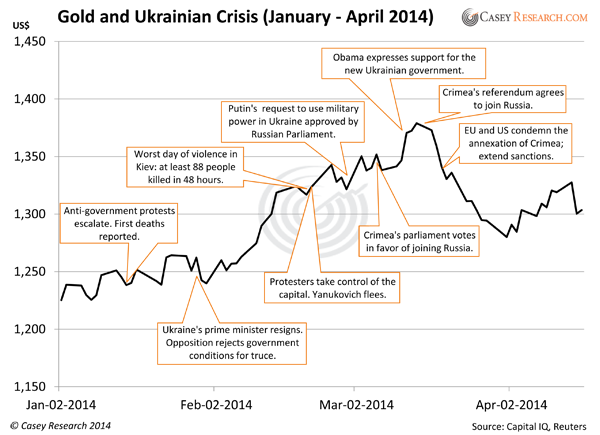

In a new commentary from Casey Research, Laurynas Vegys looks at how the crises in Syria and Ukraine affected the price of gold. Vegys then argues that the most concerning crisis isn’t overseas – it’s the unprecedented levels of US government debt. Sure, gold may respond to volatile international conflicts, but true disaster awaits those Americans who are over-invested in the US dollar.

“This ever-growing mountain—volcano—of government debt is long-term, systemic, and extremely difficult to alter trend. Unlike the crises in Ukraine and Syria (at least, so far), it’s here to stay for the foreseeable future. While some investors have grown accustomed to this government-created phenomenon and no longer regard it as dangerous as outright military conflict, make no mistake—in the mid- to long-term, it’s just as dangerous to your wealth and standard of living.”

Read the Full Piece Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

A Crisis vs THE Crisis

In a new commentary from Casey Research, Laurynas Vegys looks at how the crises in Syria and Ukraine affected the price of gold. Vegys then argues that the most concerning crisis isn’t overseas – it’s the unprecedented levels of US government debt. Sure, gold may respond to volatile international conflicts, but true disaster awaits those Americans who are over-invested in the US dollar.

Read the Full Piece Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!