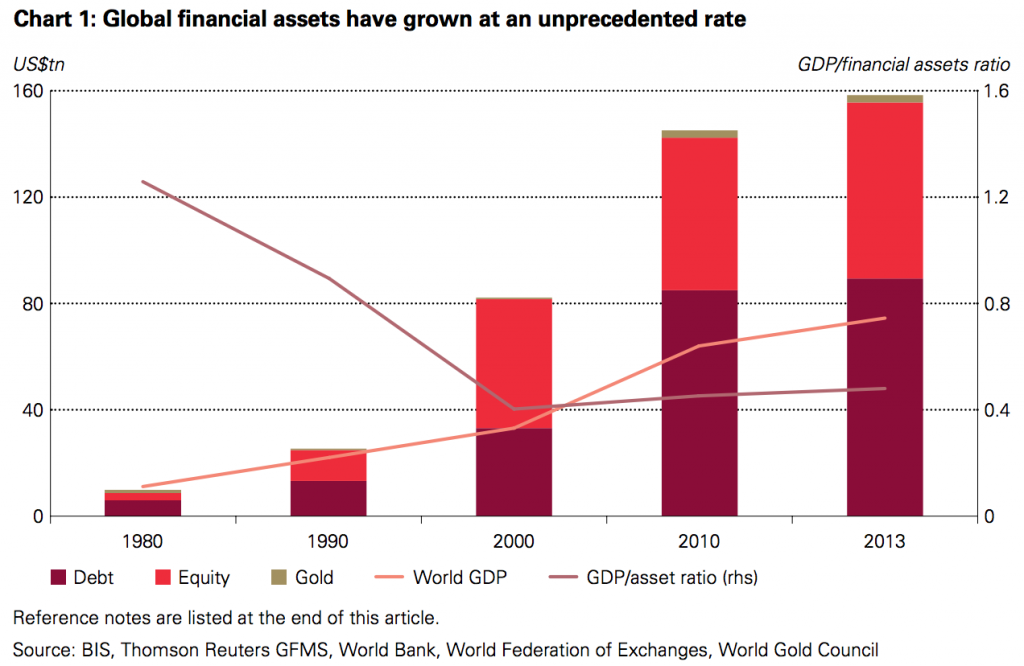

World Gold Investment Is Too Low

According to the World Gold Council’s latest research, most investors are under-allocated to physical gold. In the latest edition of Gold Investor, the WGC explains the importance of gold in an expanding and overvalued global financial system.

“Despite a significant price pullback mostly during 2013, gold has risen for most of the past decade on the back of growth in emerging markets, economic uncertainty, central-bank demand and constrained supply. Even so, gold remains a widely under-owned asset. Gold holdings account for 1% of all financial assets – a by-product both of its scarcity and the unprecedented growth in other financial assets. Further, gold’s low ownership rate stands in stark contrast to levels seen in past decades, as well as what research suggests optimal gold allocations should be.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on World Gold Investment Is Too Low

Today’s Key Gold Headlines – 3/25/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 3/25/14

Gold’s Purpose in a Paper World (Video)

On Yahoo! Finance’s The Daily Ticker, Jim Rickards defends gold as an important safe-haven asset for every investor. Rickards says we must ignore the bearish sentiment and focus on the excellent fundamentals that have not been affected by 2013’s downturn. As confidence in paper currencies collapses, look for gold to rise again.

“When confidence is lost in paper currencies, [it could be that] the IMF, or the Fed, or the ECB have to restore confidence. How do you do it? One way to do it is to go back to a gold standard. If you go back to a gold standard, you have to get the price right. $7,000 to $9,000 is the implied non-deflationary price… A lot of people say you can’t have a gold standard because there’s not enough gold. That’s nonsense, there’s always enough gold, it’s just a question of price.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Gold’s Purpose in a Paper World (Video)

Top Signs the Dollar Is Doomed

Eddie van der Walt at the Bullion Desk interviewed James Rickards last week about the US dollar and gold. Rickards discussed some of the important signs that will signal the end of the world’s reserve currency, many of which are already occurring. Richards argues that gold is one of the best assets to protect yourself from the dollar’s collapse.

Read the Full Interview Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!