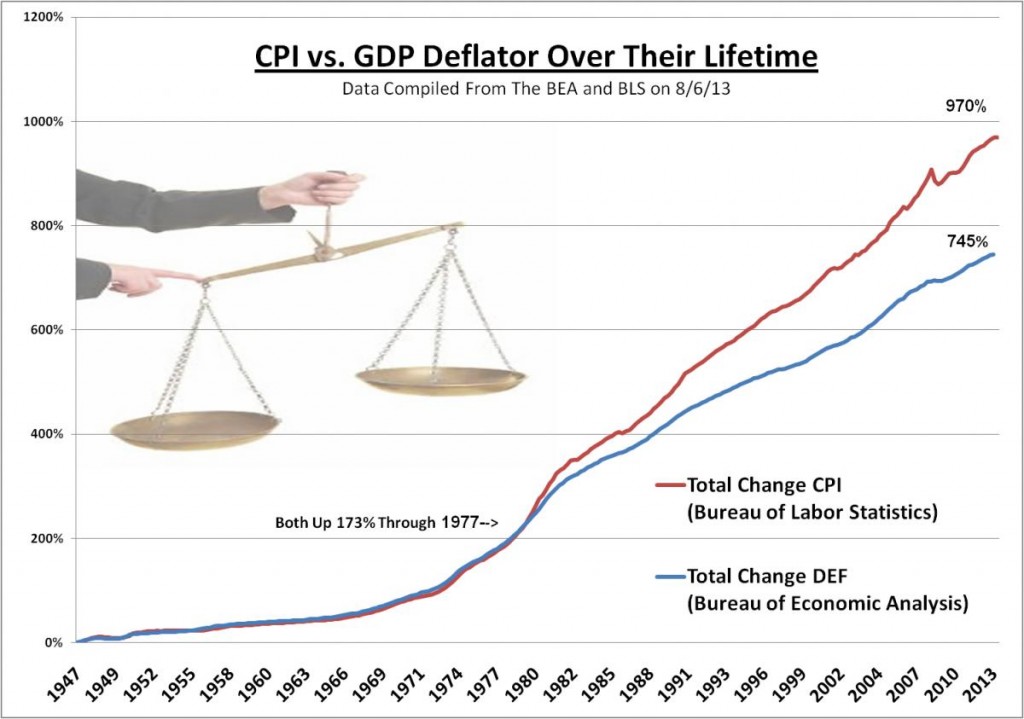

In his latest commentary, Peter Schiff explains the difference between the CPI and the GDP deflator as measurements of inflation. He then shows how the two measurements have increasingly diverged from each other over the years, suggesting that American economic growth as measured by GDP is not nearly as robust as the government would like us to believe.

“Albert Einstein, a man who knew a thing or two about celestial mechanics, supposedly once called compound interest “the most powerful force in the universe.” While the remark was likely meant to be funny (astrophysicists can be hilarious), it sheds light on the often overlooked fact that small changes, over time, can yield enormous results. Over eons, small creeks can carve large canyons through solid rock. The same phenomenon may be at work in our economy. A minor, but persistent under bias in the inflation gauge used in the Gross Domestic Product (GDP) may have created a wildly distorted picture of our economic health.

It would be impossible to measure the economy without “backing out,” inflation. That is why economists are very careful to separate GDP reports into two categories: “nominal” (which are not adjusted for inflation), and real (which are). Only the real reports matter. The big question then becomes, how do we measure inflation? Just as I reported last week with respect to the biases baked into the government’s GDP revisions, the devil is in the details.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Change the way you define an indicator and you get totally different conclusions. Yet another example of proving any point with ‘concrete’ stats.