Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: April 2014

Today’s Key Gold Headlines – 4/30/14

- GDP Slows to Crawl in First Quarter, Up 0.1%, Wall Street Journal

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 4/30/14

Today’s Key Gold Headlines – 4/29/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 4/29/14

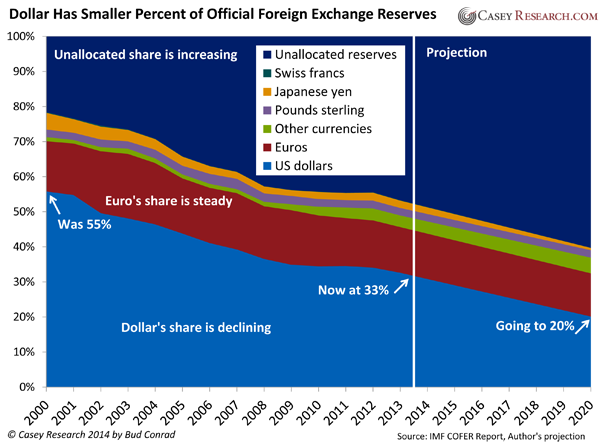

The Dollar’s Days Are Numbered

Bud Conrad’s latest commentary at Casey Research looks closely at the decline of the US dollar as the world’s reserve currency.

“After World War II, the dollar became the world’s preeminent currency. Convertible to gold at $35 an ounce, it was the backbone of international trade. Foreign central banks used it to back their own currencies.

Nixon removed the dollar’s convertibility to gold in 1971, rendering its value dependent on prudent management by its issuer. That issuer, of course, is the Federal Reserve—which conjures dollars into existence to support the US government’s spending habit.

The Fed has issued a lot of dollars since 1971, and even more since the financial crisis of 2008—thanks to Washington’s exploding debt levels. And it’s only going to get worse, as even the Congressional Budget Office (CBO) admits in its own forecasts.

What’s more, CBO debt estimates are notoriously overoptimistic; so while they are daunting, reality will likely be worse.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Dollar’s Days Are Numbered

Today’s Key Gold Headlines – 4/28/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 4/28/14

Peter Schiff’s 2014 Gold Outlook

MarketWatch interviewed Peter Schiff to get the bull case for gold in 2014. In spite of ongoing negative sentiment for the yellow metal, Peter thinks gold will keep rising this year. The only thing that could change his mind would be the Federal Reserve actually ending quantitative easing. He doesn’t expect that to happen, because the US economic recovery is a sham.

“Q: Before this year began, what were your expectations for gold prices and how does that compare with the metal’s performance year to date?

Schiff: I thought that the selloff in 2013 was completely out of touch with reality, so I expected the price to rise this year. In this, I was virtually alone in the financial community. Just about every major investment house had predicted even more losses for gold in 2014. So far this year, gold is the best-performing asset class, but I think the pullback we have seen over the last few weeks is just another indication of how much negative sentiment remains. Ultimately however, the fundamentals will prevail. The Fed will keep printing [dollars] and gold will keep rising.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews

Comments Off on Peter Schiff’s 2014 Gold Outlook

Today’s Key Gold Headlines – 4/25/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 4/25/14

Robbing Savers to Bail Out Bankers

A new opinion piece at MarketWatch rips into the corrupt policies of the Federal Reserve. Al Lewis cites recent analysis that estimates the Fed’s inflationary policies have cost American savers more than $750 billion since the 2008 financial crisis. Last year alone, savers lost more than $120 billion in purchasing power. What’s one of the best ways to protect your savings? Physical gold and silver.

“Our financial system is so corrupt you might say that a fish rots from the Fed.

How else can one describe a regime that punishes savers and rewards borrowers and speculators for years on end? Our central bank is essentially taking billions of dollars a year from average Americans, who are still struggling to get by in a bombed-out economy, and it is giving it — yes, giving it — to the very banks that helped cause the 2008 financial crisis in the first place.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Robbing Savers to Bail Out Bankers

Today’s Key Gold Headlines – 4/24/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 4/24/14

Hungry for Gold?

As Western financial media continues to downplay the importance of gold investment, Asian demand for the metal remains strong. China may have surpassed India as the world’s largest gold consumer last year, but Indians are still desperate to find ways around their government’s strict import tariffs on the yellow metal.

It’s no surprise that Indian gold smuggling has skyrocketed in the past year, but here is one of the most unusual stories we’ve yet heard. An Indian man had twelve gold bars surgically removed from his stomach this past week. It gives a whole new meaning to the old phrase, “You can’t eat money!” If only Americans were this committed to their gold consumption…

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Hungry for Gold?

Gold Levels the Investment Playing Field (Audio)

The BBC interviewed Marcus Grubb, the Managing Director for Investment at the World Gold Council (WGC), about the growing demand for gold in China. Earlier this month, the WGC released a new in-depth research report that showed gold demand in China would increase another 25% by 2017. Grubb explains why gold is such an essential asset not only to the Chinese, but to any investor who wants to avoid the risks of speculative investments and currency debasement.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!