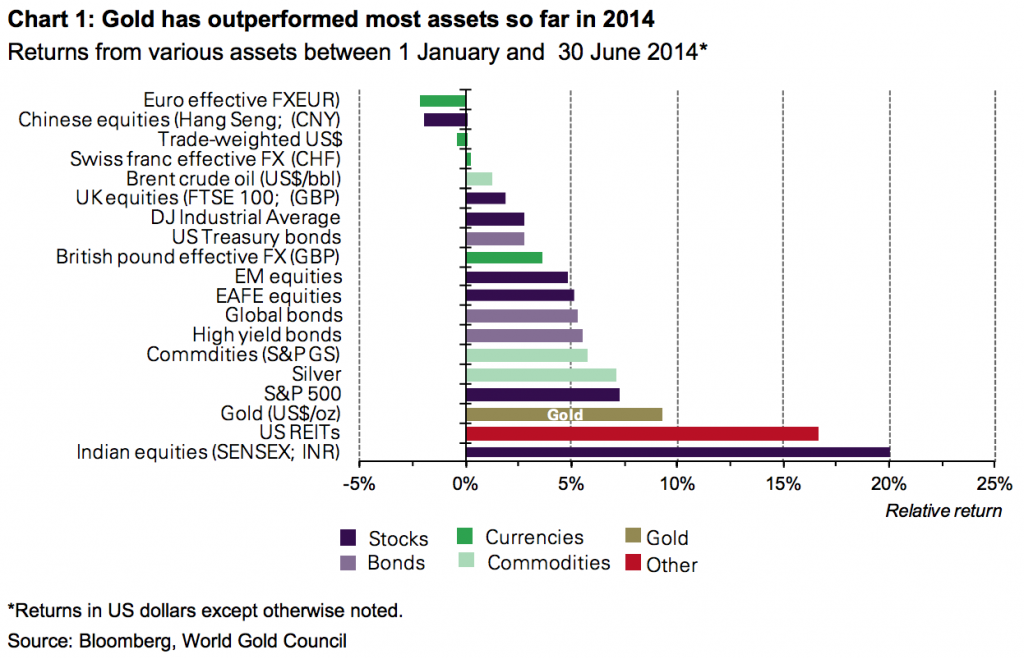

In its latest Investment Commentary, the World Gold Council explains why gold outperformed most assets in the first half of 2014, contrary to many analysts’ predictions. The report also shares the latest research on why gold is an essential asset for protecting your portfolio from high-risk debt and potential market volatility. The big takeaway – when it comes to risk protection in the second half of 2014, gold is one of your cheapest and most reliable options.

“Gold is up by 9.2% so far this year. This surprised many market participants as most analysts predicted lower prices. Some investors took advantage of last year’s price correction to buy gold but investment demand has remained tepid. We consider that the current environment of high bond issuance, tight credit spreads and record low volatility continues to offer a prime opportunity for investors to add gold. In our view, gold can reduce overall portfolio risk and it is cheaper to implement than many volatility-based strategies.”

Read the Full Report Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Gold for Risk Protection in 2014

In its latest Investment Commentary, the World Gold Council explains why gold outperformed most assets in the first half of 2014, contrary to many analysts’ predictions. The report also shares the latest research on why gold is an essential asset for protecting your portfolio from high-risk debt and potential market volatility. The big takeaway – when it comes to risk protection in the second half of 2014, gold is one of your cheapest and most reliable options.

Read the Full Report Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!