Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: August 2013

Why Are So Many Americans Fleeing the US Economy? (Video)

Fox Business spoke with Peter Schiff yesterday about the growing number of Americans renouncing their US citizenship because of onerous taxes and regulations. Most people probably can’t afford to renounce their citizenship, but they can buy gold and silver as a way of escaping the collapsing dollar.

“I think over time, more and more entrepreneurs, young people who want to make something of themselves and who find it a lot more difficult to do it here, because of their taxes and regulations – they’re going to want to leave. And I think a lot of Americans are going to want to get their money out of the US because of the inflation that I see coming and the weakness in the dollar.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Videos

1 Comment

Today’s Key Gold Headlines – 8/14/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 8/14/13

Next Fed Chairman Will Bring Economic Ruin (Video)

Yesterday, Yahoo! Finance asked Peter Schiff who he would choose as the next Federal Reserve Chairman. Unsurprisingly, Peter does not believe any of the candidates have the integrity to do the right thing with the economy.

“The mandate [the Fed] needs to keep under control is sound currency, to preserve the value of our money… If it follows that mandate, then we’ll have prosperity, we’ll have lots of job creation, lots of economic growth. It’s when they try to fine tune the economy by playing around with interest rates and money supply that we have big problems in the economy.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Videos

Comments Off on Next Fed Chairman Will Bring Economic Ruin (Video)

Today’s Key Gold Headlines – 8/13/13

- China’s Consumers Show Growing Influence in Gold Market, Wall Street Journal

- Silver Leads China-Based Metals Rally, Financial Times

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 8/13/13

Don’t Trust the Government, Gold Still Inflation Hedge

In his latest article at Forbes, Jack Adamo analyzes the history of government inflation statistics and why gold is still an excellent hedge in spite of the popular narrative that inflation is “under control.”

“The other problem I find with the inflation-to-gold ratio analysis is this: We are truly in unknown territory with the U.S. and world money supply. In 2008, when the Fed geared up its printing press, the entire balance sheet of the Federal Reserve, accumulated in its 95 year existence, was $1 trillion. For the last several years, it has been growing its balance sheet $1 trillion per year.

The only reason we don’t see rampant inflation is that the velocity of money is so low. If the economy ever picks up for real, watch out. Fortunately, or unfortunately, depending on how you look at it, there seems to be no immediate threat of that.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on Don’t Trust the Government, Gold Still Inflation Hedge

Today’s Key Gold Headlines – 8/12/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 8/12/13

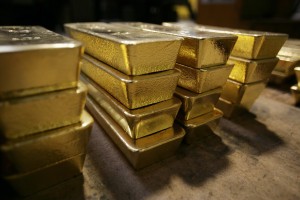

Futures Markets Signal Gold Ready to Erupt

Read Peter Schiff’s latest Gold Letter, with an insightful commentary from Precious Metals Specialist Dickson Buchanan on gold backwardation, a negative GOFO rate, and what they mean for physical gold investment.

“With gold recouping some losses in its most recent trading sessions, many are asking whether or not the bottom has finally formed for the yellow metal. Most of these gains have been simply chalked up to short-covering and dovish remarks by Bernanke during the recent Federal Open Market Committee meetings; however, there are some key indicators for gold which are overshadowed by the media hubbub. Two of them in particular are important to understand, because they reveal a renewed investment demand for physical gold over paper gold or fiat currencies.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries, Peter's Commentaries

Comments Off on Futures Markets Signal Gold Ready to Erupt

Today’s Key Gold Headlines – 8/9/13

- Ned Goodman Ditches Bank Stocks for Gold, Financial Post

- Platinum Jumps Most in 13 Months on Signs of Quickening Growth, Bloomberg

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 8/9/13

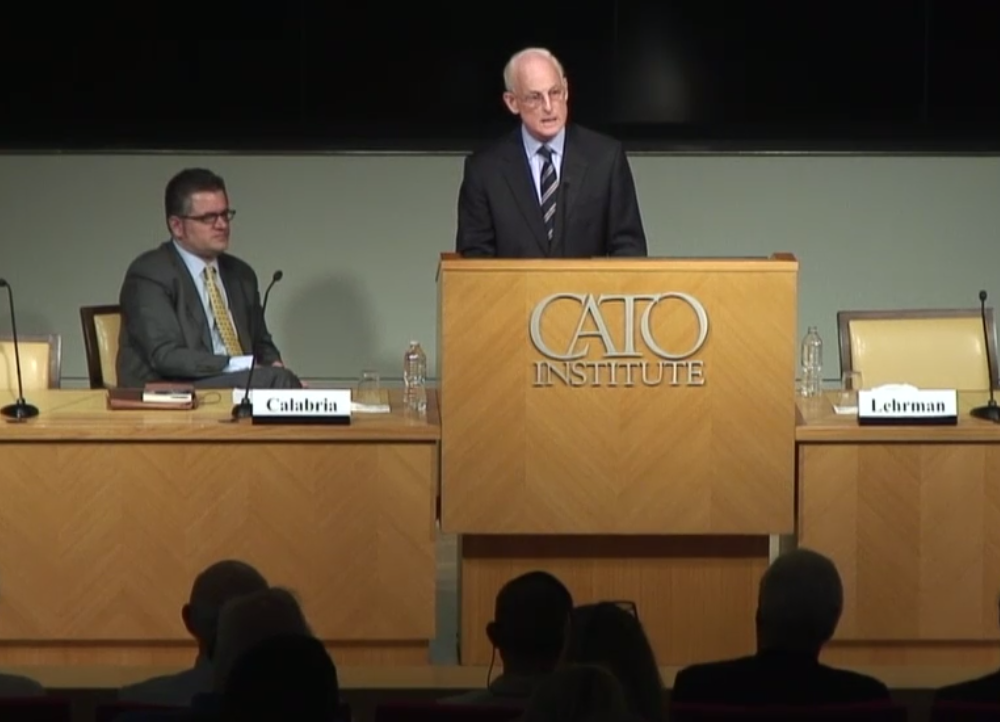

Lewis Lehrman: The Rise and Fall of Real Money (Video)

Lewis E. Lehrman, author of the new book, Money, Gold, and History, spoke at the Cato Institute last month about the history of central banking and the destruction of the gold standard. Lehrman’s lengthy talk is a great introduction to the rise and fall of real money. His new book includes 40 years of essays on the classical gold standard.

“Working people have also discovered that the credit worthy liquid financial class with access to cheap money at the Fed and at the banks has enriched itself not only by bailout subsidies, but by cheap financing derived from its symbiotic dependence on the Federal Reserve System. This [is] a fundamental cause of the rising inequality of wealth in America.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries, Videos

Comments Off on Lewis Lehrman: The Rise and Fall of Real Money (Video)

Mihir Dange: People Want to Own Physical Gold (Video)

In an interview on Bloomberg TV this week, Mihir Dange spoke about the unusual “backwardation” of the gold futures market happening right now and what that means for physical gold demand. If you want to learn more about what the gold futures market can tell us about physical gold, read this month’s Gold Letter.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog