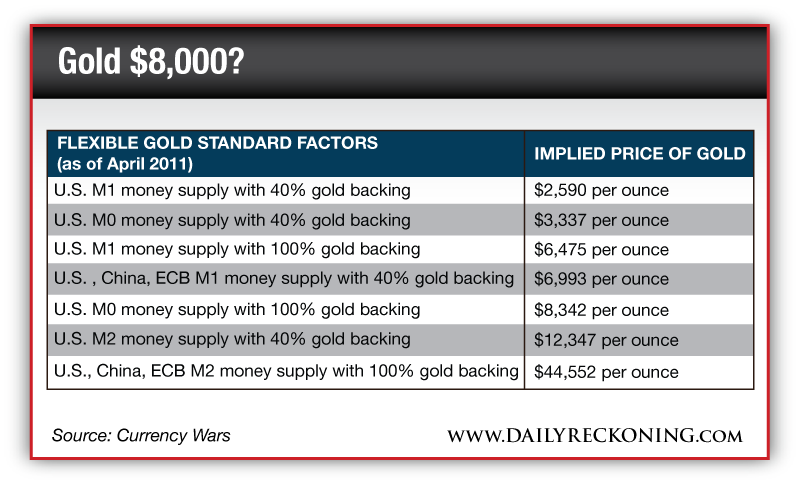

Jim Rickards, author of Currency Wars, published an interesting article over at The Daily Reckoning about why you don’t need to wait for central banks to adopt a gold standard before adopting your own.

“There isn’t a central bank in the world that wants to go back to a gold standard. But that’s not the point. The point is whether they will have to.

I’ve had conversations with several of the Federal Reserve Bank presidents. When you ask them point-blank, “Is there a theoretical limit to the Fed’s balance sheet?” they say no. They say there are policy reasons to make it higher or lower, but that there’s no limit to the amount of money you can print.

That is completely wrong. That’s what they say; that’s how they think; and that’s how they act. But in their heart of hearts, some people at the Fed know it’s wrong. Luckily, people can vote with their feet.

I always tell people who say we’re not on the gold standard that, in a way, we are. You can put yourself on a personal gold standard just by buying gold. In other words, if you think that the value of paper money will be in some jeopardy, or confidence in paper money may be lost, one way to protect yourself is by buying gold, and there’s nothing stopping you.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

3 Responses to Jim Rickards: Your Personal Gold Standard