Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Author Archives: admin

Euro Pacific Precious Metals Is Now SchiffGold

Euro Pacific Precious Metals is now SchiffGold. Follow the link below to explore our new website and watch a personal message from our Chairman Peter Schiff.

WELCOME TO SCHIFFGOLD!

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

1 Comment

Bear vs Bull: Can the US Survive without Cheap Money? (Video)

Peter Schiff appeared on Fox Business yesterday to debate James Cordier about the state of the United States economy. While their conversation was friendly, Peter posed some tough questions that never got answered.

“Every time [the Fed] launched QE, they always followed it up with another one. They’ve never claimed that they were going to do it. Everyone thought, ‘Well, they’re going to do QE and then the economy will recover and they’ll be able to raise rates.’ They’ve never followed QE with a rate hike. They’ve always followed it with a bigger dose, because it doesn’t work…”

Then Peter asked:

“If you’re so bearish on the global economy, and you believe the Fed is going to tighten and ultimately shrink its balance sheet, which is something the Fed has never done really in its history. The balance sheet always expands. So we’re about to have a tight monetary policy and we’re going to have a weak global economy – how is the US economy, in isolation, going to withstand this?”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries, Videos

Comments Off on Bear vs Bull: Can the US Survive without Cheap Money? (Video)

The Fed Can’t Raise Rates No Matter What Yellen Says (Video)

The precious metals have been having a hard time recently, especially following Janet Yellen’s press conference last week. While Yellen was extremely vague about when the Federal Reserve would raise interest rates, the financial media latched on to her theoretical discussion of how rates would be raised when the time came. This turned out to be the only part of Yellen’s statement the markets seemed to care about. Even unbiased, legitimate new agencies like Reuters reported that “…the Federal Reserve indicated in its policy statement it could raise borrowing costs faster than expected when it starts moving.” This is the explanation for gold and silver’s latest downturn. Talk about not seeing the forest for the trees.

In his latest Schiff Report video, Peter Schiff dissects Yellen’s press conference and the Fed’s statement to explain why the Fed will never raise interest rates. In fact, Peter thinks the United States is overdue for another cyclical recession. Physical gold and silver investors should be focusing on this big picture view instead of the deliberately confusing hypotheticals presented by Yellen and the financial media. The economy is getting worse, and this latest news is just another opportunity to stock up on more gold at discounted prices before the markets wake up to the reality of the Fed’s predicament. Here are some excerpts from the video, which you can watch below.

“What the Fed really means by ‘considerable period’ is indefinitely, or forever. Because I don’t think the Fed can raise interest rates. In fact, I don’t even think they could end QE without precipitating a recession, and I think they’ve already set those balls in motion. I think the economy is careening towards recession right now, the Fed just hasn’t figured that out yet. But the Fed certainly doesn’t want to help push it over the edge by raising rates. So it has to stall with this ‘considerable period.’ … If Janet Yellen claims that she has no idea what that means, why even insert the words? Why even include it in your official communique? … I think the reason it’s there is because they want to talk about raising rates, but not actually do it…

Interest rates have to stay at zero. They can never go up, and the only thing the Fed does is adjust the amount of QE… We’re now so broke, we have so much debt, that we cannot possibly afford interest rates above zero… But all this talk now about how soon the Fed is going to raise rates and when is the Fed going to raise rates belies the point that they can’t! Because not only can we not afford higher rates, I don’t even think the economy can sustain itself without the QE… Currency traders [and] metals traders [believe] that yes, the Fed is closer to a rate hike, just because they’re talking about it…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries

Comments Off on The Fed Can’t Raise Rates No Matter What Yellen Says (Video)

Destroying the Dollar a Penny at a Time

A recent article on the Wall Street Journal’s blog draws attention to the high cost of producing a single penny – 1.6 cents each, to be exact. They blame this unsustainable price on the high cost of zinc, which makes up 97.5% of every American penny. The online publication Quartz ran with this story, giving it a new headline: “It costs 1.6 cents to make one penny because of the rising price of zinc”. Time for a short economics lesson.

An alternate, more accurate headline for this story would be, “It cost 1.6 cents to make a penny because of currency debasement.” Rather than pondering whether or not the United States should simply stop producing pennies to save money, Americans should really be thinking about the long-term effects of currency debasement that has been going on for generations.

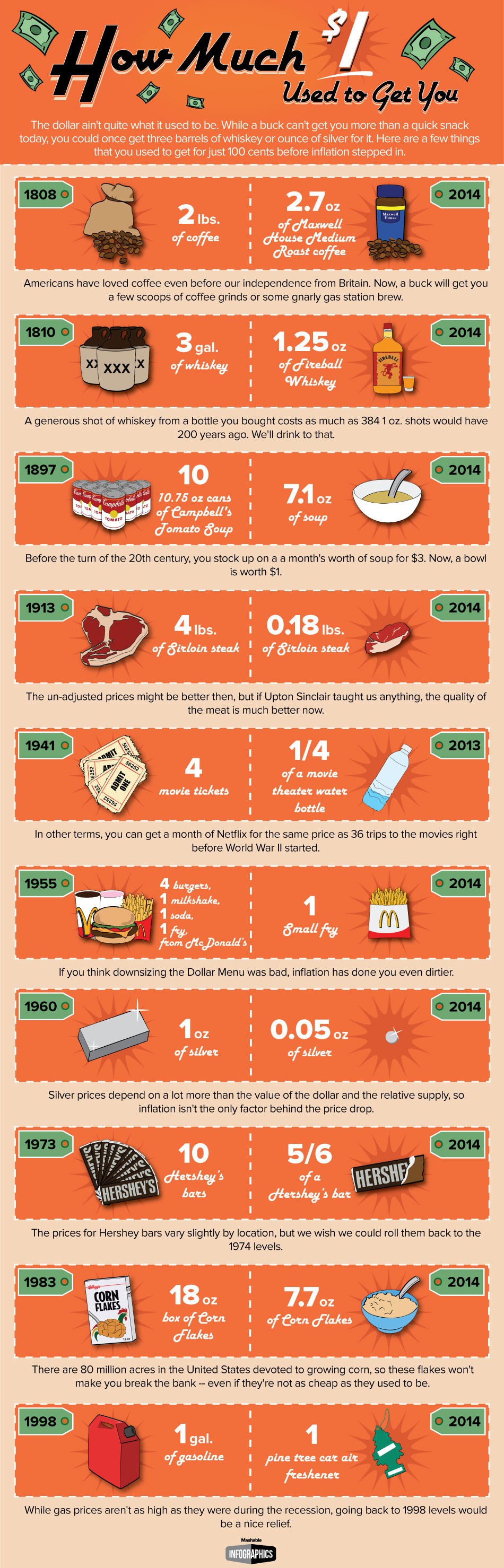

To debase a currency is to weaken its purchasing power. This is often done by inflating the money supply through quantitative easing, which the Federal Reserve has been practicing for years. When a currency is debased, a unit of that currency doesn’t buy the same amount of stuff that it once did. The US dollar has been seriously debased over the last hundred years or more. Just take a look at the handy infographic at the end of this blog post to see how bad it has become.

Currency debasement is the same reason why the US ditched the copper penny in 1982, as well as silver half-dollars, quarters, and dimes in 1964. Today we call these old silver coins “junk silver,” and they’re popular physical precious metals investments. However, they’re anything but junk – they actually contain a useful commodity that has held its value for centuries. It’s not that zinc or copper or silver has become “too expensive,” it’s that those coins have lost some of their purchasing power.

The government debases our currency and says it is because it became too expensive to produce instead of the real reason – destructive monetary policies. The policies of central banks around the world are supposed to stabilize economies and protect the people from currency debasement. However, the truth is that these policies only enrich the politically well-connected, while hurting the poor, those on fixed incomes, and savers.

When currencies aren’t debased, prices tend to fall, not rise. This gives more purchasing power to the poor, those on fixed incomes, and savers. It also decreases the need to gamble savings in the stock market, which means you have fewer bubbles like the one we’re experiencing right now.

So the next time a friend brings up the pretty well-know fact that it costs more to produce a penny than its worth, take the time to educate them about currency debasement.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

6 Comments

Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Let’s be honest. No one has the time or patience to actually watch Janet Yellen’s press conferences about the Federal Open Market Committee’s meetings. Besides, the news never seems to change – the US economy is never quite good enough for the Committee to recommend that interest rates actually be raised back to “normal” levels. Even if Yellen did have something interesting to say, her delivery is about as captivating as a pet rock. At most, you might be able to sit through, say… four minutes. Thank goodness Grabien has created a video mash-up of every Janet Yellen press conference ever to fit exactly that time frame. So next time Yellen has something to say about the FOMC, skip it. You can watch this instead. Just make sure you have a pillow handy.

If you’re seriously wondering when the Fed will actually raise interest rates, read Peter Schiff’s latest commentary explaining what the Fed’s “new normal” is. Find it here.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Peter Schiff Explains the New Fed Playbook

Once again, the financial world watched the Federal Reserve this week in the hopes of hearing some real news about whether or not interest rates would be raised in the near future. While the Fed continued to taper its quantitative easing, it said that interest rates would remain at zero for a “considerable time.” To economists like Peter Schiff this is more or less an open admission that the United States economy is in terrible condition. If the economy was improving, why would it need the continued intervention from the central bank?

In his latest written commentary, Peter compares historical Fed policies to the central banks’ actions in the past eight years. He explains clearly and succinctly why we’re in a new age of “forward guidance” and how disastrous it will be for the economy. Don’t look for interest rates to be raised at all, Peter argues. Instead, another dose of QE is probably right around the corner.

“The truth is the Fed knows the economy needs zero percent rates to stay afloat, which is why they have yet to pull the trigger. The last serious Fed campaign to raise interest rates led to the bursting of the housing bubble in 2006 and the financial crisis that followed in 2008. This occurred despite the slow and predictable manner in which the rates were raised, by 25 basis points every six weeks for two years (a kind of reverse tapering). At the time, Greenspan knew that the housing market and the economy had become dependent on low interest rates, and he did not want to deliver a shock to fragile markets with an abrupt normalization. But his measured and gradual approach only added more air to the real estate bubble, producing an even greater crisis than what might have occurred had he tightened more quickly.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries

Comments Off on Peter Schiff Explains the New Fed Playbook

Are Government Bonds Really ‘Safe’?

Are Government Bonds Really ‘Safe’?

By Dickson Buchanan Jr., Director of International Development

One of the striking ironies of our modern economy is that government bonds are considered safe-haven investments, while gold is a “barbarous relic” to be avoided at all costs. Since the 2008 financial collapse, the bond market has been on a tear, thanks to the Federal Reserve’s endless interest rate suppression. This has only served to reinforce the traditional notion that government bonds are “safe.”

Meanwhile, the financial media argues that gold is no longer relevant to today’s investors. They conveniently ignore the fact that gold has been a safe-haven for thousands of years, while government paper has only been around for a handful of decades.

However, government bonds fall short of traditional investment goals. A look at the history of government-issued bonds in the 20th century reveals terrible performance. Applying this historical knowledge to our current economic climate, and bonds don’t stand a chance when compared to time-tested gold bullion.

Posted in Original Analysis

1 Comment

Eastern Gold Reserves Are Growing and Growing…

Listening to the financial media, you might be convinced that the precious metals – gold in particular – are simply not considered reliable investments anymore. This is a viewpoint peculiar to the West, as Peter Schiff has repeatedly emphasized. However, every now and then, the mainstream media shares some news reminding us that while Americans and Europeans might be disenchanted with the yellow metal, other countries are still very concerned with protecting their savings with the hard asset that has served as a safe-haven for thousands of years. Often that news comes from countries that have a much longer history of troubled economies, and therefore a greater understanding of what assets carry real value in this world.

Today, for instance, Bloomberg published two stories about central bank and Chinese gold demand. In the first, “China May Boost Gold Reserves Amid Imbalances in Holdings“, Bloomberg reports on research from the London-based Official Monetary and Financial Institutions Forum. David Marsh, managing director of the Forum, reminds us that while China hasn’t officially announced an increase in its gold reserves since 2009, there is a good chance that it will very soon. Marsh vaguely suggests that China has been adding to its reserves since 2009 “in different ways.”

Additionally, Bloomberg notes that according to the official figures, Russia has surpassed China to become the fifth-largest gold-holding country in the world. In general, central banks of the world have been net buyers of gold for 14 straight quarters, or 3-1/2 years. So while Wall Street speculators might have been shying away from the yellow metal since it has come down from its 2011 peak, the powers that actually control the world’s money supply have been gobbling up gold. As Marsh puts it:

“Gold will become more traded amongst central banks in the next 30 years because there are colossal imbalances in world gold holdings as a percentage of overall asset reserves.”

Bloomberg’s second article on Chinese gold demand notes that the Chinese Gold & Silver Exchange Society of Hong Kong has become the first non-mainland entity to be allowed warehouse access by China. Construction of the new vault storage facility will begin in Shenzhen next year. It will have a capacity of 1,500 tons. This is just another signal that China is preparing to position itself as the hub of the international gold trade in the years to come.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Eastern Gold Reserves Are Growing and Growing…

The Fed Is Destroying the Economy and Nobody Cares (Video)

Peter Schiff was interviewed by Paul Vigna on Wall Street Journal Video yesterday. Peter explained to Vigna the terrible effects that the Federal Reserve’s zero interest-rate policy is having on the United States economy. They spoke about how tepid the American job market is right now, and why Peter thinks a new round of quantitative easing is right around the corner. If you’d like to read Peter’s latest written commentary about why central banks are wrong to think that inflation is the cure for our economic woes, you can find it here.

“The next thing the Fed is going to do is launch an even bigger round of QE than the one they’re tapering off from. Because the US economy is not recovering. We are slipping back into recession. If the Fed doesn’t know that yet, it will by the end of the year… Tightening is all talk… [The Fed will eventually start] a new round of QE that will make the Europeans and Japanese blush.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries, Videos

Comments Off on The Fed Is Destroying the Economy and Nobody Cares (Video)

The Swiss Want Even More Economic Freedom (and Gold)

Switzerland is ranked as the freest economy in Europe in the 2014 Index of Economic Freedom, published by the Heritage Foundation in partnership with the Wall Street Journal. In the world rankings, Switzerland is the 4th most economic free country. While the United States Federal Reserve argues that inflation is necessary for economic stability, it should be noted that Switzerland has achieved its economic freedom with a current inflation rate of negative 0.7%. That means consumer goods are getting cheaper for the average Swiss citizen every year. Try to wrap your head around that, Janet Yellen. And while you’re at it, explain why the United States isn’t even in the top 10 freest economies in the world.

Yet in spite of this relative prosperity, the Swiss populace is not satisfied. They want more freedom and are getting ready to demand more economic responsibility from their central bank, the Swiss National Bank (SNB). This fall, the citizens of Switzerland will be voting on a referendum that would dramatically alter the SNB’s gold bullion allocations and holding policy.

If passed, the initiative would dictate three important gold policies for the SNB:

This initiative would force the Swiss central bank to make large purchases of the yellow metal to comply with the new guidelines. Not only that, it would make it very difficult for the SNB to manipulate the Swiss economy with destructive monetary policies. It’s a lot harder to lend money to irresponsible politicians when your holdings are in hard assets like gold bullion. Unsurprisingly, the bureaucrats of the Swiss Parliament and SNB are strongly opposed to the initiative.

Back in May, a guest columnist for David Stockman’s blog Contra Corner wrote in detail about the Keynesian opposition to Swiss gold repatriation. He raised some excellent points countering the SNB’s argument that the gold initiative would severely limit its flexibility and damage its credibility.

Dr. Ron Paul brought the referendum back into the limelight just the other week in a new essay published at The Ron Paul Institute. As always, Dr. Paul brings common-sense wisdom to the table and urges the Swiss to vote for gold and freedom.

So while the United States and much of the West seems to have become completely disenchanted with the yellow metal, there is a bright spot over in Europe. Just as Dr. Paul points out, if the Swiss pass their gold referendum, it could play a huge role in reestablishing gold as a foundational monetary asset for modern economies.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!