Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: April 2014

Translating Yellen’s Doublespeak (Video)

Last week, Janet Yellen gave her first monetary policy speech as Chair of the Federal Reserve. In this hour-long segment from The Peter Schiff Show, Peter goes into detail dissecting both her speech and follow-up Q&A session.

“When Janet Yellen talks, everybody on Wall Street listens, although I don’t know why. I can’t think of a less relevant opinion of what’s actually going to happen with the US economy than Janet Yellen’s… Janet Yellen’s opinion only counts to the extent that she controls the Fed. And so she will make policy based upon her opinion of what the economy is going to do. But her opinion of what the economy is going to do is no more valid than anybody’s.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries, Videos

1 Comment

Today’s Key Gold Headlines – 4/21/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 4/21/14

The Government’s Campaign of Deflation Fear (Audio)

Chris Waltzek interviewed Peter Schiff on Goldseek Radio yesterday. They talked about the ridiculous government propaganda that deflation is bad for the economy, as well as the prospects for gold in 2014.

“Everybody wants to talk about how last year was the worst year for gold in twenty or thirty years and that this is just a dead cat bounce. The only reason that gold sold off so hard in the second half of 2013 was because so many people jumped to the wrong conclusion at the same time. The Fed said that they were going to end QE and a bunch of people believed it.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries

Comments Off on The Government’s Campaign of Deflation Fear (Audio)

Today’s Key Gold Headlines – 4/18/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 4/18/14

How to Safely Vault Gold & Silver Bullion (Audio)

Last week, Peter interviewed Rob Coleman on The Peter Schiff Show. Coleman is the owner of Gold Silver Vault, LLC. Gold Silver Vault inspects, securely vaults, and internally transfers precious metals. Located in Idaho, it is one of the only facilities in the United States that is not regulated by state or Federal governments. Peter and Rob discussed all the ins and outs of safely storing your precious metals, from insurance to concerns over government confiscation.

“The government doesn’t like people who own gold… We’re trying to get out of paper into real money. They don’t like that. They don’t want anybody escaping from the monetary system that they are perpetrating. They don’t want anybody to protect themselves against inflation. They’re counting on people to be victimized by inflation. When the government steals through inflation, they can only steal from you if you’re holding the currency that they’re inflating. If anybody is in gold and silver, you’re avoiding the inflation tax, and we know the government hates it when people avoid paying taxes.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Videos

Comments Off on How to Safely Vault Gold & Silver Bullion (Audio)

Today’s Key Gold Headlines – 4/17/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 4/17/14

Why Buy Gold? Peter Schiff Debates Gold Bear (Video)

Peter Schiff and Paul Krake got into a heated discussion about gold on CNBC’s Futures Now. They argued about gold’s role as a hedge against inflation and how they expect it to perform in the face of continued central bank money printing.

“I’ve been buying gold for over twelve years… I’ve been recommending it to my clients… Not once have I bought gold because of geopolitical risks. I’ve never even considered that. People that talk about that are the people that don’t buy any gold. I’ve been buying gold for the same reason for the last decade and it’s because central banks are creating too much money. There’s too much inflation, interest rates are too low. So I want to store my purchasing power in something central banks can’t print.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Videos

Comments Off on Why Buy Gold? Peter Schiff Debates Gold Bear (Video)

Today’s Key Gold Headlines – 4/16/14

- Gold Steadies above $1,300, Supported by Ukraine Crisis, Fox Business

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 4/16/14

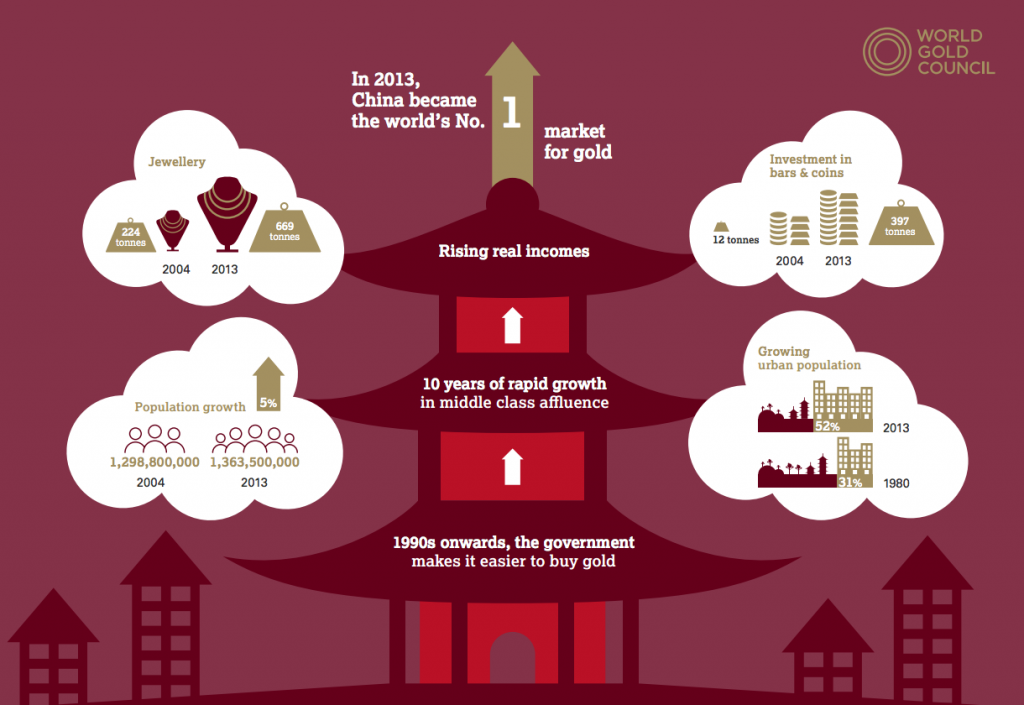

The Future of Chinese Gold Demand

One of the biggest precious metals stories over the past year has been the astounding physical gold demand from Asia, particularly China. The World Gold Council has just released a major report on the history and future of consumer gold demand in China.

“Chinese gold demand in 2013 was exceptional. Jewellery buyers and investors in bullion products took full advantage of the rapid and sizeable fall in local gold prices. They set the bar at a very high level – private sector demand for jewellery, investment and gold used in industrial applications hit a record 1,132 tonnes (t).

We expect 2014 to be a year of consolidation. The sudden price drop in 2013 meant some Chinese consumers brought forward jewellery and bar purchases, which may limit growth in demand in 2014. Expansion by the trade is also expected to slow, particularly in terms of additional manufacturing capacity. However, the lower domestic gold price should support purchases by consumers, especially of 24 carat jewellery. Over the medium term physical gold demand is likely to see further growth driven by a number of factors, including…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Future of Chinese Gold Demand

A Crisis vs THE Crisis

In a new commentary from Casey Research, Laurynas Vegys looks at how the crises in Syria and Ukraine affected the price of gold. Vegys then argues that the most concerning crisis isn’t overseas – it’s the unprecedented levels of US government debt. Sure, gold may respond to volatile international conflicts, but true disaster awaits those Americans who are over-invested in the US dollar.

Read the Full Piece Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!