Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: September 2014

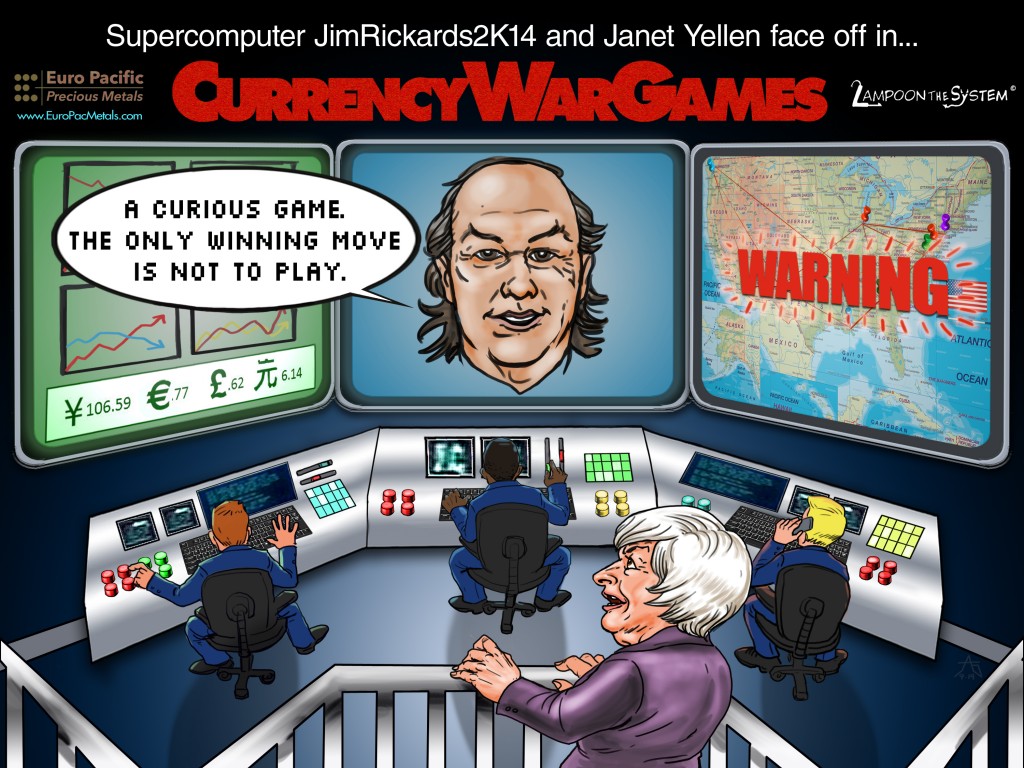

Currency War Games

In the 80’s, America confronted two great risks – an evil empire and an out-of-control US dollar. Unfortunately, though we beat the communists, we seem to be losing the battle for sound money.

For its latest comic, Lampoon the System reprises War Games, the classic 1983 blockbuster starring Matthew Broderick. The esteemed Jim Rickards plays the role of “Joshua”, the supercomputer in the movie. Peter Schiff interviewed Rickards in August, and they talked extensively about the repercussions of an international “currency war.” If you missed it, check it out here.

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Click here for more cartoons and information on his anthology book, available for only $15.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Lampoon Comics

1 Comment

Is the World at ‘Peak Gold’?

This week, Chuck Jeannes told The Wall Street Journal that either this year or next, miners will have reached “peak gold.” Peak gold means that the amount of gold being pulled out of the earth will begin to shrink every year, rather than increase, which has been the case since the 1970s. Jeannes is the chief executive of the world’s largest gold mining company, Goldcorp, so it’s probably safe to assume he knows a thing or two about mining the yellow metal.

Let’s put this into context. Central banks continue to stockpile gold (even Scotland is wondering how much of the United Kingdom’s gold it will get if it becomes an independent country). Nobody knows how much gold China is hoarding, but pretty much everyone assumes it’s a lot more than the official reports. Smart economists like Peter Schiff and Jim Rickards have been pointing out for a year now that gold buyers throughout Asia are accumulating more and more gold from Western investors, and they have almost no intention of selling it.

For physical precious metals investors, all of this news should hit home. What happens when this robust demand for gold runs up against the hard limits of the mining industry? This is simple supply and demand – prices go up.

“As gold production declines, the miner’s job becomes harder, as companies compete for increasingly rare deposits. Discoveries have already tapered off. In 1995, 22 gold deposits with at least two million ounces of gold each were discovered, according to SNL Metals Economics Group. In 2010, there were six such discoveries, and in 2011 there was one. In 2012: nothing.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

1 Comment

The Amazing World of Silver Technology

The Silver Institute’s August edition of Silver News is now available. This issue explains the fundamentals behind the surging growth in demand for industrial silver, which is expected to exceed global GDP growth through 2016. The constantly evolving industry for silver technology is largely to thank for this increasing demand. August’s Silver News highlights some of the fascinating new applications of silver, including:

- Two forms of 3D printing with silver

- Using heated nanosilver to treat cancer

- Screen-printed silver circuits that cure in UV light

- Antibacterial silver on home hardware products

You’ll also find an explanation of how silver is used as an essential chemical catalyst in the production of ethylene oxide (EO), which in turn is needed to create ethylene glycol. Ethylene glycol is one of the most important substances in our modern world.

“Ethylene glycol, in turn, is used to produce many products including polyester fibers for clothes and carpets, plastics, solvents and other chemicals, and even antifreeze formulations. By itself, EO is used to sterilize many health-care products and medical instruments, including delicate electronic or optical tools, which would be harmed by the high heat or radiation sterilization processes. EO is also used to accelerate the aging of tobacco leaves, as a fungicide, and even as a preservative for spices.”

Image: Tanaka’s printed silver circuit board.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on The Amazing World of Silver Technology

‘Shrinkflation’: The Prelude to True Inflation

The financial media regularly plays down reports of consumer price inflation that are much higher than the official numbers. Even worse, analysts generally argue that more inflation is needed for the health of the US economy. Pippa Malmgren, author of a new book, Signals: The Breakdown of the Social Contract and the Rise of Geopolitics, has been studying price inflation that is cleverly hidden – she calls it “shrinkflation.”

Shrinkflation occurs when consumer products cost the same, but contain less. For instance, Malmgren points to Cadbury chocolate bars that were reduced in size in 2011, while the price remained the same. Nestle’s Shredded Wheat and Carlsberg beer are two other major products that are practicing shrinkflation. Haagen-Dazs shrunk its “pint” of ice cream by 20% in 2011. Here’s an entire list of shrinkflation products published by CNN Money three years ago. Peter Schiff has talked about this very phenomenon in his videos and podcasts for years.

The financial media will likely downplay this trend in favor of broader, “official” measures of inflation that show prices are well under control. However, they’d be missing one of Melmgren’s most important insights: “Shrinking the size of goods is exactly what happened in the 1970s just before inflation proper set in.” At a certain point, a company can’t just keep lopping squares off the chocolate bar – they’re going to have to raise the price.

Remember, if there’s one thing you want to be holding when inflation really hits hard, it’s physical gold and silver bullion.

Read the Full Article on Shrinkflation Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on ‘Shrinkflation’: The Prelude to True Inflation

American Workers: The Economy Is Terrible

The John J. Heldrich Center for Workforce Development at Rutgers University released its latest Work Trends report. The national survey found that Americans are extremely pessimistic about the state of the US economy in spite of the financial media’s claims that a strong economic recovery is underway. The report is titled “Unhappy, Worried and Pessimistic: Americans in the Aftermath of the Great Recession”. Some of its major findings include:

The report paints a bleak picture of the American workforce and economy coming from the direct experience of American laborers. Cliff Zukin, co-director of the surveys, said:

Read the Full Report Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!