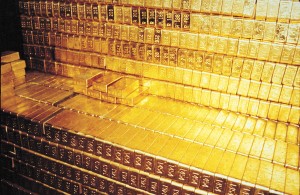

News keeps coming in of central banks increasing their gold reserves. From Russia to Korea to Iraq, it seems bankers around the world are preparing for the worst as governments continue to crank out fiat currency. Bloomberg covers the latest news of Brazil leading the pack by more than doubling their gold holdings since August:

Central banks have been expanding reserves as the metal heads for a 12th annual gain and investors hold a record amount in bullion-backed exchange-traded products. Nations bought 373.9 tons in the first nine months of the year and full-year additions will probably be at the bottom end of a range from 450 to 500 tons, the London-based World Gold Council estimates.

“Central banks, particularly in the emerging economies, are looking to increase the proportion of gold in their reserve assets,” Alexandra Knight, an analyst at National Australia Bank Ltd., said from Melbourne. “That will drive prices of gold because they can be quite significant purchases.”

And let’s not forget that China have “quietly” been buying up gold as well. Who know where they rank now in terms of gold holdage.