Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: October 2013

Today’s Key Gold Headlines – 10/24/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 10/24/13

QE Could Rise to $1 Trillion a Month? (Video)

Peter Schiff isn’t the only one who is confident that the Federal Reserve will increase its quantitative easing in the next year. Marc Faber of The Gloom, Boom & Doom Report speaks with CNBC about the Fed’s nonexistent exit strategy and the possibility of increasing the stimulus to $1 trillion a month! Now there is a good reason to buy a safe haven investment like physical gold.

“The Fed has boxed themselves into a position where there is no exit strategy. The question is not tapering. The question is at what point will they increase the asset purchases to say, $150 [billion], $200 [billion], a trillion dollars a month? That is the question.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on QE Could Rise to $1 Trillion a Month? (Video)

Today’s Key Gold Headlines – 10/23/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 10/23/13

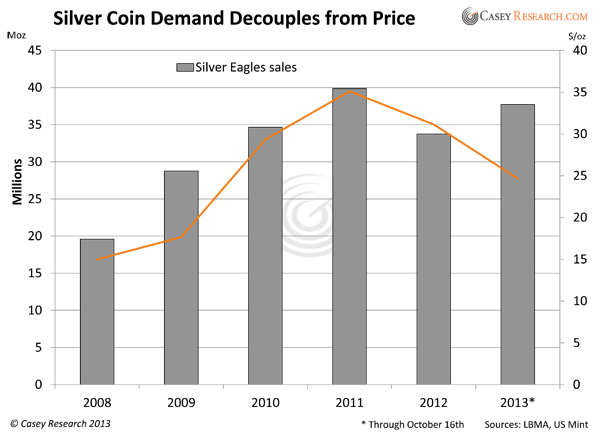

The Silver Bull Is Alive and Well

Jeff Clark, Senior Precious Metals Analyst for Casey Research, published an excellent article about the undiminished investment demand for silver this year. Gold has taken a beating from unjustly bearish investors, but the appetite for silver around the world does not seem to be fading at all. In a recent interview, Peter Schiff noted that silver is one of his most important safe haven investments thanks to its amazing upside potential.

“As of last Friday, silver is down 26.6% on the year, and down a whopping 55% since its $48.70 high on April 28, 2011. The bear market cycle is now two and a half years old—and no one can say with absolute certainty that the bottom is in.

Sounds like an investment to avoid.

For now, let’s ignore the fundamental argument for silver—an alternative currency that, like gold, will sooner or later respond to the historic levels of currency dilution throughout much of the developed world—and consider the behavior of investors. In response to the price drubbing, have they abandoned the silver market? If that were so, it might be a warning sign that we’ve overstayed our welcome.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Silver Bull Is Alive and Well

Today’s Key Gold Headlines – 10/22/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 10/22/13

“Debtoxication” & America’s Misplaced Priorities (Video)

Russia Today’s Worlds Apart interviewed Peter Schiff yesterday about the ongoing debt problems of the United States. This long discussion addresses America’s toxic addiction to debt enabled by creditor nations, as well as America’s misplaced political priorities. Ultimately, all these problems will lead to a dollar collapse, which Peter suggests avoiding by investing commodities like physical gold and silver.

“We have really almost a parasitical relationship…with the rest of the world, with the world being the host and unfortunately, America being the parasite. We don’t have a balanced trading relationship. America imports all sorts of goods, valuable consumer goods and resources, and we export debt. We export paper, inflation.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Videos

Comments Off on “Debtoxication” & America’s Misplaced Priorities (Video)

Today’s Key Gold Headlines – 10/21/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 10/21/13

The Gold Surge Is Just Starting (Video)

CNBC’s Talking Numbers interviewed Peter Schiff yesterday to get his opinion on the surge in the gold price that followed the debt ceiling agreement. Not only did Peter explain the long-term bull case for gold, he also spoke about his investment strategy with silver and the other precious metals.

“We are headed back into recession… Janet Yellen, the first thing she is going to do as Fed Chairman is increase the size of the monthly QE. So all of that is going to be very bullish for gold. Gold is going to make new highs well above $2,000, and people are going to forget that this correction ever took place… We are in a major historic gold bull market.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Videos

Comments Off on The Gold Surge Is Just Starting (Video)

Peter Schiff on Debt & Gold

In an interview with The Daily Caller, Peter Schiff shares his views on the debt ceiling agreement, the future of gold and silver, and how indebted individuals can best prepare for the coming economic crisis.

“Both [gold and silver] are undervalued because no one understands them. Gold’s future is bright, just like its past. Its value won’t end anytime soon. A lot of people have forgotten it’s money, and that paper is just a substitute. We can’t just have fiat currency. That’s why we have so many problems.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries

Comments Off on Peter Schiff on Debt & Gold

Preparing for the Inevitable Dollar Collapse

This week, Peter Schiff spoke with Gold Silver Worlds about why the collapse of the US dollar is unavoidable and what you can do to protect yourself from it.

Read the Full Q&A Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!