Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Outside Commentaries

American Workers: The Economy Is Terrible

The John J. Heldrich Center for Workforce Development at Rutgers University released its latest Work Trends report. The national survey found that Americans are extremely pessimistic about the state of the US economy in spite of the financial media’s claims that a strong economic recovery is underway. The report is titled “Unhappy, Worried and Pessimistic: Americans in the Aftermath of the Great Recession”. Some of its major findings include:

- One-quarter of the public says they’ve experience a major decline in quality of life.

- Only one-sixth of Americans believe the next generation will have better opportunities than the current generation.

- Most Americans don’t think the economy improved last year or will in the next.

- Four in five Americans don’t have any faith that the government will be able to improve conditions in the next year.

The report paints a bleak picture of the American workforce and economy coming from the direct experience of American laborers. Cliff Zukin, co-director of the surveys, said:

“Looking at the aftermath of the recession, it is clear that the American landscape has been significantly rearranged. With the passage of time, the public has become convinced that they are at a new normal of a lower, poorer quality of life. The human cost is truly staggering.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines, Outside Commentaries

Comments Off on American Workers: The Economy Is Terrible

Jim Grant: The Word for Inflation Is “Bull Market” (Video)

Jim Grant, publisher of Grant’s Interest Rate Observer, was interviewed by Steve Forbes. Grant gives a grim overview of the economy, saying that the Federal Reserve’s suppression of interest rates and the creation of “unimaginable amounts of digital money” since 2007 have caused major distortions. He argues that economic intervention leads to more economic intervention until the “the patient is over-medicated.” This is the same argument that Peter Schiff has made for years.

“Inflation is too much money and credit. That’s the cause. The symptoms are variable. The word for inflation is: bull market…

Gold is a universal currency. People recognize it at sight. The derivation of the term ‘sound money’ is – [Clang! He drops a gold American Eagle coin on the table]. Isn’t that lovely?”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Jim Grant: The Word for Inflation Is “Bull Market” (Video)

Clueless in Wyoming

Central bankers from around the world got together last week in Jackson Hole, Wyoming for their yearly monetary mixer. We know they talked a lot about how central bank monetary policies could “help” the world with its economic woes. But there’s one thing we can be sure they didn’t discuss – how many of the world’s economic problems are created by these very same policies. In a new commentary, Steve Forbes analyses six areas about which these central bankers are completely clueless.

- The role of money: Central bankers think money controls economic activity, instead of the other way around. Thus, they believe they can successfully manipulate the economy into real growth with their monetary meddling.

- What money is: Money itself isn’t wealth. Money measures wealth and reflects marketplace activity. Creating more of it is counterfeiting, a.k.a. theft.

- Commerce does not cause inflation: On the contrary, central banks cause inflation when they create more currency.

- Manipulating interest rates is equivalent to price controls: Interest rates are the price we pay to borrow money. Just like any other price, the market should set them.

- The job of central banks is to keep the value of money stable: They have clearly failed at this. The gold standard is the best system ever devised for keeping the value of a currency stable. The whims of central planners have failed over and over, and nothing will change this time around.

- Monetary policy can’t cure an economy’s structural flaws: Taxes, regulations, and labor laws are suffocating economies all throughout the world. Even if central bankers were able to overcome the failures of central planning through monetary policy, they could not overcome the barriers of regulations.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Clueless in Wyoming

Former Mob Boss: Avoid Wall Street, Buy Physical Gold (Video)

Michael Franzese, a former mob boss who went straight following a 10-year prison term, thinks stocks are in a bubble. He says he has worked with many of the people on Wall Street and doesn’t feel comfortable letting “shady” characters handle his money. In 1986, Franzese ranked No. 8 on Fortune Magazine’s list of the 50 wealthiest and most powerful mob bosses.

Franzese says he thinks he can do better with his money than Wall Street speculators. In fact, his number one piece of advice to investors is to not even bother with stocks. He strongly recommends physical gold bullion specifically, because “No matter what, it’s always going to have value. Unlike stocks, where…you go to sleep, everyone tells you everything is wonderful, you wake up and everything is gone.”

Investors don’t need to trust an ex-mob boss with their wealth in order to recognize the truth of his words. As someone who had first hand experience dealing with the casino on Wall Street, Franzese wants no part of it. He prefers to have his money in his own hands, not in the system that has proven over and over again it can’t be trusted.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Former Mob Boss: Avoid Wall Street, Buy Physical Gold (Video)

Prominent Voices Warning of Stock Market Bubble

Stocks continue to soar to record highs and the media breathlessly touts the economic recovery. But the Fed-fueled bull market for stocks can’t last forever. In an article from CNN Money, some renowned experts are issuing ominous warnings:

- Nobel Prize-winning economist Robert Shiller says the stock market is looking very expensive. By his metric, stocks have only been at their current level three other times: 1929, 1999, and 2007.

- Hedge fund king Carl Ichan says, “We are in an asset bubble.” He describes a “dangerous financial situation” dependent on the Federal Reserve continuously refilling the punchbowl to stimulate the economy.

- Ex-Treasury Secretary Robert Rubin says that extremely low interest rates have caused major instability and could lead to another financial crisis. When the bubble pops and hedge funds all head for the doors at the same time there is a risk of a “contagion and snowballing effect.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines, Outside Commentaries

Comments Off on Prominent Voices Warning of Stock Market Bubble

The Global Economy Is In a Depression (Video)

Jim Rickards, author of The Death of Money, was interviewed on RT. Jim checks off a daunting list of countries around the world experiencing economic difficulties and offers analysis of what is really going on.

What’s happening in Germany is happening all over the world. Germany’s economy contracted… Italy’s already contracted. France has two quarters in a row of zero GDP. The United States in the first half [of 2014]… did not even grow 1%… China is slowing down, and of course, Japan fell off a cliff. If you look around the world, it looks like we’re going into a global recession, except I would say this is a continuation of a global depression that began in 2007… This is not a normal recovery, not a normal business cycle…

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

2 Comments

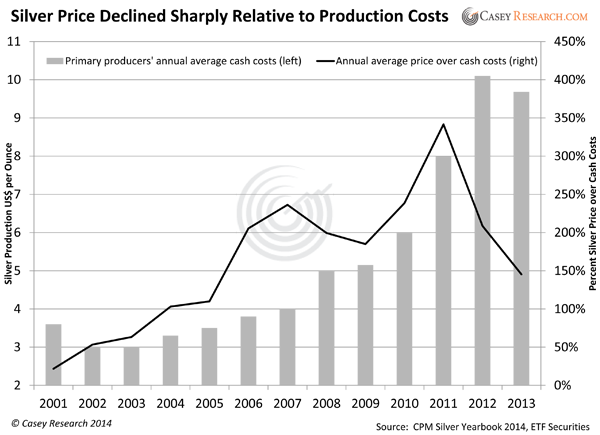

Silver Can Protect You from “Financial Heroin”

Jeff Clark of Casey Research has just released a new commentary laying out his reasoning for buying silver right now. From the rising cost of production to Asian demand, Clark goes into detail about the latest silver fundamentals that serious precious metals investors need to be aware of.

“The drugs of choice for governments—money printing, deficit spending, and nonstop debt increases—have proved too addictive for world leaders to break their habits. At this point, the US and other governments around the world have toked, snorted, and mainlined their way into an addictive corner; they are completely hooked. The Fed and their international central-bank peers are the drug pushers, providing the easy money to keep the high going. And despite the Fed’s latest taper of bond purchases, past actions will not be consequence-free.

At first, drug-induced highs feel euphoric, but eventually the body breaks down from the abuse. Similarly, artificial stimuli and sub-rosa manipulations by central banks have delivered their special effects—but addiction always leads to a systemic breakdown.

When government financial heroin addicts are finally forced into cold-turkey withdrawal, the ensuing crisis will spark a rush into precious metals. The situation will be exacerbated when assets perceived as “safe” today—like bonds and the almighty greenback—enter bear markets or crash entirely.

As a result, the rise in silver prices from current levels won’t be 10% or 20%—but a double, triple, or more.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Silver Can Protect You from “Financial Heroin”

Silver Demand to Increase by 20-Million Ounces by 2018

According to a new report released by the Silver Institute, the demand for silver is expected to exceed projected global GDP growth. Silver demand should grow by 5% per year from 2014 to 2016. Demand for industrial silver, which accounts for over 50% of global demand, will rise due to its use in three key areas: flexible electronics displays, LEDs, and semiconductor computer chips.

“With the introduction of these advanced uses of silver in the electrical and electronics category, which last year provided over 40% of total silver industrial demand, along with growth in established uses, we should see silver industrial demand develop even further, especially as economies grow globally.” – Michael DiRienzo, Executive Director of the Silver Institute.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Silver Demand to Increase by 20-Million Ounces by 2018

Don’t Believe the News, China Still LOVES Gold

If you’ve been following the mainstream media, you might be under the false impression that the largest consumer of gold in the world – China – is no longer so enamored with the yellow metal. The financial media could not be more wrong, and it should come as no surprise to our readers that they are cherry-picking their facts. To clear up just how strong Chinese gold demand really is, Jeff Clark of Casey Research has published this in-depth analysis of the Chinese gold hoard. He clears up all sorts of common misconceptions that have been in the news lately.

“Gold Demand in China Is Falling. This headline comes from mainstream claims that China is buying less gold this year than last. The International Business Times cites a 30% drop in demand during the ‘Golden Week’ holiday period in May. Many articles point to lower net imports through Hong Kong in the second quarter of the year. “The buying frenzy, triggered by a price slump last April, has not been repeated this year,” reports Kitco.

However, these articles overlook the fact that the Chinese government now accepts gold imports directly into Beijing.

In other words, some of the gold that normally went through Hong Kong is instead shipped to the capital. Bypassing the normal trade routes means these shipments are essentially done in secret. This makes the Western headline misleading at best, and at worst could lead investors to make incorrect decisions about gold’s future.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Don’t Believe the News, China Still LOVES Gold

The Swiss Want Even More Economic Freedom (and Gold)

Switzerland is ranked as the freest economy in Europe in the 2014 Index of Economic Freedom, published by the Heritage Foundation in partnership with the Wall Street Journal. In the world rankings, Switzerland is the 4th most economic free country. While the United States Federal Reserve argues that inflation is necessary for economic stability, it should be noted that Switzerland has achieved its economic freedom with a current inflation rate of negative 0.7%. That means consumer goods are getting cheaper for the average Swiss citizen every year. Try to wrap your head around that, Janet Yellen. And while you’re at it, explain why the United States isn’t even in the top 10 freest economies in the world.

Yet in spite of this relative prosperity, the Swiss populace is not satisfied. They want more freedom and are getting ready to demand more economic responsibility from their central bank, the Swiss National Bank (SNB). This fall, the citizens of Switzerland will be voting on a referendum that would dramatically alter the SNB’s gold bullion allocations and holding policy.

If passed, the initiative would dictate three important gold policies for the SNB:

- 20% of the SNB’s assets would have to be held in physical gold bullion.

- All Swiss gold would have to be repatriated from foreign countries back into domestic Swiss vaults.

- The SNB would no longer be allowed to sell any Swiss gold.

This initiative would force the Swiss central bank to make large purchases of the yellow metal to comply with the new guidelines. Not only that, it would make it very difficult for the SNB to manipulate the Swiss economy with destructive monetary policies. It’s a lot harder to lend money to irresponsible politicians when your holdings are in hard assets like gold bullion. Unsurprisingly, the bureaucrats of the Swiss Parliament and SNB are strongly opposed to the initiative.

Back in May, a guest columnist for David Stockman’s blog Contra Corner wrote in detail about the Keynesian opposition to Swiss gold repatriation. He raised some excellent points countering the SNB’s argument that the gold initiative would severely limit its flexibility and damage its credibility.

Dr. Ron Paul brought the referendum back into the limelight just the other week in a new essay published at The Ron Paul Institute. As always, Dr. Paul brings common-sense wisdom to the table and urges the Swiss to vote for gold and freedom.

So while the United States and much of the West seems to have become completely disenchanted with the yellow metal, there is a bright spot over in Europe. Just as Dr. Paul points out, if the Swiss pass their gold referendum, it could play a huge role in reestablishing gold as a foundational monetary asset for modern economies.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!