Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: December 2012

On the Money Radio Talks Gold with Peter Schiff

Steven Pomeranz interviewed Peter on his radio program On the Money last week. While they may not see eye-to-eye on the value of gold as money, Pomeranz gave Peter the opportunity to explain the historical importance of gold, as well as its value during the current economic crisis.

“In a world of real money, prices go down every year. If you go back and look at American history…prices were lower in 1900 than they were in 1800…We had the industrial revolution on a gold standard. In fact, the economy grew more, percentage-wise, in the 19th century than in the 20th. And if you look at living standards, living standards went up more in the 19th century than in the 20th century. So we had massive economic growth in America on the gold standard.”

Posted in Interviews

Comments Off on On the Money Radio Talks Gold with Peter Schiff

Rising Prices in 2013: Schiff on Fox Business (Video)

Fox Business spoke with Peter Schiff yesterday about the coming problems in the bond market, and the effect it will have on consumer prices:

“And when foreigners start selling dollars, rates are going to go up and consumer prices are going to start going up. And that’s really going to hit consumers hard. Take a look what’s happened in the crude oil market. That chart looks really really strong. You could see a huge breakout in oil prices and food prices in 2013. That’s going to hit consumers right in the wallet. And Ben Bernanke has already said, he doesn’t care how much his inflationary monetary policies pushes up the cost of food and energy. He’s going to ignore that and is just going to feed the fire by printing even more money.”

Posted in Interviews, Videos

Comments Off on Rising Prices in 2013: Schiff on Fox Business (Video)

Big Government is the Problem: Schiff on CNBC (Video)

Yesterday, CNBC’s Street Signs spoke with Peter Schiff about the fiscal cliff and what is needed to avoid the real economic armageddon:

“Look: big government is very expensive. The fiscal cliff is part of the problem. We can’t keep borrowing and the Fed can’t keep printing money. If we want government, we have to pay for it. That means we have to have higher taxes. I would rather see a much bigger fiscal cliff in the way of government spending cuts. That’s what we really need. But if we’re not going to do that, if we’re not going to cut spending, then the middle class has to brace for the bad news. They have to pay for all this government and the best way to do it is with taxes.”

Posted in Interviews, Videos

Comments Off on Big Government is the Problem: Schiff on CNBC (Video)

Central Banks Are Stockpiling Gold

News keeps coming in of central banks increasing their gold reserves. From Russia to Korea to Iraq, it seems bankers around the world are preparing for the worst as governments continue to crank out fiat currency. Bloomberg covers the latest news of Brazil leading the pack by more than doubling their gold holdings since August:

Central banks have been expanding reserves as the metal heads for a 12th annual gain and investors hold a record amount in bullion-backed exchange-traded products. Nations bought 373.9 tons in the first nine months of the year and full-year additions will probably be at the bottom end of a range from 450 to 500 tons, the London-based World Gold Council estimates.

“Central banks, particularly in the emerging economies, are looking to increase the proportion of gold in their reserve assets,” Alexandra Knight, an analyst at National Australia Bank Ltd., said from Melbourne. “That will drive prices of gold because they can be quite significant purchases.”

Posted in Daily Gold Headlines

1 Comment

Inflation & Government on Keiser Report (Video)

Peter Schiff appeared on Russia Today’s Keiser Report this last weekend to talk about the bond bubble, hyperinflation, and the government’s manipulation of the central banks.

“Prices have to adjust, but the government won’t let it happen, and so they create inflation to fight off the deflationary forces that naturally develop in the economy. But the problem for people who are looking at deflation, they go back and look at periods of time when we had honest money, when we were on the gold standard. And they see what happened, and they don’t understand the difference between real money that you can’t create out of thin air and fiat currency that you can create at zero cost in infinite amounts…If you’re going to measure prices against the dollar, prices are going to rise – they could rise dramatically. But if you measure them in terms of gold, they’re going to fall.”

Peter’s appearance begins at 16:15:

Posted in Interviews, Videos

Comments Off on Inflation & Government on Keiser Report (Video)

Schiff and $50 Silver on CNBC (Video)

Peter continued his interview on CNBC yesterday, talking about silver alongside Pan American Silver CEO Geoffrey Burns, who predicts $50 silver at some point in 2013. Both Peter and Burns emphasized the long-term strength of precious metals in spite of short-term losses:

“You’ve got a perfect storm coming in the future, because miners aren’t going to be able to produce enough of this stuff, because it costs so much money to get it out of the ground. Yet the supply of paper money is going to go through the roof, just at the time that the supply of gold and silver is shrinking. And all of a sudden, you’re going to have the whole world waking up to this inflationary nightmare…”

Posted in Interviews, Videos

Comments Off on Schiff and $50 Silver on CNBC (Video)

Schiff on CNBC: Gold is a Long-Term Investment (Video)

Peter Schiff spoke yesterday on CNBC’s Futures Now to hammer home the point that gold is a long-term investment that offers protection from volatile fiat currencies:

“Well, you have this record physical demand. Not only in America, but around the world. I mean, think about it: what are you going to do if you want to save your money? …You’re going to hold dollars at zero percent with Ben Bernanke promising to print to infinity? You’re going to hold euros, you’re going to hold yen, the Chinese RMB? There’s no currency you can hold and be confident of its future purchasing power…People are figuring this out, they’re voting with their feet. They’re holding something with intrinsic value that has historically been money, that people like Ben Bernanke can’t print.”

Posted in Interviews, Videos

Comments Off on Schiff on CNBC: Gold is a Long-Term Investment (Video)

A Golden Future for Millenials?

While the older generation of politicians and central bankers seem intent on spending the United States into insolvency, perhaps the younger generations can learn from the past. Travis N. Taylor published an op/ed in the Washington Times this week calling on 18-29 year-olds to support a return to the gold standard:

“Although the federal government’s gross inability to balance a checkbook is a cause of great concern, it remains true that “all politics is local.” Few people can pay attention to Washington’s “fiscal cliff” when they are struggling to provide for the well-being of their family.

Millennials must encourage the return to a precious-metals-backed monetary system. Regardless of difficult-to-understand technical terms, there is plenty of empirical evidence that a departure from the gold standard has shattered our monetary system. The United States officially ended the gold-backed dollar standard in 1971. This offers a bright line of distinction for examining the issue. The 40 years since that time have borne witness to prices on everyday goods that are radically higher than during the previous four decades.”

Posted in Outside Commentaries

Comments Off on A Golden Future for Millenials?

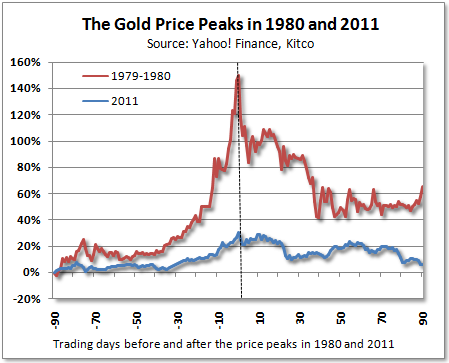

Gold Bull Market Far From Over

Gold’s poor performance in the past week has triggered a flood of commentaries declaring that gold peaked back in 2011 and that prices may plummet next year. Don’t be fooled – there is plenty of evidence that gold still has a bright future. Tim Iacono published an interesting article on Seeking Alpha yesterday debunking the naysayers:

“Since the gold price failed to advance after the Federal Reserve’s latest stimulus measure last week, that is, the one where the central bank raised its open-ended money printing effort to a cool $1 trillion per year, an increasing number of calls have been heard with the same refrain – the secular gold bull market is over.

Earlier in the month, it was investment bank Goldman Sachs who said that prices may rise back up above $1,800 an ounce next year but that last year’s high at just over $1,900 an ounce or a similar high next year will go down in the history books as the end of the long-running bull market.”

Posted in Outside Commentaries

Comments Off on Gold Bull Market Far From Over

12 Years of Bullish Gold

It looks like gold is ready to complete the year with a 6% gain, continuing it’s longest streak since 1920, according to Bloomberg. A few days before Christmas, Jeff Clark of Casey Research published a good commentary reviewing the opinions of prominent gold bugs and the many reasons why 2013 looks like another shiny year for the yellow metal:

Continue Reading…