Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Author Archives: admin

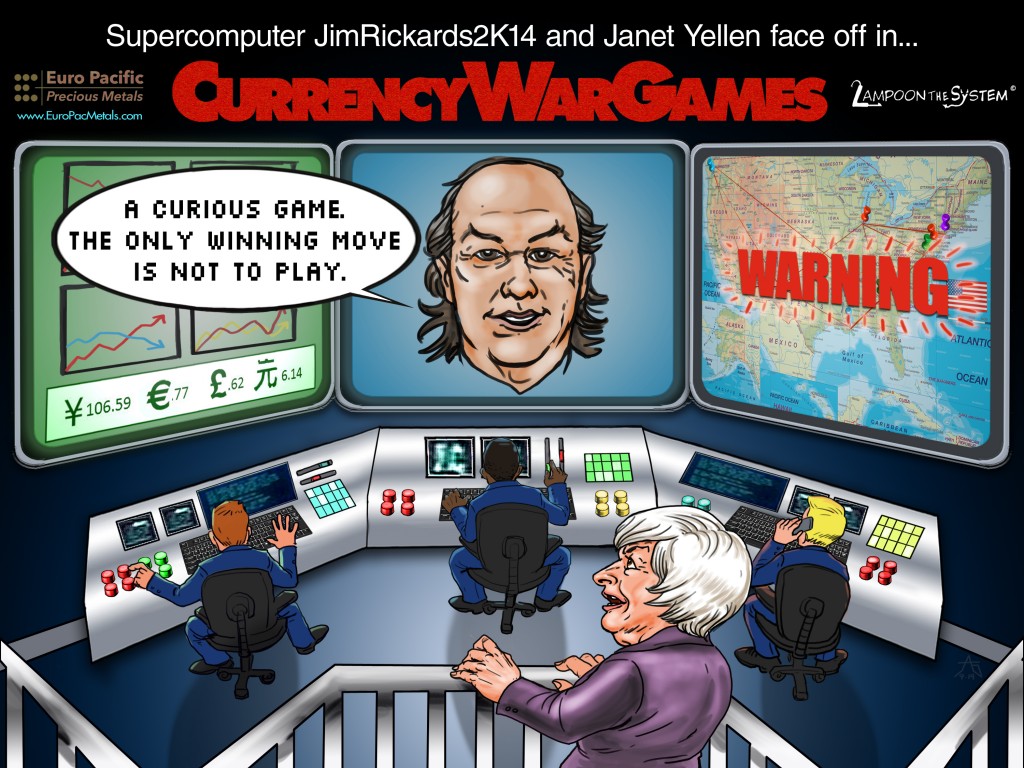

Currency War Games

In the 80’s, America confronted two great risks – an evil empire and an out-of-control US dollar. Unfortunately, though we beat the communists, we seem to be losing the battle for sound money.

For its latest comic, Lampoon the System reprises War Games, the classic 1983 blockbuster starring Matthew Broderick. The esteemed Jim Rickards plays the role of “Joshua”, the supercomputer in the movie. Peter Schiff interviewed Rickards in August, and they talked extensively about the repercussions of an international “currency war.” If you missed it, check it out here.

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Click here for more cartoons and information on his anthology book, available for only $15.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Lampoon Comics

1 Comment

Is the World at ‘Peak Gold’?

This week, Chuck Jeannes told The Wall Street Journal that either this year or next, miners will have reached “peak gold.” Peak gold means that the amount of gold being pulled out of the earth will begin to shrink every year, rather than increase, which has been the case since the 1970s. Jeannes is the chief executive of the world’s largest gold mining company, Goldcorp, so it’s probably safe to assume he knows a thing or two about mining the yellow metal.

Let’s put this into context. Central banks continue to stockpile gold (even Scotland is wondering how much of the United Kingdom’s gold it will get if it becomes an independent country). Nobody knows how much gold China is hoarding, but pretty much everyone assumes it’s a lot more than the official reports. Smart economists like Peter Schiff and Jim Rickards have been pointing out for a year now that gold buyers throughout Asia are accumulating more and more gold from Western investors, and they have almost no intention of selling it.

For physical precious metals investors, all of this news should hit home. What happens when this robust demand for gold runs up against the hard limits of the mining industry? This is simple supply and demand – prices go up.

“As gold production declines, the miner’s job becomes harder, as companies compete for increasingly rare deposits. Discoveries have already tapered off. In 1995, 22 gold deposits with at least two million ounces of gold each were discovered, according to SNL Metals Economics Group. In 2010, there were six such discoveries, and in 2011 there was one. In 2012: nothing.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

1 Comment

The Amazing World of Silver Technology

The Silver Institute’s August edition of Silver News is now available. This issue explains the fundamentals behind the surging growth in demand for industrial silver, which is expected to exceed global GDP growth through 2016. The constantly evolving industry for silver technology is largely to thank for this increasing demand. August’s Silver News highlights some of the fascinating new applications of silver, including:

- Two forms of 3D printing with silver

- Using heated nanosilver to treat cancer

- Screen-printed silver circuits that cure in UV light

- Antibacterial silver on home hardware products

You’ll also find an explanation of how silver is used as an essential chemical catalyst in the production of ethylene oxide (EO), which in turn is needed to create ethylene glycol. Ethylene glycol is one of the most important substances in our modern world.

“Ethylene glycol, in turn, is used to produce many products including polyester fibers for clothes and carpets, plastics, solvents and other chemicals, and even antifreeze formulations. By itself, EO is used to sterilize many health-care products and medical instruments, including delicate electronic or optical tools, which would be harmed by the high heat or radiation sterilization processes. EO is also used to accelerate the aging of tobacco leaves, as a fungicide, and even as a preservative for spices.”

Image: Tanaka’s printed silver circuit board.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on The Amazing World of Silver Technology

‘Shrinkflation’: The Prelude to True Inflation

The financial media regularly plays down reports of consumer price inflation that are much higher than the official numbers. Even worse, analysts generally argue that more inflation is needed for the health of the US economy. Pippa Malmgren, author of a new book, Signals: The Breakdown of the Social Contract and the Rise of Geopolitics, has been studying price inflation that is cleverly hidden – she calls it “shrinkflation.”

Shrinkflation occurs when consumer products cost the same, but contain less. For instance, Malmgren points to Cadbury chocolate bars that were reduced in size in 2011, while the price remained the same. Nestle’s Shredded Wheat and Carlsberg beer are two other major products that are practicing shrinkflation. Haagen-Dazs shrunk its “pint” of ice cream by 20% in 2011. Here’s an entire list of shrinkflation products published by CNN Money three years ago. Peter Schiff has talked about this very phenomenon in his videos and podcasts for years.

The financial media will likely downplay this trend in favor of broader, “official” measures of inflation that show prices are well under control. However, they’d be missing one of Melmgren’s most important insights: “Shrinking the size of goods is exactly what happened in the 1970s just before inflation proper set in.” At a certain point, a company can’t just keep lopping squares off the chocolate bar – they’re going to have to raise the price.

Remember, if there’s one thing you want to be holding when inflation really hits hard, it’s physical gold and silver bullion.

Read the Full Article on Shrinkflation Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on ‘Shrinkflation’: The Prelude to True Inflation

American Workers: The Economy Is Terrible

The John J. Heldrich Center for Workforce Development at Rutgers University released its latest Work Trends report. The national survey found that Americans are extremely pessimistic about the state of the US economy in spite of the financial media’s claims that a strong economic recovery is underway. The report is titled “Unhappy, Worried and Pessimistic: Americans in the Aftermath of the Great Recession”. Some of its major findings include:

- One-quarter of the public says they’ve experience a major decline in quality of life.

- Only one-sixth of Americans believe the next generation will have better opportunities than the current generation.

- Most Americans don’t think the economy improved last year or will in the next.

- Four in five Americans don’t have any faith that the government will be able to improve conditions in the next year.

The report paints a bleak picture of the American workforce and economy coming from the direct experience of American laborers. Cliff Zukin, co-director of the surveys, said:

“Looking at the aftermath of the recession, it is clear that the American landscape has been significantly rearranged. With the passage of time, the public has become convinced that they are at a new normal of a lower, poorer quality of life. The human cost is truly staggering.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines, Outside Commentaries

Comments Off on American Workers: The Economy Is Terrible

Court Freezes Assets of Merit Gold Executives

A Los Angeles Superior Court judge has issued a restraining order freezing the assets of Merit Gold owners Peter Epstein and Michael Getlin. Also included in the court document is an order for Merit to cease and desist accepting payments from its customers. The judge found that it was very likely that the company “was permeated with fraud.” A trial date has been set for October 14.

On August 5th, Merit Financial allegedly committed what appears to be a fraudulent transfer when it sold its assets to Credit Management Association for just $1.00. This triggered the restraining order.

Merit Gold and Silver has closed its doors and is no longer selling precious metals. If you missed the news this past February, the Santa Monica City Attorney’s Office had filed a consumer protection lawsuit against Seacoast Coin, Inc., which is the parent company of Merit Financial and Merit Gold and Silver. Merit Gold was one of the largest precious metals dealers in the nation and operated large national TV advertising campaigns.

Merit Gold allegedly used aggressive “bait and switch” tactics to lure in customers nationwide. The lawsuit said it would draw customers in to buy gold bullion at just “1% over cost.” Then, Merit salespeople apparently would trick customers into buying “collector” coins that carried very large mark-ups.

It is alleged that Merit falsely told customers various deceptive statements about their collectible products, including:

“That the coins are a better investment than bullion; that the coins offer more privacy than bullion; that the coins are not “reportable” on consumers’ taxes; that the coins can’t be confiscated by the government, while bullion can be.”

The complaint says that the coins that Merit sold had “none of these advantages.” City attorneys say that Merit swindled millions of dollars from its customers, many of whom were seniors.

Euro Pacific Precious Metals has never and will never sell “numismatic” or “collectible” gold and silver products. We do not recommend them to serious investors.

Please give us a call if you would like to speak more about this:

1-888-GOLD-160 (1-888-465-3160)

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

2 Comments

Jim Grant: The Word for Inflation Is “Bull Market” (Video)

Jim Grant, publisher of Grant’s Interest Rate Observer, was interviewed by Steve Forbes. Grant gives a grim overview of the economy, saying that the Federal Reserve’s suppression of interest rates and the creation of “unimaginable amounts of digital money” since 2007 have caused major distortions. He argues that economic intervention leads to more economic intervention until the “the patient is over-medicated.” This is the same argument that Peter Schiff has made for years.

“Inflation is too much money and credit. That’s the cause. The symptoms are variable. The word for inflation is: bull market…

Gold is a universal currency. People recognize it at sight. The derivation of the term ‘sound money’ is – [Clang! He drops a gold American Eagle coin on the table]. Isn’t that lovely?”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Jim Grant: The Word for Inflation Is “Bull Market” (Video)

Clueless in Wyoming

Central bankers from around the world got together last week in Jackson Hole, Wyoming for their yearly monetary mixer. We know they talked a lot about how central bank monetary policies could “help” the world with its economic woes. But there’s one thing we can be sure they didn’t discuss – how many of the world’s economic problems are created by these very same policies. In a new commentary, Steve Forbes analyses six areas about which these central bankers are completely clueless.

- The role of money: Central bankers think money controls economic activity, instead of the other way around. Thus, they believe they can successfully manipulate the economy into real growth with their monetary meddling.

- What money is: Money itself isn’t wealth. Money measures wealth and reflects marketplace activity. Creating more of it is counterfeiting, a.k.a. theft.

- Commerce does not cause inflation: On the contrary, central banks cause inflation when they create more currency.

- Manipulating interest rates is equivalent to price controls: Interest rates are the price we pay to borrow money. Just like any other price, the market should set them.

- The job of central banks is to keep the value of money stable: They have clearly failed at this. The gold standard is the best system ever devised for keeping the value of a currency stable. The whims of central planners have failed over and over, and nothing will change this time around.

- Monetary policy can’t cure an economy’s structural flaws: Taxes, regulations, and labor laws are suffocating economies all throughout the world. Even if central bankers were able to overcome the failures of central planning through monetary policy, they could not overcome the barriers of regulations.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Clueless in Wyoming

Former Mob Boss: Avoid Wall Street, Buy Physical Gold (Video)

Michael Franzese, a former mob boss who went straight following a 10-year prison term, thinks stocks are in a bubble. He says he has worked with many of the people on Wall Street and doesn’t feel comfortable letting “shady” characters handle his money. In 1986, Franzese ranked No. 8 on Fortune Magazine’s list of the 50 wealthiest and most powerful mob bosses.

Franzese says he thinks he can do better with his money than Wall Street speculators. In fact, his number one piece of advice to investors is to not even bother with stocks. He strongly recommends physical gold bullion specifically, because “No matter what, it’s always going to have value. Unlike stocks, where…you go to sleep, everyone tells you everything is wonderful, you wake up and everything is gone.”

Investors don’t need to trust an ex-mob boss with their wealth in order to recognize the truth of his words. As someone who had first hand experience dealing with the casino on Wall Street, Franzese wants no part of it. He prefers to have his money in his own hands, not in the system that has proven over and over again it can’t be trusted.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Former Mob Boss: Avoid Wall Street, Buy Physical Gold (Video)

Gold Videocast: Peter Schiff Answers Your FAQs (Video)

Peter answers some of the more challenging questions he has received from you, his loyal clients and subscribers. Learn what he really thinks about gold manipulation, why Wall Street hates gold, who should buy silver instead of gold, and more!

0:05 – Question: “According to the financial media, the world has ‘fallen out of love with gold.’ Is this really true?”

0:40 – The world cannot fall out of love with something it never loved in the first place – but it will fall out of love with fiat currencies.

2:03 – The time to buy gold is when everyone hates it. That’s why it’s so cheap.

2:30 – Question: “In your last Gold Videocast, Jim Rickards said that gold price manipulation is true. Why do you keep ignoring this issue”?

2:40 – Even if gold is being manipulated, I still want to own it.

3:10 – If manipulation is true, it allows my clients to buy more at artificially low prices.

3:38 – Manipulation cannot go on forever. Before long, free-market forces overwhelm artificial price controls.

4:17 – Question: “You keep warning about hyperinflation and a collapse of the US dollar, but it hasn’t happened! Has our modern banking system solved this problem?”

4:43 – You have to warn about things in advance to give people time to prepare, which is exactly what I did with the housing bubble.

6:03 – A recent article mentioned widespread Shrinkflation. If a company charges the same price for less of a product, that’s still inflation!

6:55 – Inflation will become hyperinflation if the government doesn’t take drastic measures.

7:15 – Question: “You always recommend gold as the best way to protect one’s wealth, but I can’t afford it. Is silver a good alternative?”

7:28 – Silver coins are better for small barter transactions.

7:57 – There is more potential for upside in silver. So if you can only afford a little right now, why not get started with the metal that may give you more bang for your buck?

8:10 – Eventually, you should hold both metals, but for some people it makes sense to get started with silver.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!