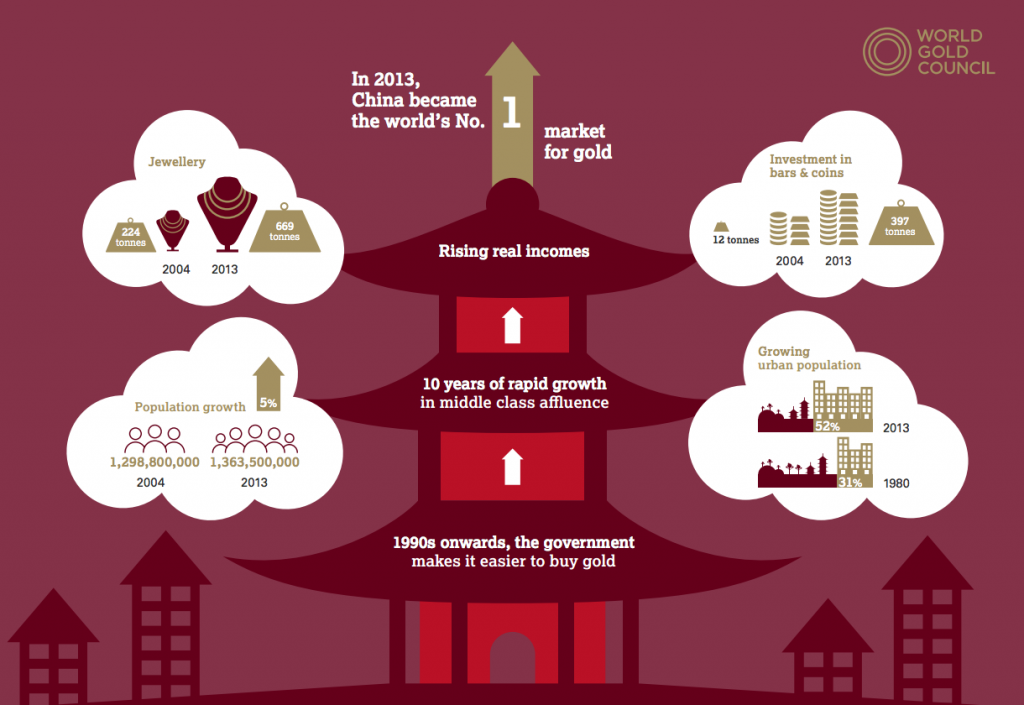

One of the biggest precious metals stories over the past year has been the astounding physical gold demand from Asia, particularly China. The World Gold Council has just released a major report on the history and future of consumer gold demand in China.

“Chinese gold demand in 2013 was exceptional. Jewellery buyers and investors in bullion products took full advantage of the rapid and sizeable fall in local gold prices. They set the bar at a very high level – private sector demand for jewellery, investment and gold used in industrial applications hit a record 1,132 tonnes (t).

We expect 2014 to be a year of consolidation. The sudden price drop in 2013 meant some Chinese consumers brought forward jewellery and bar purchases, which may limit growth in demand in 2014. Expansion by the trade is also expected to slow, particularly in terms of additional manufacturing capacity. However, the lower domestic gold price should support purchases by consumers, especially of 24 carat jewellery. Over the medium term physical gold demand is likely to see further growth driven by a number of factors, including…”

Download the Full Report Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The Future of Chinese Gold Demand

One of the biggest precious metals stories over the past year has been the astounding physical gold demand from Asia, particularly China. The World Gold Council has just released a major report on the history and future of consumer gold demand in China.

Download the Full Report Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!