Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Author Archives: admin

Today’s Key Gold Headlines – 7/15/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/15/14

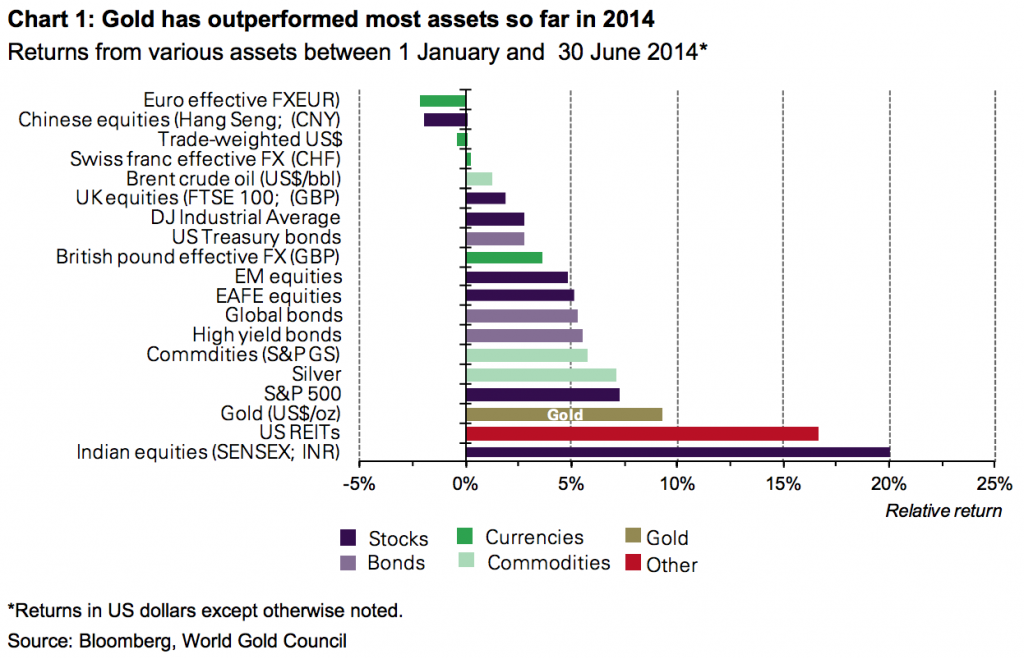

Gold for Risk Protection in 2014

In its latest Investment Commentary, the World Gold Council explains why gold outperformed most assets in the first half of 2014, contrary to many analysts’ predictions. The report also shares the latest research on why gold is an essential asset for protecting your portfolio from high-risk debt and potential market volatility. The big takeaway – when it comes to risk protection in the second half of 2014, gold is one of your cheapest and most reliable options.

“Gold is up by 9.2% so far this year. This surprised many market participants as most analysts predicted lower prices. Some investors took advantage of last year’s price correction to buy gold but investment demand has remained tepid. We consider that the current environment of high bond issuance, tight credit spreads and record low volatility continues to offer a prime opportunity for investors to add gold. In our view, gold can reduce overall portfolio risk and it is cheaper to implement than many volatility-based strategies.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Gold for Risk Protection in 2014

Today’s Key Gold Headlines – 7/14/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/14/14

Gold Videocast: Gold’s 2014 Half-Time Report

In the first edition of the new Gold Videocast, Peter delivers his verdict on the gold market for the first half of 2014, analyzes Janet Yellen’s performance so far as Fed Chair, and makes some contrarian forecasts for the rest of the year.

1:00 – Gold’s rise has confounded Wall Street banks that advised their clients to sell in expectation of a big correction.

1:40 – Even though the financial media has focused on the Dow breaking 17,000, gold has actually outperformed the Dow this year.

2:10 – Mainstream forecasters have bought into the narrative of a genuine US economic recovery and the ability of the Fed to effectively withdraw its monetary stimulus. In fact, the economy is not recovering and will relapse into recession, perhaps beginning in the second half of 2014.

3:17 – The price of gold is putting in a bottom, supported by the mining stocks. They led the market down in 2013, and are now leading it up.

4:15 – There is going to be a short squeeze as gold sellers try to buy back their positions when they realize the economy is not recovering.

5:30 – Even though the Fed’s own inflation measure has passed its target of 2%, Janet Yellen continues to claim inflation is under control.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries, Videos

12 Comments

Today’s Key Gold Headlines – 7/11/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/11/14

Gold Is the Only Undervalued Asset in a World of Bubbles (Video)

In this long segment on CNBC’s Futures Now, Peter Schiff, Marc Faber, and Dennis Gartman discuss the massive bubbles forming in almost every asset class. Faber called for a potential bear market correction of 30% in US stocks. All three agreed that gold is the best option for retail investors to protect themselves from the Federal Reserve’s inflationary monetary policy.

“The only place there’s not a bubble is in gold, and that’s the only place that most people on Wall Street think they see one. They’re oblivious to the actual bubbles, but they’re overlooking the value in gold…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Videos

Comments Off on Gold Is the Only Undervalued Asset in a World of Bubbles (Video)

Today’s Key Gold Headlines –

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines –

Today’s Key Gold Headlines – 7/9/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 7/9/14

US Dollar Doesn’t Deserve to Be Reserve Currency (Video)

Russia Today spoke with Peter Schiff about the United States’ international spy activity and what effect it will have on the strength of the US dollar.

“[Europe is not economically dependent on the US.] I think it is the other way around – the US is very dependent on the rest of the world. It is just incumbent on the rest of the world to figure that out. But the US dollar is still functioning as a reserve currency, so the dollar is a part of larger transactions but there is no reason for the dollar to be at the center of these transactions because the dollar shouldn’t be a reserve currency. Maybe at one time when we were the world’s largest exporter, as far as biggest trade surpluses, we had high savings rates, and the dollar was backed by gold. [At] one time maybe the dollar deserved to be a reserve currency, but certainly those conditions have changed dramatically.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Videos

Comments Off on US Dollar Doesn’t Deserve to Be Reserve Currency (Video)

The Fed Has Trapped Itself In a Market Mirage

In a new commentary published by The Gold Republic Journal, renowned author and economist Jim Rickards explains why the Federal Reserve cannot safely exit its quantitative easing program. Rickards argues that the supposed strength of the US markets is a complete mirage created by the Fed’s policies.

Read the Full Piece Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!