Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: July 2014

Americans… The Best Spenders of Other People’s Money (Video)

Fox Business spoke with Peter Schiff on “Money with Melissa Francis,” where Peter points out that it’s not the geopolitical events that investors should be worried about, but the failed monetary policy in the US.

“What I think American really have to worry about, at least from the perspective of an investor, is not what the Russian separatists are doing in the Ukraine , but what Janet Yellen and her cohorts are doing at the Federal Reserve, because far more damage is being inflicted now on the US economy and will be inflected on investors by the Federal Reserve.” – Peter Schiff

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Videos

Comments Off on Americans… The Best Spenders of Other People’s Money (Video)

Evolving Beyond the US Dollar Hegemony (Video)

Major news hit this week that the BRICS have launched their own development bank to challenge the currently Western-dominated banking system. Read about it here. Who could better explain the rationale behind this new bank than the author of the book Currency Wars, Jim Rickards? Rickards appeared on CNBC this week to share his thoughts. His message? The world is ready to leave the dollar behind and kick the irresponsible United States out of the economic driver’s seat.

“Every single member of the BRICS, multiple times has voiced dissatisfaction with the dollar, the dollar hegemony, the dollar-based system, and the IMF, which is really dominated by the US. So it’s not that there’s a revolution that happens overnight, but it’s more of an evolution away from the dollar.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Videos

Comments Off on Evolving Beyond the US Dollar Hegemony (Video)

Today’s Key Gold Headlines – 7/17/14

- US Sanctions on Russia Lift Precious Metals, Wall Street Journal

- Gold Fix Banks Said to Propose Changes to Pricing Process, Bloomberg

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/17/14

The Fed’s Monetary “Experiment” Is a Failure

More and more mainstream investors are waking up to the economic problems stemming from the Federal Reserve’s unprecedented amount of money-printing in the last six years. This new opinion piece from Investor’s Business Daily takes a look at Janet Yellen’s congressional testimony and explains why the economy will be reeling for years from the damage done by QE. If you agree with people like Peter Schiff and believe that the “Real Crash” is approaching, make sure you’ve protected your savings with physical gold and silver.

“The recovery is not yet ‘complete,’ Federal Reserve Chairwoman Janet Yellen suggested Tuesday, but the central bank plans to let interest rates rise anyway. We’ll soon learn just how solid this so-called recovery is.

‘The economy is continuing to make progress toward the Fed’s objectives of maximum employment and price stability,’ Yellen told Congress, predicting ‘a moderate pace’ of growth for the economy ‘over the next several years.’

Sadly, we don’t fully share her rosy outlook. Indeed, we think the Fed’s extraordinary interventions over the past 5-1/2 years have distorted markets and prices, and have held the economy back.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Fed’s Monetary “Experiment” Is a Failure

Today’s Key Gold Headlines – 7/16/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/16/14

The Fed Has Trapped Itself In a Market Mirage

In a new commentary published by The Gold Republic Journal, renowned author and economist Jim Rickards explains why the Federal Reserve cannot safely exit its quantitative easing program. Rickards argues that the supposed strength of the US markets is a complete mirage created by the Fed’s policies.

“The Federal Reserve, the central bank of the US, is nearing the end of its ability to manipulate the US economy without producing consequences worse that those it set out to avoid in 2008. The Fed has no good exits from seven years of market manipulation. If it continues its current policy of reducing purchases of assets, the so-called ‘tapering,’ it risks throwing the U.S. into a recession. If it reverses course and pauses the taper and later increases asset purchases, it risks destroying confidence in the dollar among foreign creditors of the U.S. Both outcomes are potentially disastrous, but there are no good outcomes on the horizon. This is the result of manipulating markets to the point where they no longer function as markets providing useful price signals and guiding the efficient allocation of capital. Today markets are a mirage, created by the Federal Reserve, which is caught in a prison of its own device.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Fed Has Trapped Itself In a Market Mirage

Today’s Key Gold Headlines – 7/15/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/15/14

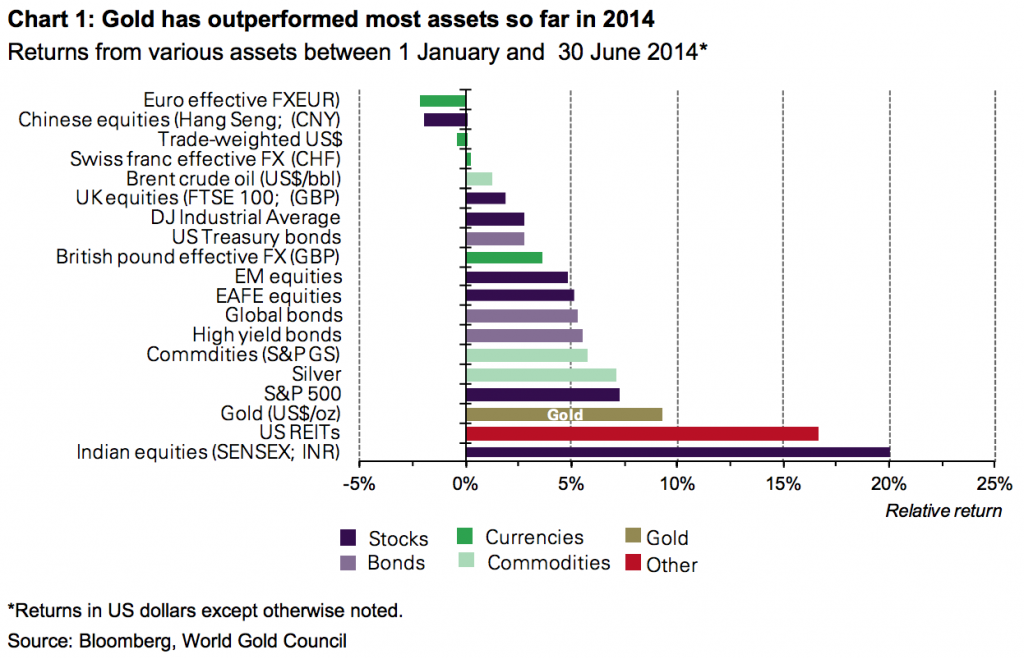

Gold for Risk Protection in 2014

In its latest Investment Commentary, the World Gold Council explains why gold outperformed most assets in the first half of 2014, contrary to many analysts’ predictions. The report also shares the latest research on why gold is an essential asset for protecting your portfolio from high-risk debt and potential market volatility. The big takeaway – when it comes to risk protection in the second half of 2014, gold is one of your cheapest and most reliable options.

“Gold is up by 9.2% so far this year. This surprised many market participants as most analysts predicted lower prices. Some investors took advantage of last year’s price correction to buy gold but investment demand has remained tepid. We consider that the current environment of high bond issuance, tight credit spreads and record low volatility continues to offer a prime opportunity for investors to add gold. In our view, gold can reduce overall portfolio risk and it is cheaper to implement than many volatility-based strategies.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Gold for Risk Protection in 2014

Today’s Key Gold Headlines – 7/14/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/14/14

Rick Santelli vs. Conventional Ignorance (Video)

You may have seen the explosive debate between Rick Santelli and Steve Liesman on CNBC’s Halftime Report this week. Santelli admittedly “blew a gasket” when he began to challenge the conventional “wisdom” that the Federal Reserve has actually helped the economy with its quantitative easing. So was Santelli completely off-base? Has the Fed’s stimulus been successful? Absolutely not. In a longer segment on his radio show this week, Peter Schiff reviewed Santelli’s points and defended his argument that the Fed’s stimulus is actually laying the groundwork for much worse economic woes.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!