This is part two of three in a series exploring three key reasons why gold could be the best hedge in the event of a major market correction. For part one, click here.

As we wrote yesterday, there are many stories in the news lately exploring the various ways to protect yourself from a major market correction. They talk about hedge funds shorting US municipal debt, junk bonds, and foreign bonds in Asia and the eurozone. However, hardly anyone in the media mentions the use of physical gold bullion to protect your savings from a stock market crash. We believe gold will outperform any of these conventional “safe havens” for three key reasons.

The second promising factor for gold is that many of the “weak hands” have been shaken out of the gold market. This means that short-term speculators who were just jumping on the bandwagon have exited the gold market. Those that remain are primarily long-term holders who understand the fundamentals of gold.

A primary example of these “weak hands” is those who held “paper gold” investments such as exchange-traded funds (ETFs). In this type of investment, you don’t actually own gold. You simply put your money into a fund that is invested in gold companies or gold bullion. This is very different from holding the physical precious metal yourself. These paper gold investments are very popular with short-term speculators who can make quick money if they’re savvy enough.

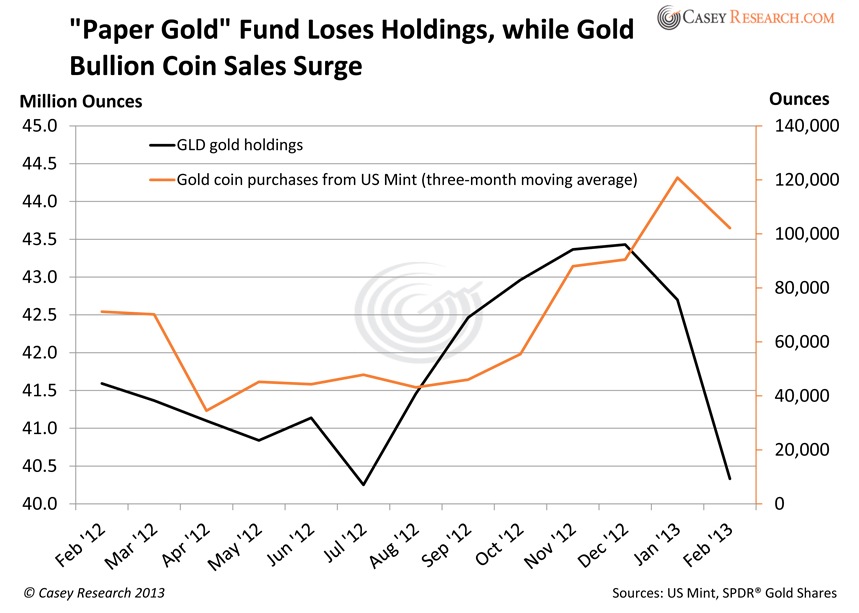

Not surprisingly, the speculators looking to make a quick buck have abandoned gold. As the price of gold began to fall, they were content to sell and cut their losses. This caused a vicious selling cycle that fed on itself and drove down the price of gold even further. The amount of gold ETF investments have fallen below 2010 levels, while gold prices are 20% above 2010 levels. This is a good indicator that a floor has been established.

As you can see in the chart from Casey Research published last year, ETF holdings took a huge dive, especially when compared to purchases of bullion. (Click on the image to enlarge it.)

This is a great illustration of the difference between those who solely buy paper gold and those who hold physical metals. Paper investors and gold speculators never understood gold as a way to protect their wealth from Fed-caused economic crises. On the other hand, owners of physical gold understand that they are holding their wealth in their hands, out of the reach of bureaucrats, central bankers and dollar devaluation.

As governments and central banks continue to double down on the exact same policies that got us into the economic mess we’re in, we can expect to see turbulent waters ahead. We believe gold will be the best hedge against the inevitable market correction.

Check back later this week to learn the third and final reason physical gold bullion is a better hedge than the mainstream alternatives.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!