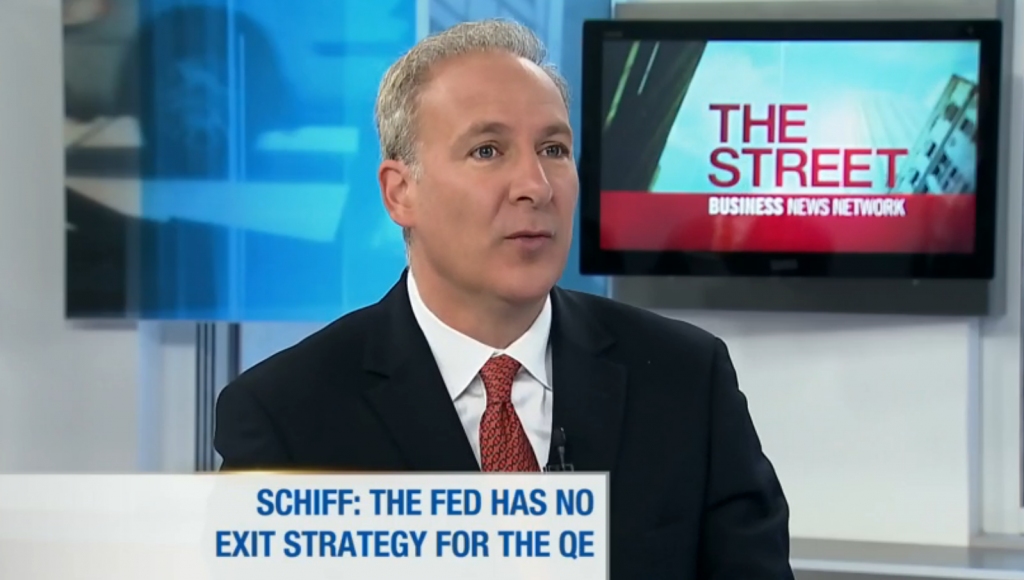

Peter Schiff appeared on BNN’s The Street to talk about the endless quantitative easing that is destroying the US economy. Contrary to popular opinion, Peter maintains that the Fed has no exit strategy and the stimulus will continue until a major crisis erupts. In the meantime, investors should avoid the asset bubbles that all this easy money creates.

“The Fed’s actually going to do the opposite of tapering – they’re going to up the dosage [of QE]. It’s going to end when there’s a currency crisis. When the dollar collapses and then that morphs into a sovereign debt crisis – that’s going to force the Fed’s hand. But until then, it’s just going to pretend there’s an exit…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!