Peter answers some of the more challenging questions he has received from you, his loyal clients and subscribers. Learn what he really thinks about gold manipulation, why Wall Street hates gold, who should buy silver instead of gold, and more!

0:05 – Question: “According to the financial media, the world has ‘fallen out of love with gold.’ Is this really true?”

0:40 – The world cannot fall out of love with something it never loved in the first place – but it will fall out of love with fiat currencies.

2:03 – The time to buy gold is when everyone hates it. That’s why it’s so cheap.

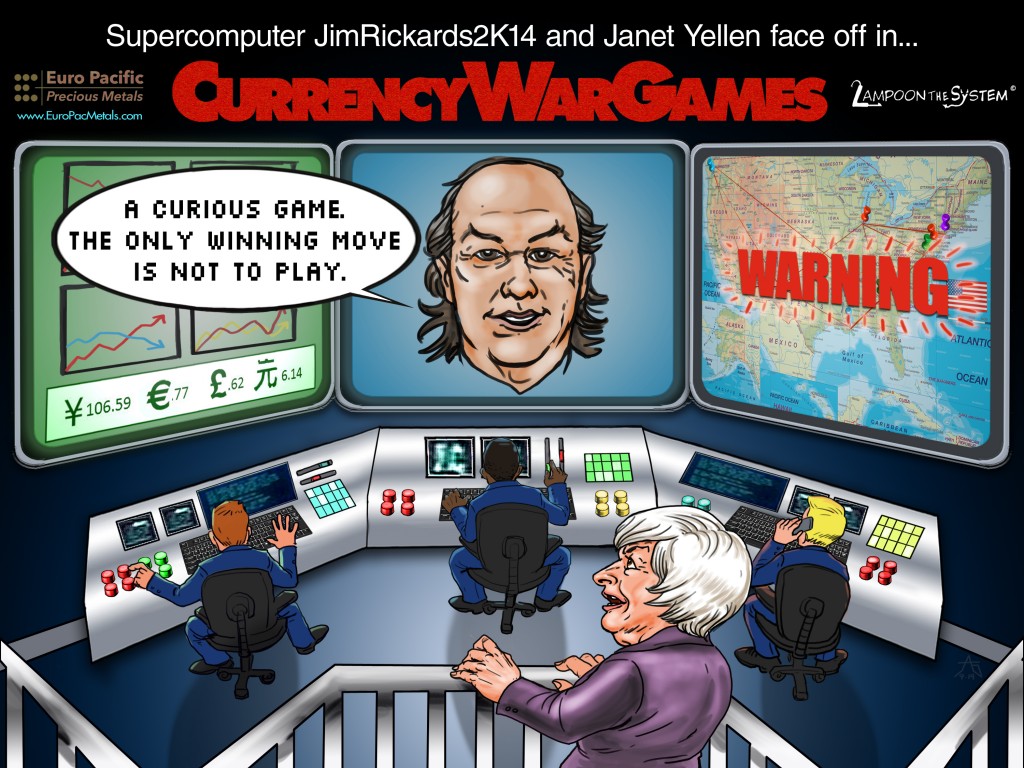

2:30 – Question: “In your last Gold Videocast, Jim Rickards said that gold price manipulation is true. Why do you keep ignoring this issue”?

2:40 – Even if gold is being manipulated, I still want to own it.

3:10 – If manipulation is true, it allows my clients to buy more at artificially low prices.

3:38 – Manipulation cannot go on forever. Before long, free-market forces overwhelm artificial price controls.

4:17 – Question: “You keep warning about hyperinflation and a collapse of the US dollar, but it hasn’t happened! Has our modern banking system solved this problem?”

4:43 – You have to warn about things in advance to give people time to prepare, which is exactly what I did with the housing bubble.

6:03 – A recent article mentioned widespread Shrinkflation. If a company charges the same price for less of a product, that’s still inflation!

6:55 – Inflation will become hyperinflation if the government doesn’t take drastic measures.

7:15 – Question: “You always recommend gold as the best way to protect one’s wealth, but I can’t afford it. Is silver a good alternative?”

7:28 – Silver coins are better for small barter transactions.

7:57 – There is more potential for upside in silver. So if you can only afford a little right now, why not get started with the metal that may give you more bang for your buck?

8:10 – Eventually, you should hold both metals, but for some people it makes sense to get started with silver.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Gold Videocast: Peter Schiff Answers Your FAQs (Video)

Peter answers some of the more challenging questions he has received from you, his loyal clients and subscribers. Learn what he really thinks about gold manipulation, why Wall Street hates gold, who should buy silver instead of gold, and more!

0:05 – Question: “According to the financial media, the world has ‘fallen out of love with gold.’ Is this really true?”

0:40 – The world cannot fall out of love with something it never loved in the first place – but it will fall out of love with fiat currencies.

2:03 – The time to buy gold is when everyone hates it. That’s why it’s so cheap.

2:30 – Question: “In your last Gold Videocast, Jim Rickards said that gold price manipulation is true. Why do you keep ignoring this issue”?

2:40 – Even if gold is being manipulated, I still want to own it.

3:10 – If manipulation is true, it allows my clients to buy more at artificially low prices.

3:38 – Manipulation cannot go on forever. Before long, free-market forces overwhelm artificial price controls.

4:17 – Question: “You keep warning about hyperinflation and a collapse of the US dollar, but it hasn’t happened! Has our modern banking system solved this problem?”

4:43 – You have to warn about things in advance to give people time to prepare, which is exactly what I did with the housing bubble.

6:03 – A recent article mentioned widespread Shrinkflation. If a company charges the same price for less of a product, that’s still inflation!

6:55 – Inflation will become hyperinflation if the government doesn’t take drastic measures.

7:15 – Question: “You always recommend gold as the best way to protect one’s wealth, but I can’t afford it. Is silver a good alternative?”

7:28 – Silver coins are better for small barter transactions.

7:57 – There is more potential for upside in silver. So if you can only afford a little right now, why not get started with the metal that may give you more bang for your buck?

8:10 – Eventually, you should hold both metals, but for some people it makes sense to get started with silver.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!