According to the World Gold Council’s latest research, most investors are under-allocated to physical gold. In the latest edition of Gold Investor, the WGC explains the importance of gold in an expanding and overvalued global financial system.

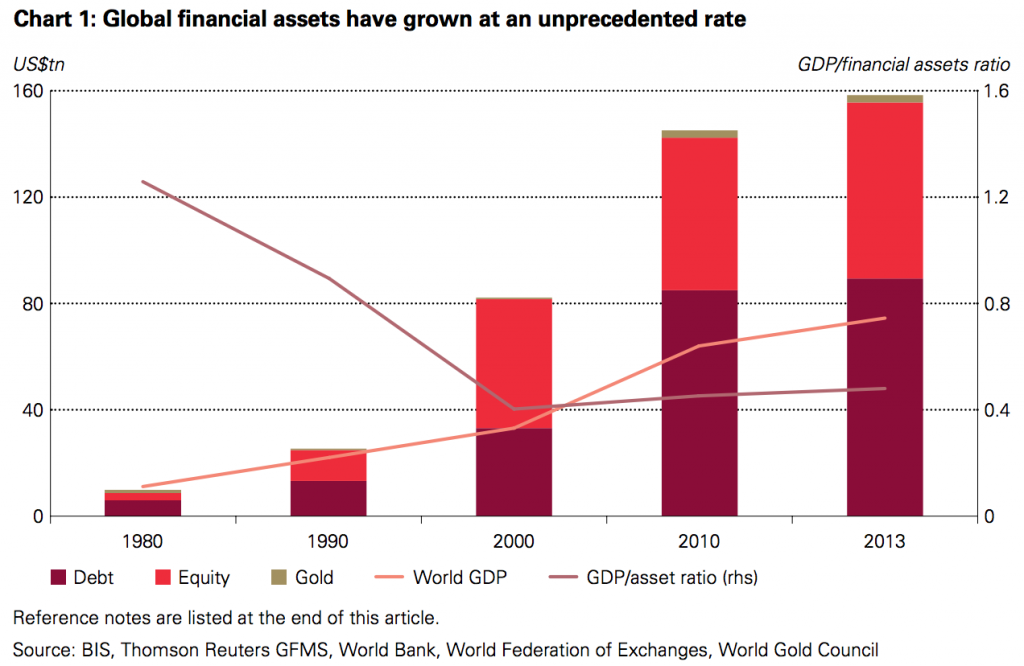

“Despite a significant price pullback mostly during 2013, gold has risen for most of the past decade on the back of growth in emerging markets, economic uncertainty, central-bank demand and constrained supply. Even so, gold remains a widely under-owned asset. Gold holdings account for 1% of all financial assets – a by-product both of its scarcity and the unprecedented growth in other financial assets. Further, gold’s low ownership rate stands in stark contrast to levels seen in past decades, as well as what research suggests optimal gold allocations should be.”

Download Gold Investor Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

World Gold Investment Is Too Low

According to the World Gold Council’s latest research, most investors are under-allocated to physical gold. In the latest edition of Gold Investor, the WGC explains the importance of gold in an expanding and overvalued global financial system.

Download Gold Investor Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!