Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Author Archives: admin

Today’s Key Gold Headlines – 5/2/14

- Bright Spot for India’s Gold Demand, Wall Street Journal

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 5/2/14

The Gold Price Is Fixed. So What?

Check out Peter Schiff’s May Gold Letter released today. Peter addresses the topic that has been on the mind of every precious metals investor – gold price manipulation. Peter argues that even if gold is fixed, the real question is… does it matter? Plus, Casey Research shares the latest facts about silver’s fundamentals, Lampoon the System reveals how China hides its gold, and much more. Enjoy!

“We can’t ignore it anymore – the markets are rigged. The LIBOR scandal broke almost two years ago, and the banks found responsible for manipulating that key index are still dealing with lawsuits. Meanwhile, allegations of gold market manipulation have been simmering for over a decade and grew into an inferno after the spot price dropped dramatically last spring.

Yet I’m left wondering what the conspiracy theorists hope to accomplish. Yes, I believe in exposing truth for its own sake and that the individual investor should have the same opportunities in the marketplace as the big institutions. But with these conspiracists, there is often a subtext of, “Because the price is suppressed, buying gold is for suckers.” I think this conclusion is precisely wrong.”

Continue Reading the Full Gold Letter Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Featured, Peter's Commentaries

1 Comment

Today’s Key Gold Headlines – 5/1/14

- China Poised to Pass US as World’s Leading Economic Power This Year, Financial Times

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 5/1/14

Today’s Key Gold Headlines – 4/30/14

- GDP Slows to Crawl in First Quarter, Up 0.1%, Wall Street Journal

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 4/30/14

Gold Levels the Investment Playing Field (Audio)

The BBC interviewed Marcus Grubb, the Managing Director for Investment at the World Gold Council (WGC), about the growing demand for gold in China. Earlier this month, the WGC released a new in-depth research report that showed gold demand in China would increase another 25% by 2017. Grubb explains why gold is such an essential asset not only to the Chinese, but to any investor who wants to avoid the risks of speculative investments and currency debasement.

“Basically, gold plays a role as a diversifier… a way of keeping their money safe from inflation, from currency debasement, from the vagaries of other asset markets… Remember, gold is priced in many different currencies all over the world at the same time. The yuan has been gradually appreciating against most currencies… So if you look at gold in Chinese terms, to the Chinese consumer, it will certainly look less volatile than it does, in say, dollar terms.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Gold Levels the Investment Playing Field (Audio)

Today’s Key Gold Headlines – 4/29/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 4/29/14

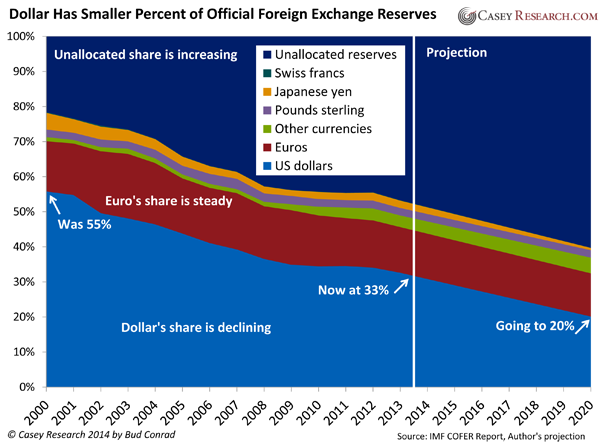

The Dollar’s Days Are Numbered

Bud Conrad’s latest commentary at Casey Research looks closely at the decline of the US dollar as the world’s reserve currency.

“After World War II, the dollar became the world’s preeminent currency. Convertible to gold at $35 an ounce, it was the backbone of international trade. Foreign central banks used it to back their own currencies.

Nixon removed the dollar’s convertibility to gold in 1971, rendering its value dependent on prudent management by its issuer. That issuer, of course, is the Federal Reserve—which conjures dollars into existence to support the US government’s spending habit.

The Fed has issued a lot of dollars since 1971, and even more since the financial crisis of 2008—thanks to Washington’s exploding debt levels. And it’s only going to get worse, as even the Congressional Budget Office (CBO) admits in its own forecasts.

What’s more, CBO debt estimates are notoriously overoptimistic; so while they are daunting, reality will likely be worse.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Dollar’s Days Are Numbered

Today’s Key Gold Headlines – 4/28/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 4/28/14

Peter Schiff’s 2014 Gold Outlook

MarketWatch interviewed Peter Schiff to get the bull case for gold in 2014. In spite of ongoing negative sentiment for the yellow metal, Peter thinks gold will keep rising this year. The only thing that could change his mind would be the Federal Reserve actually ending quantitative easing. He doesn’t expect that to happen, because the US economic recovery is a sham.

“Q: Before this year began, what were your expectations for gold prices and how does that compare with the metal’s performance year to date?

Schiff: I thought that the selloff in 2013 was completely out of touch with reality, so I expected the price to rise this year. In this, I was virtually alone in the financial community. Just about every major investment house had predicted even more losses for gold in 2014. So far this year, gold is the best-performing asset class, but I think the pullback we have seen over the last few weeks is just another indication of how much negative sentiment remains. Ultimately however, the fundamentals will prevail. The Fed will keep printing [dollars] and gold will keep rising.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews

Comments Off on Peter Schiff’s 2014 Gold Outlook

Watch Out for a Major Market Correction (Video)

Renowned investor Marc Faber spoke with CNBC this week about the over optimism surrounding the US stock market. Faber thinks this is the wrong time to get into US stocks and warns of an inevitable correction. While Faber talks about emerging markets as good investments, don’t forget that this is also a great time to buy into physical gold and silver at very cheap prices.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!