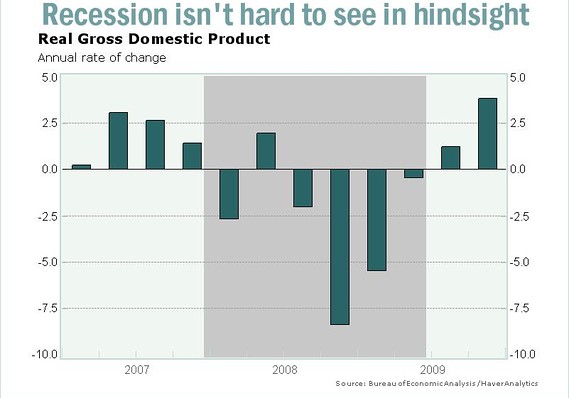

A MarketWatch commentary has analyzed the Federal Reserve’s transcripts from the 2008 recession and found that it is grossly incompetent at predicting and understanding recessions. There doesn’t seem to be any good reasons to expect that the Fed has improved its market diagnostic skills. What does that mean for investors today? Don’t trust the official hype – the economy is doing a lot worse than Yellen’s Fed claims.

“There’s no question that the economy has softened in recent months, but policy makers at the Federal Reserve tell us not to worry, that it’s mostly just bad weather and the normal ups and downs of the economic data.

But what if they’re wrong? Would they tell us if they thought we were heading for a new recession? Could they bring themselves to tell us if they did think it?”

Read the Full Commentary Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Fed Incapable of Predicting Recessions

A MarketWatch commentary has analyzed the Federal Reserve’s transcripts from the 2008 recession and found that it is grossly incompetent at predicting and understanding recessions. There doesn’t seem to be any good reasons to expect that the Fed has improved its market diagnostic skills. What does that mean for investors today? Don’t trust the official hype – the economy is doing a lot worse than Yellen’s Fed claims.

Read the Full Commentary Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!