Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Daily Gold Headlines

Euro Pacific Precious Metals Is Now SchiffGold

Euro Pacific Precious Metals is now SchiffGold. Follow the link below to explore our new website and watch a personal message from our Chairman Peter Schiff.

WELCOME TO SCHIFFGOLD!

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

1 Comment

Destroying the Dollar a Penny at a Time

A recent article on the Wall Street Journal’s blog draws attention to the high cost of producing a single penny – 1.6 cents each, to be exact. They blame this unsustainable price on the high cost of zinc, which makes up 97.5% of every American penny. The online publication Quartz ran with this story, giving it a new headline: “It costs 1.6 cents to make one penny because of the rising price of zinc”. Time for a short economics lesson.

An alternate, more accurate headline for this story would be, “It cost 1.6 cents to make a penny because of currency debasement.” Rather than pondering whether or not the United States should simply stop producing pennies to save money, Americans should really be thinking about the long-term effects of currency debasement that has been going on for generations.

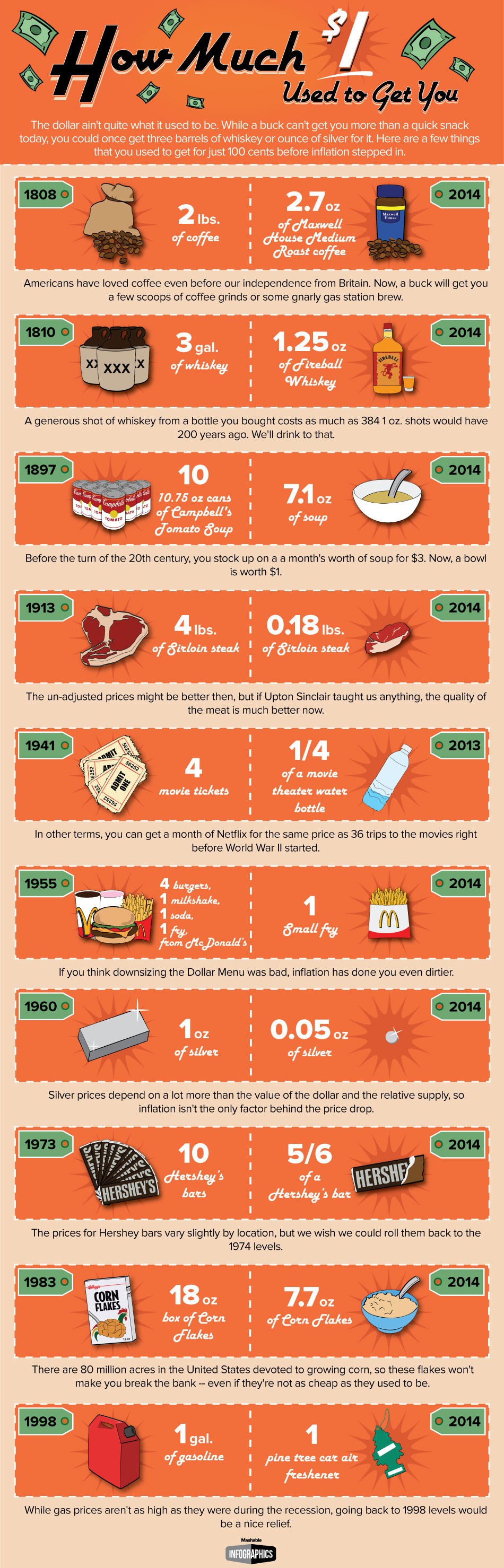

To debase a currency is to weaken its purchasing power. This is often done by inflating the money supply through quantitative easing, which the Federal Reserve has been practicing for years. When a currency is debased, a unit of that currency doesn’t buy the same amount of stuff that it once did. The US dollar has been seriously debased over the last hundred years or more. Just take a look at the handy infographic at the end of this blog post to see how bad it has become.

Currency debasement is the same reason why the US ditched the copper penny in 1982, as well as silver half-dollars, quarters, and dimes in 1964. Today we call these old silver coins “junk silver,” and they’re popular physical precious metals investments. However, they’re anything but junk – they actually contain a useful commodity that has held its value for centuries. It’s not that zinc or copper or silver has become “too expensive,” it’s that those coins have lost some of their purchasing power.

The government debases our currency and says it is because it became too expensive to produce instead of the real reason – destructive monetary policies. The policies of central banks around the world are supposed to stabilize economies and protect the people from currency debasement. However, the truth is that these policies only enrich the politically well-connected, while hurting the poor, those on fixed incomes, and savers.

When currencies aren’t debased, prices tend to fall, not rise. This gives more purchasing power to the poor, those on fixed incomes, and savers. It also decreases the need to gamble savings in the stock market, which means you have fewer bubbles like the one we’re experiencing right now.

So the next time a friend brings up the pretty well-know fact that it costs more to produce a penny than its worth, take the time to educate them about currency debasement.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

6 Comments

Eastern Gold Reserves Are Growing and Growing…

Listening to the financial media, you might be convinced that the precious metals – gold in particular – are simply not considered reliable investments anymore. This is a viewpoint peculiar to the West, as Peter Schiff has repeatedly emphasized. However, every now and then, the mainstream media shares some news reminding us that while Americans and Europeans might be disenchanted with the yellow metal, other countries are still very concerned with protecting their savings with the hard asset that has served as a safe-haven for thousands of years. Often that news comes from countries that have a much longer history of troubled economies, and therefore a greater understanding of what assets carry real value in this world.

Today, for instance, Bloomberg published two stories about central bank and Chinese gold demand. In the first, “China May Boost Gold Reserves Amid Imbalances in Holdings“, Bloomberg reports on research from the London-based Official Monetary and Financial Institutions Forum. David Marsh, managing director of the Forum, reminds us that while China hasn’t officially announced an increase in its gold reserves since 2009, there is a good chance that it will very soon. Marsh vaguely suggests that China has been adding to its reserves since 2009 “in different ways.”

Additionally, Bloomberg notes that according to the official figures, Russia has surpassed China to become the fifth-largest gold-holding country in the world. In general, central banks of the world have been net buyers of gold for 14 straight quarters, or 3-1/2 years. So while Wall Street speculators might have been shying away from the yellow metal since it has come down from its 2011 peak, the powers that actually control the world’s money supply have been gobbling up gold. As Marsh puts it:

“Gold will become more traded amongst central banks in the next 30 years because there are colossal imbalances in world gold holdings as a percentage of overall asset reserves.”

Bloomberg’s second article on Chinese gold demand notes that the Chinese Gold & Silver Exchange Society of Hong Kong has become the first non-mainland entity to be allowed warehouse access by China. Construction of the new vault storage facility will begin in Shenzhen next year. It will have a capacity of 1,500 tons. This is just another signal that China is preparing to position itself as the hub of the international gold trade in the years to come.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Eastern Gold Reserves Are Growing and Growing…

Is the World at ‘Peak Gold’?

This week, Chuck Jeannes told The Wall Street Journal that either this year or next, miners will have reached “peak gold.” Peak gold means that the amount of gold being pulled out of the earth will begin to shrink every year, rather than increase, which has been the case since the 1970s. Jeannes is the chief executive of the world’s largest gold mining company, Goldcorp, so it’s probably safe to assume he knows a thing or two about mining the yellow metal.

Let’s put this into context. Central banks continue to stockpile gold (even Scotland is wondering how much of the United Kingdom’s gold it will get if it becomes an independent country). Nobody knows how much gold China is hoarding, but pretty much everyone assumes it’s a lot more than the official reports. Smart economists like Peter Schiff and Jim Rickards have been pointing out for a year now that gold buyers throughout Asia are accumulating more and more gold from Western investors, and they have almost no intention of selling it.

For physical precious metals investors, all of this news should hit home. What happens when this robust demand for gold runs up against the hard limits of the mining industry? This is simple supply and demand – prices go up.

“As gold production declines, the miner’s job becomes harder, as companies compete for increasingly rare deposits. Discoveries have already tapered off. In 1995, 22 gold deposits with at least two million ounces of gold each were discovered, according to SNL Metals Economics Group. In 2010, there were six such discoveries, and in 2011 there was one. In 2012: nothing.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

1 Comment

The Amazing World of Silver Technology

The Silver Institute’s August edition of Silver News is now available. This issue explains the fundamentals behind the surging growth in demand for industrial silver, which is expected to exceed global GDP growth through 2016. The constantly evolving industry for silver technology is largely to thank for this increasing demand. August’s Silver News highlights some of the fascinating new applications of silver, including:

- Two forms of 3D printing with silver

- Using heated nanosilver to treat cancer

- Screen-printed silver circuits that cure in UV light

- Antibacterial silver on home hardware products

You’ll also find an explanation of how silver is used as an essential chemical catalyst in the production of ethylene oxide (EO), which in turn is needed to create ethylene glycol. Ethylene glycol is one of the most important substances in our modern world.

“Ethylene glycol, in turn, is used to produce many products including polyester fibers for clothes and carpets, plastics, solvents and other chemicals, and even antifreeze formulations. By itself, EO is used to sterilize many health-care products and medical instruments, including delicate electronic or optical tools, which would be harmed by the high heat or radiation sterilization processes. EO is also used to accelerate the aging of tobacco leaves, as a fungicide, and even as a preservative for spices.”

Image: Tanaka’s printed silver circuit board.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on The Amazing World of Silver Technology

‘Shrinkflation’: The Prelude to True Inflation

The financial media regularly plays down reports of consumer price inflation that are much higher than the official numbers. Even worse, analysts generally argue that more inflation is needed for the health of the US economy. Pippa Malmgren, author of a new book, Signals: The Breakdown of the Social Contract and the Rise of Geopolitics, has been studying price inflation that is cleverly hidden – she calls it “shrinkflation.”

Shrinkflation occurs when consumer products cost the same, but contain less. For instance, Malmgren points to Cadbury chocolate bars that were reduced in size in 2011, while the price remained the same. Nestle’s Shredded Wheat and Carlsberg beer are two other major products that are practicing shrinkflation. Haagen-Dazs shrunk its “pint” of ice cream by 20% in 2011. Here’s an entire list of shrinkflation products published by CNN Money three years ago. Peter Schiff has talked about this very phenomenon in his videos and podcasts for years.

The financial media will likely downplay this trend in favor of broader, “official” measures of inflation that show prices are well under control. However, they’d be missing one of Melmgren’s most important insights: “Shrinking the size of goods is exactly what happened in the 1970s just before inflation proper set in.” At a certain point, a company can’t just keep lopping squares off the chocolate bar – they’re going to have to raise the price.

Remember, if there’s one thing you want to be holding when inflation really hits hard, it’s physical gold and silver bullion.

Read the Full Article on Shrinkflation Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on ‘Shrinkflation’: The Prelude to True Inflation

American Workers: The Economy Is Terrible

The John J. Heldrich Center for Workforce Development at Rutgers University released its latest Work Trends report. The national survey found that Americans are extremely pessimistic about the state of the US economy in spite of the financial media’s claims that a strong economic recovery is underway. The report is titled “Unhappy, Worried and Pessimistic: Americans in the Aftermath of the Great Recession”. Some of its major findings include:

- One-quarter of the public says they’ve experience a major decline in quality of life.

- Only one-sixth of Americans believe the next generation will have better opportunities than the current generation.

- Most Americans don’t think the economy improved last year or will in the next.

- Four in five Americans don’t have any faith that the government will be able to improve conditions in the next year.

The report paints a bleak picture of the American workforce and economy coming from the direct experience of American laborers. Cliff Zukin, co-director of the surveys, said:

“Looking at the aftermath of the recession, it is clear that the American landscape has been significantly rearranged. With the passage of time, the public has become convinced that they are at a new normal of a lower, poorer quality of life. The human cost is truly staggering.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines, Outside Commentaries

Comments Off on American Workers: The Economy Is Terrible

Court Freezes Assets of Merit Gold Executives

A Los Angeles Superior Court judge has issued a restraining order freezing the assets of Merit Gold owners Peter Epstein and Michael Getlin. Also included in the court document is an order for Merit to cease and desist accepting payments from its customers. The judge found that it was very likely that the company “was permeated with fraud.” A trial date has been set for October 14.

On August 5th, Merit Financial allegedly committed what appears to be a fraudulent transfer when it sold its assets to Credit Management Association for just $1.00. This triggered the restraining order.

Merit Gold and Silver has closed its doors and is no longer selling precious metals. If you missed the news this past February, the Santa Monica City Attorney’s Office had filed a consumer protection lawsuit against Seacoast Coin, Inc., which is the parent company of Merit Financial and Merit Gold and Silver. Merit Gold was one of the largest precious metals dealers in the nation and operated large national TV advertising campaigns.

Merit Gold allegedly used aggressive “bait and switch” tactics to lure in customers nationwide. The lawsuit said it would draw customers in to buy gold bullion at just “1% over cost.” Then, Merit salespeople apparently would trick customers into buying “collector” coins that carried very large mark-ups.

It is alleged that Merit falsely told customers various deceptive statements about their collectible products, including:

“That the coins are a better investment than bullion; that the coins offer more privacy than bullion; that the coins are not “reportable” on consumers’ taxes; that the coins can’t be confiscated by the government, while bullion can be.”

The complaint says that the coins that Merit sold had “none of these advantages.” City attorneys say that Merit swindled millions of dollars from its customers, many of whom were seniors.

Euro Pacific Precious Metals has never and will never sell “numismatic” or “collectible” gold and silver products. We do not recommend them to serious investors.

Please give us a call if you would like to speak more about this:

1-888-GOLD-160 (1-888-465-3160)

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

2 Comments

Prominent Voices Warning of Stock Market Bubble

Stocks continue to soar to record highs and the media breathlessly touts the economic recovery. But the Fed-fueled bull market for stocks can’t last forever. In an article from CNN Money, some renowned experts are issuing ominous warnings:

- Nobel Prize-winning economist Robert Shiller says the stock market is looking very expensive. By his metric, stocks have only been at their current level three other times: 1929, 1999, and 2007.

- Hedge fund king Carl Ichan says, “We are in an asset bubble.” He describes a “dangerous financial situation” dependent on the Federal Reserve continuously refilling the punchbowl to stimulate the economy.

- Ex-Treasury Secretary Robert Rubin says that extremely low interest rates have caused major instability and could lead to another financial crisis. When the bubble pops and hedge funds all head for the doors at the same time there is a risk of a “contagion and snowballing effect.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines, Outside Commentaries

Comments Off on Prominent Voices Warning of Stock Market Bubble

The Swiss Want Even More Economic Freedom (and Gold)

Switzerland is ranked as the freest economy in Europe in the 2014 Index of Economic Freedom, published by the Heritage Foundation in partnership with the Wall Street Journal. In the world rankings, Switzerland is the 4th most economic free country. While the United States Federal Reserve argues that inflation is necessary for economic stability, it should be noted that Switzerland has achieved its economic freedom with a current inflation rate of negative 0.7%. That means consumer goods are getting cheaper for the average Swiss citizen every year. Try to wrap your head around that, Janet Yellen. And while you’re at it, explain why the United States isn’t even in the top 10 freest economies in the world.

Yet in spite of this relative prosperity, the Swiss populace is not satisfied. They want more freedom and are getting ready to demand more economic responsibility from their central bank, the Swiss National Bank (SNB). This fall, the citizens of Switzerland will be voting on a referendum that would dramatically alter the SNB’s gold bullion allocations and holding policy.

If passed, the initiative would dictate three important gold policies for the SNB:

- 20% of the SNB’s assets would have to be held in physical gold bullion.

- All Swiss gold would have to be repatriated from foreign countries back into domestic Swiss vaults.

- The SNB would no longer be allowed to sell any Swiss gold.

This initiative would force the Swiss central bank to make large purchases of the yellow metal to comply with the new guidelines. Not only that, it would make it very difficult for the SNB to manipulate the Swiss economy with destructive monetary policies. It’s a lot harder to lend money to irresponsible politicians when your holdings are in hard assets like gold bullion. Unsurprisingly, the bureaucrats of the Swiss Parliament and SNB are strongly opposed to the initiative.

Back in May, a guest columnist for David Stockman’s blog Contra Corner wrote in detail about the Keynesian opposition to Swiss gold repatriation. He raised some excellent points countering the SNB’s argument that the gold initiative would severely limit its flexibility and damage its credibility.

Dr. Ron Paul brought the referendum back into the limelight just the other week in a new essay published at The Ron Paul Institute. As always, Dr. Paul brings common-sense wisdom to the table and urges the Swiss to vote for gold and freedom.

So while the United States and much of the West seems to have become completely disenchanted with the yellow metal, there is a bright spot over in Europe. Just as Dr. Paul points out, if the Swiss pass their gold referendum, it could play a huge role in reestablishing gold as a foundational monetary asset for modern economies.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!