Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Author Archives: admin

Today’s Key Gold Headlines – 6/30/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 6/30/14

Today’s Key Gold Headlines – 6/20/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 6/20/14

The Euro Goes Negative

Euro Pacific Precious Metals’ very own Dickson Buchanan Jr. explains how negative interest rates in Europe will impact the global debt crisis and gold investors.

The European Central Bank’s (ECB) decision to charge a negative interest on overnight deposits is not going to lead to a higher targeted inflation rate, despite ECB President Mario Draghi’s insistence that it will. Like all cases of central planning, this decision will have unintended and costly consequences – some of which are already starting to play out. In this particular case, instead of stimulating business lending or higher prices, the decision will only stimulate the increased buying of insolvent government debt – leading us all one step closer to the economy’s eventual unravelling.

The Sovereign Debt Bubble Is a Bigger Issue

Since the announcement earlier this month, banks have skirted around the negative interest rate imposed by the ECB via the purchasing of government bonds. These are the perfect vehicles for banks, as they are considered “virtually” risk free securities.

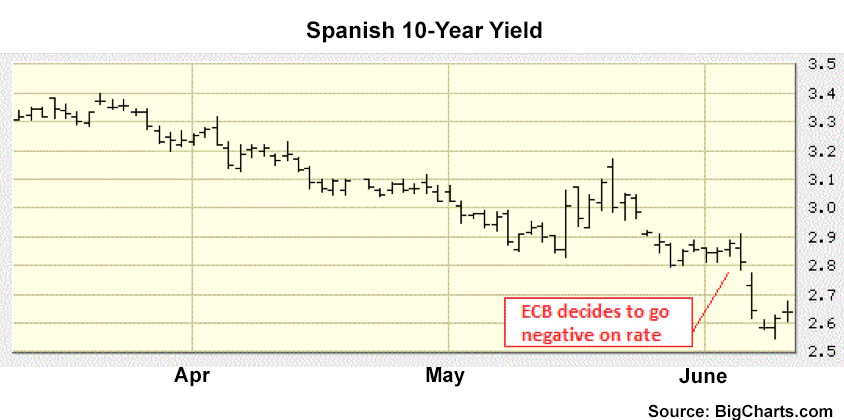

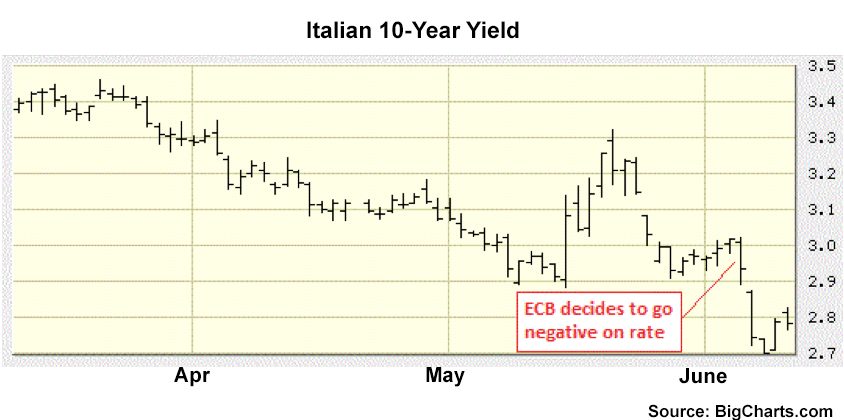

We can see this has already started occurring if we examine the yield on a couple of 10-year eurozone bonds. Keeping in mind that the yield on a bond is inverse to its price, take a look at the charts for the Spanish 10-year bond and the Italian 10-year bond. The yield on both bonds has dropped.

It should be obvious that this measure has and will continue to allow governments to borrow more money and more easily roll over their existing debt obligations. However, more importantly – and more dangerously – it increases the net exposure that banks (and their customers, who are you and me) have to the promises of insolvent governments. This could spell real trouble for anyone that hasn’t already removed their capital from the financial system with gold or silver.

The “Real Crash” Is Yet to Come

The last five years since the 2008 financial crisis have been marked by unprecedented intervention by central banks. Peter Schiff was one of the first to realize that the policies being passed to aid the economic recovery (TARP, bailouts, QE, etc.) were really creating the next boom and bust cycle.

But this new boom and bubble is different.

In his own words, Peter described 2008 as the “tremor” that would precede the “earthquake.”

What’s the Difference?

The reason why Peter thinks the day of reckoning is still to come does not have as much to do with the size of the current bubble. Although size is important, it has everything to do with where the bubble is being blown.

The coming “Real Crash,” as Peter calls it, has its roots in the false promises of insolvent governments to pay their debt obligations when they literally can’t. That is why the ECB’s decision is so pernicious – because it fuels a sovereign debt bubble that will be all the more destructive when it pops.

What You Can Do

In his book, The Real Crash, Peter highlights several ways to keep your capital safe from what’s coming. Among other advice, he recommends you “own gold” and “stay liquid.”

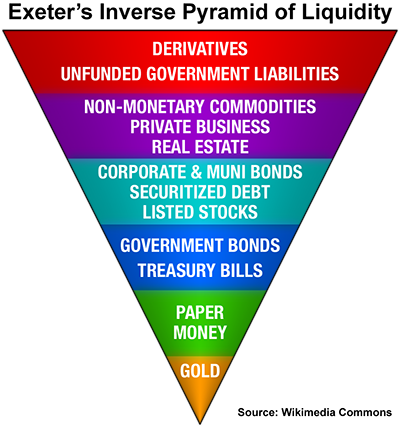

Owning gold seems simple enough, but what does staying liquid actually entail? There is a little-known-gem-of-a-chart by the American economist John Exeter, who was considered an expert on the economics of the Great Depression. The chart is called Exeter’s Inverse Pyramid of Liquidity. Below is a modern adaptation.

The pyramid organizes asset classes from top to bottom in order of increasing liquidity. Part of the theory behind the chart is that in times of crisis there is always a movement out of less-liquid assets into more-liquid assets. The reason for this is not hard to understand. When you are faced with the reality of losses or defaults, you want to minimize them as best you can. The way to do this is to sell out of the losing investment into something more stable and resilient – something more universally demanded.

In the most recent boom-bust cycle – the housing crash of 2008 – we saw the selling out of less-liquid assets (real estate, which you will find near the top of the pyramid) into more-liquid assets (dollars, bonds, and gold, generally speaking). Once a large enough number of market participants realized that the euphoric boom had run its course, there was a mad scramble to get into more-liquid asset classes. The value of the less-liquid assets plummeted. The value of the more-liquid assets rose.

We are now in the middle of another cycle created once again by our institutions of volatility – central banks. But this cycle is different.

This is the earthquake cycle that the tremor of 2008 preceded. It’s not another housing bubble (top of the pyramid) we have to worry about; it’s a government debt bubble (right in the middle). The ECB’s decision to go negative on the overnight deposit rate has only served to increase the total amount of debt in the system. You will notice on the chart that government debt lies right above the pieces of paper we call money.

It’s not a fiscal cliff we are going over, it’s a money cliff.

Once people realize that this boom in government debt is not worth the paper it’s printed on, then there will be a similar flight to more-liquid assets at the bottom of the pyramid.

This is where gold and silver come into the picture. By now, you should realize that when Peter recommends buying gold and staying liquid, he is really saying the same thing. Gold stands at the bottom of the pyramid.

The best way to insulate yourself from the costly folly of central bankers and insolvent governments is to own the most liquid asset.

Gold is the most liquid asset.

Dickson Buchanan Jr. is Director of International Development and Senior Precious Metals Specialist at Euro Pacific Precious Metals, Peter Schiff’s gold and silver firm. He received his MA in Austrian Economics from King Juan Carlos University in Madrid, Spain. Dickson joined the Euro Pacific Precious Metals team in 2012 after returning from his economic studies abroad.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

7 Comments

Today’s Key Gold Headlines – 6/19/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 6/19/14

Today’s Key Gold Headlines – 6/18/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 6/18/14

Marc Faber Blames Media for Stifling Gold Investment (Video)

CNBC’s Futures Now had an interesting conversation with Marc Faber today. Though brief, Faber’s insights into the gold market were spot on. He urged investors to avoid overpriced equities and buy into physical gold while it is still cheap. On top of that, he blamed the financial media for hamstringing gold and scaring investors away from one of the best hard assets for wealth preservation.

“Investors should have some exposure to gold. I have an exposure of approximately 25%, and just recently when it dropped, I bought some more… I think that eventually the monetary policies of central banks will lead to a further loss of purchasing power in the value of paper money. We have everywhere colossal asset inflation. Nothing is particularly cheap… Gold is relatively cheap compared with equities at the present time.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Marc Faber Blames Media for Stifling Gold Investment (Video)

The Perfect Storm for Gold (Audio)

Chris Waltzek interviewed Peter Schiff on GoldSeek Radio last week. They began by discussing how the European Central Bank’s interest rate cut will influence the price of gold. They moved on to address the rising cost of living, Asian gold consumption, technical indicators of gold’s bottom, gold repatriation, buying precious metals with bitcoin, and much more.

“I think going into the second half of the year, people are going to be surprised by how weak the economy is… Yellen’s going to come back screaming for more QE. The gold market has to take off sometime between now and then… I think the problem that the traders are going to have is buying back the gold they sold… A lot of the gold that was dumped into the marketplace since the middle of last year is now very deep in some Chinese vault… It’s not coming back to the market. The people who bought gold at $1,300 or $1,400 – they ain’t selling it. They bought it to keep it, not to trade it.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries, Videos

1 Comment

Today’s Key Gold Headlines – 6/16/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 6/16/14

Debt Is No Salvation

In his latest commentary, Peter Schiff addresses the ridiculous claim that America was built on consumer debt, as put forth by Steve Liesman, senior economic reporter for CNBC. Peter explains why a healthy economy is based upon savings and production, not debt. While most of the Western world seems intent on accumulating more debt, wise investors are protecting their economic futures with savings in physical gold and silver.

“Thus far 2014 has been a fertile year for really stupid economic ideas. But of all the half-baked doozies that have come down the pike (the perils of “lowflation,” Thomas Piketty’s claims about capitalism creating poverty, and President Obama’s “pay as you earn” solution to student debt), an idea hatched last week by CNBC’s reliably ridiculous Steve Liesman may in fact take the cake. In diagnosing the causes of the continued malaise in the U.S. economy he explained, “the problem is that consumers are not taking on enough debt.” And that “historically the U.S. economy has been built on consumer credit.” His conclusion: Consumers must be encouraged to borrow more money and spend it. Given that Liesman is CNBC’s senior economic reporter, I would hate to see the ideas the junior people come up with.

Before I get into the historical amnesia needed to make such a statement, we first have to confront the question of causation. Just as most economists believe that falling prices cause recession, rather than the other way around, Liesman believes that economic growth is created when people tap into society’s savings in order to buy consumer goods that they could not otherwise afford. But consumption does not create growth. Increasing productive output allows for greater consumption. Something needs to be produced before it can be consumed.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries

1 Comment

Gold Is One of the Most Liquid Assets

The World Gold Council released Volume 6 of their Gold Investor this week. Their latest research highlights the amazing liquidity of gold, even when compared to other alternative asset classes. This special report focuses on three aspects of gold investment:

Download and Read the Full Gold Investor Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!