A recent article on the Wall Street Journal’s blog draws attention to the high cost of producing a single penny – 1.6 cents each, to be exact. They blame this unsustainable price on the high cost of zinc, which makes up 97.5% of every American penny. The online publication Quartz ran with this story, giving it a new headline: “It costs 1.6 cents to make one penny because of the rising price of zinc”. Time for a short economics lesson.

An alternate, more accurate headline for this story would be, “It cost 1.6 cents to make a penny because of currency debasement.” Rather than pondering whether or not the United States should simply stop producing pennies to save money, Americans should really be thinking about the long-term effects of currency debasement that has been going on for generations.

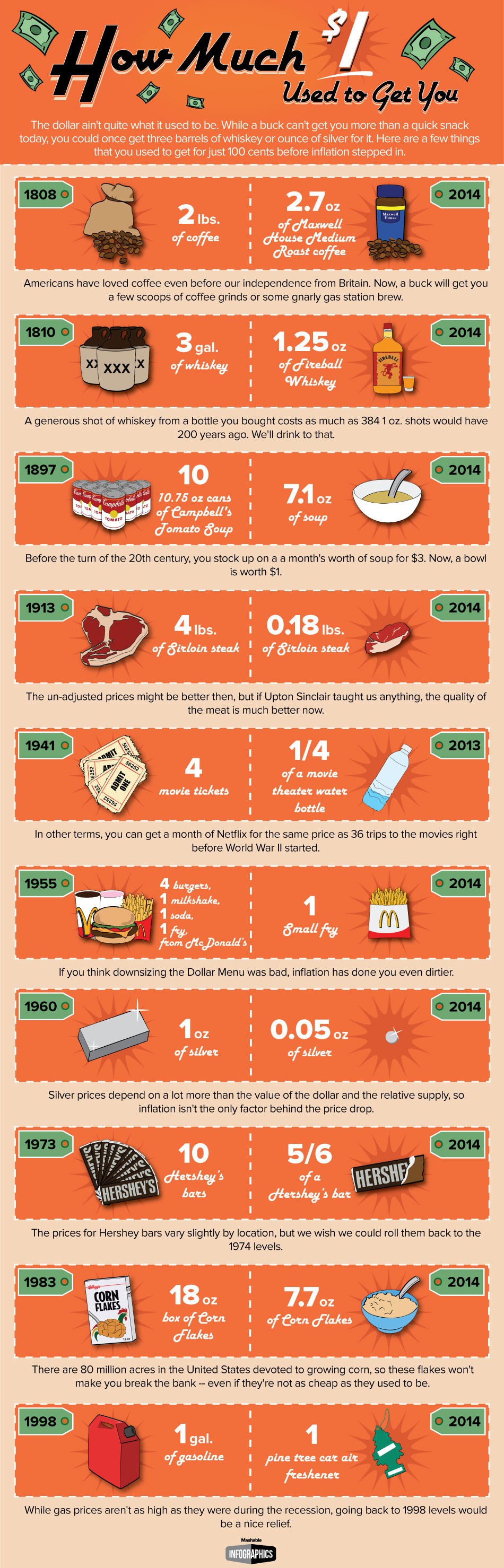

To debase a currency is to weaken its purchasing power. This is often done by inflating the money supply through quantitative easing, which the Federal Reserve has been practicing for years. When a currency is debased, a unit of that currency doesn’t buy the same amount of stuff that it once did. The US dollar has been seriously debased over the last hundred years or more. Just take a look at the handy infographic at the end of this blog post to see how bad it has become.

Currency debasement is the same reason why the US ditched the copper penny in 1982, as well as silver half-dollars, quarters, and dimes in 1964. Today we call these old silver coins “junk silver,” and they’re popular physical precious metals investments. However, they’re anything but junk – they actually contain a useful commodity that has held its value for centuries. It’s not that zinc or copper or silver has become “too expensive,” it’s that those coins have lost some of their purchasing power.

The government debases our currency and says it is because it became too expensive to produce instead of the real reason – destructive monetary policies. The policies of central banks around the world are supposed to stabilize economies and protect the people from currency debasement. However, the truth is that these policies only enrich the politically well-connected, while hurting the poor, those on fixed incomes, and savers.

When currencies aren’t debased, prices tend to fall, not rise. This gives more purchasing power to the poor, those on fixed incomes, and savers. It also decreases the need to gamble savings in the stock market, which means you have fewer bubbles like the one we’re experiencing right now.

So the next time a friend brings up the pretty well-know fact that it costs more to produce a penny than its worth, take the time to educate them about currency debasement.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

I agree that inflation has cost people more and it’s not being accounted for, but is it not a little misleading to compare the prices of goods today to 100 years ago without accounting for median wages for that time period?

Rollover Guy – Your comment smells of the Labor Theory of Value, which has been proven to be false. Read Up!

Peter, I really would love your autograph because I think you’re gonna go down in history as one of the greatest minds of our time. You really are an undervalued mind and under appreciated. I’d love to have your autograph to leave to my son Noah. He’s only 4 but I’ve taught him the difference in paper currency and real money. Thanks to men like you, Mile Maloney and several others I know of, he won’t walk through his life unaware and misinformed. Thank you for everything you do. I’ve learned a lot from you and will continue to strive to be a true free market capitalist like you sir. Semper Fi

Fluctuations in the price level has always been and will continue to be a feature of the market system. Wether or not we observe inflation is not the problem. The issue is more about how much of it could seriously disrupt real economic relationships. At least empirically, It appears to be that risks associated with fluctuations in the price level are asymmetric meaning that a little bit of deflation appears to be more problematic than a little bit of inflation. But it is undeniable that high levels of inflation can create havoc in any economy. History has indeed shown that in countries with high levels of inflation, the less well off tend to suffer much more while the wealthy appear to have the capacity to minimize the impact of currency debasement or even benefit from it. Latin American countries do provide useful insight into this issue as Brazil, Mexico, Argentina and Venezuela have experienced different degrees of hyperinflation.

While it appears that most economists now accept that the simplistic framework of the quantity theory of money is incomplete, it is safe to say that inflation continues to be a monetary phenomena that takes place as as result of a central bank’s accommodation of the “excessive” spending of central governments. In other words, debasements is the result of the political economy of the modern system encompassing, the estate, economic actors and society as a whole.

Is this a perfect system? of course it is not. It tends to produce imbalances overtime that may be difficult/painful to correct, but I am not entirely sure that it is worse relative to the shortcomings that a gold standard type of currency system could generate.

just some thoughts…..

This is just the tip of the iceberg. As Peter often says this counts for the price increase when we should have additionally seen lower prices due to improved efficienciesand technolgies. One person can harvest much more coffee today then a 1000 could in 1808.

this was a blast from the past and really made us think!