This week, Peter Schiff spoke with Gold Silver Worlds about why the collapse of the US dollar is unavoidable and what you can do to protect yourself from it.

“What would the dollar be replaced with once it falls? Schiff believes the world cannot use the euro or the yen as the world reserve currency because they are nearly as bad as the dollar. At the end of the day, those are all fiat currencies backed by nothing but promises.

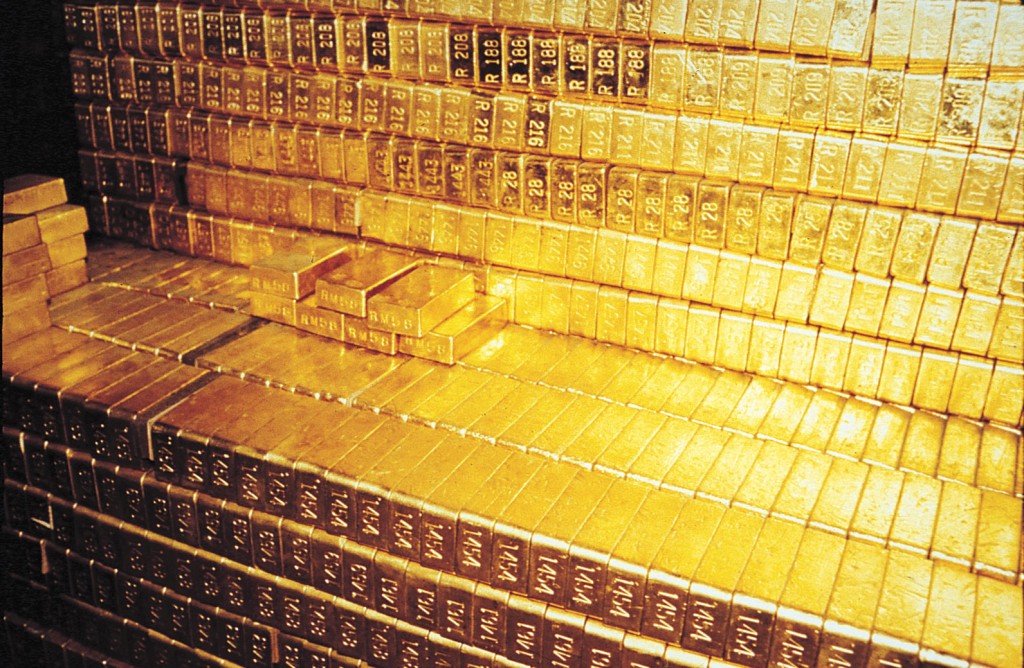

When countries (other than the US) have a confidence problem with their currency, what is the way to restore confidence? They link it to the dollar with the aim to impose discipline. But when the dollar collapses, what could countries peg their currency to? The only thing that would make sense to stabilize the dollar and recreate confidence is gold. Gold is the main reserve of the US. The US has 90% of its reserves in gold and no foreign reserves.

Gold was the international reserve before the dollar hegemony. Going back to the gold standard would result in one of the two things: either the price of gold goes up or the price of everything else goes down. Schiff believes that it is much easier to adjust the price of one thing up instead of the price of every other asset down. His expectation is that the gold price will go much higher from here.”

Read the Full Q&A Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Preparing for the Inevitable Dollar Collapse

This week, Peter Schiff spoke with Gold Silver Worlds about why the collapse of the US dollar is unavoidable and what you can do to protect yourself from it.

Read the Full Q&A Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!