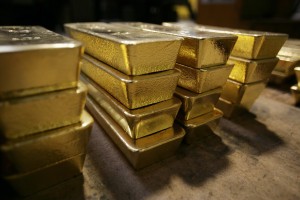

In his latest article at Forbes, Jack Adamo analyzes the history of government inflation statistics and why gold is still an excellent hedge in spite of the popular narrative that inflation is “under control.”

“The other problem I find with the inflation-to-gold ratio analysis is this: We are truly in unknown territory with the U.S. and world money supply. In 2008, when the Fed geared up its printing press, the entire balance sheet of the Federal Reserve, accumulated in its 95 year existence, was $1 trillion. For the last several years, it has been growing its balance sheet $1 trillion per year.

The only reason we don’t see rampant inflation is that the velocity of money is so low. If the economy ever picks up for real, watch out. Fortunately, or unfortunately, depending on how you look at it, there seems to be no immediate threat of that.”

Read the Full Commentary Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Don’t Trust the Government, Gold Still Inflation Hedge

In his latest article at Forbes, Jack Adamo analyzes the history of government inflation statistics and why gold is still an excellent hedge in spite of the popular narrative that inflation is “under control.”

Read the Full Commentary Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog