Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Outside Commentaries

Marc Faber: Physical Gold Headed to New Highs

Hard Asset Investor interviewed Marc Faber last week to get his opinion of where the stock market and gold price are headed. Unsurprisingly, the publisher of the Gloom, Doom & Boom Report thinks the stock market is preparing for a large correction and gold is destined for an epic bull rally. Most importantly, he emphasized that investors should buy physical gold – not paper gold assets.

“We have had a meaningful correction [in gold]. From $1,921 in September 2011 to less than $1,200 at the bottom is a fairly large correction. But in longer-term bull markets, these kinds of corrections do occur. We had a 40-50 percent correction in 1987 in equity markets. But the bull market lasted until the year 2000.

Looking at the fundamentals, looking at how debt will continue to increase and how central banks will continue their monetization not only in the U.S. but on a worldwide scale, I assume the price of gold will trend higher. Most likely we’ve seen the lows below $1,200.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

Comments Off on Marc Faber: Physical Gold Headed to New Highs

Jim Rogers: Seas of Artificial Money Spell Disaster (Video)

Jim Rogers was interviewed by Reuters about how a war with Syria might affect the price of gold, but he went on to spell out the economic disaster that is yet to come thanks to a “sea of artificial free money.” In preparation, what does Jim buy? Gold and hard assets that serve as excellent safe havens in times of economic turmoil.

“When this artificial sea of liquidity ends, we’re going to see panic in a lot of markets, including in the US… This is the first time in recorded history that all major central banks have been flooding the market with artificial money printing at the same time… This has never happened in recorded history. When this ends, it’s going to be a huge mess.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Outside Commentaries, Videos

Comments Off on Jim Rogers: Seas of Artificial Money Spell Disaster (Video)

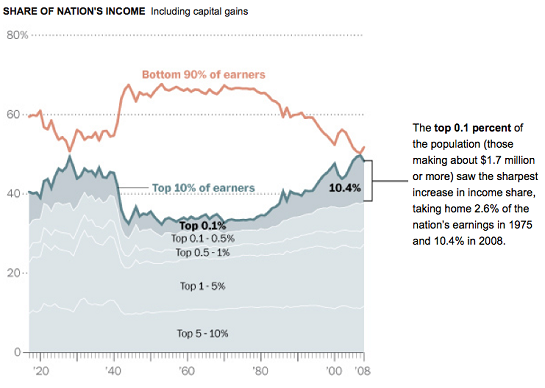

Recession Never Ended for the Bottom 95%

On his blog Of Two Minds, Charles Hugh Smith published a scathing commentary on the supposed recovery from the 2008 recession. By examining a number of under-reported metrics, Smith paints a bleak picture of the ongoing recession that the government has tried to obscure with bogus GDP data.

“In other words, huge leaps in the income and wealth of the top 5% mask the decline of income and wealth of the bottom 95%. Average all wealth and income and it appears that the economy is expanding to the benefit of all, when it fact only the top 5% have escaped the recession; the recession never ended for the bottom 95%.

An even better way to create an illusory expansion is to simply not measure trends that would reveal a deepening recession.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on Recession Never Ended for the Bottom 95%

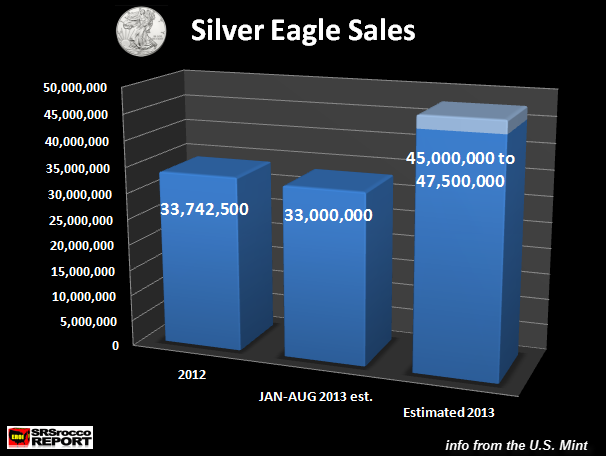

Staggering US Mint Silver Eagle Coin Sales

Peter Schiff’s latest research report, The Powerful Case for Silver (available for download here), noted the wide gap between US Mint sales of American Silver Eagle and American Gold Eagle coins. The numbers continue to amaze. In a commentary on Wealth Wire, Steve St. Angelo goes through the numbers and explains why smart investors are making big plays on physical silver. For those who cannot afford to buy gold right now, silver is a great alternative to consider.

“Ever since the big take-down in the price of the precious metals in April of this year, an interesting trend has taken place in the Gold & Silver Eagle market. While demand for both coins remained strong in the first four months of the year, investors are now overwhelming purchasing more Silver Eagles…

Silver Eagle sales are on track to surpass the total sales for 2012 within the next 2-3 weeks. I forecast that total sales for Silver Eagles by the end of August will be 33 million oz. Of course, we could see a bit more or less depending how the U.S. Mint updates its records.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on Staggering US Mint Silver Eagle Coin Sales

Faber: Own Physical Gold (Video)

Marc Faber, editor of the Gloom Doom & Boom Report, appeared on CNBC to give his take on the current precious metals market. Faber was skeptical about the health of the stock market, hinted that it is in a bubble, and emphasized the importance of having safe haven hard assets in your portfolio.

“I have a preference for physical gold held in a safe deposit box outside the United States… Some experts say they don’t like gold. Well, they never owned a single ounce of gold during gold’s great bull market of 1999 to 2011. So I don’t pay much attention to so-called experts.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Outside Commentaries, Videos

1 Comment

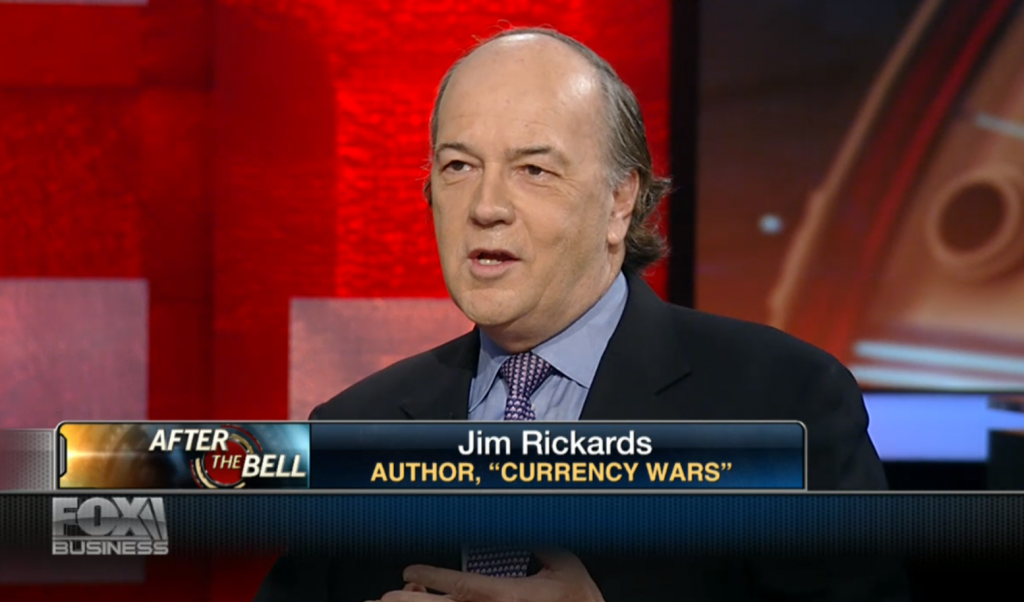

Rickards: Fed Won’t Taper, Bullish for Gold (Video)

Jim Rickards, author of Currency Wars, appeared on Fox Business last week to talk about currencies. While Rickards made it clear that he didn’t have any faith in the dollar, he really wanted to talk about the bullish fundamentals for gold investing throughout most of the interview.

“Labor force participation is crashing… Look at the fundamentals. 50 million Americans on food stamps. 24 million Americans unemployed or underemployed. 11 million Americans on disability. I mean, the fundamental economy is in awful shape. So my expectation is [that the Fed] won’t taper, which I think would be bullish for gold, bearish for the dollar.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Outside Commentaries, Videos

Comments Off on Rickards: Fed Won’t Taper, Bullish for Gold (Video)

Surging Gold Bullion Demand as Wealth Heads East

The big news out this week comes from the World Gold Council’s 2nd quarter Gold Demand Trends newsletter, which revealed that demand for physical gold increased more than 50% over 2012. Global gold jewelry demand rose 37%, a five-year high.

Read the Full Gold Demand Trends Here

The majority of the surging demand is attributed to unrelenting precious metals consumption in Asia, particularly China and India. Pair that with the news today that China, Japan, and other countries continue to sell huge amounts of US debt, and it looks pretty clear that real wealth is migrating East. An article in The Telegraph explains:

“Stocks of physical gold crossed continents in the first half of 2013 as Westerners dumped their holdings and, on the other side of the world, the resulting fall in price sent consumers flocking to jewellers and bullion dealers.

Indian, Chinese, Thai and other Asian consumers flocked to jewellers and bullion dealers to build their holdings.

The trend, disclosed in the latest data from the World Gold Council, a trade organisation established by the gold mining industry, highlights the different ways in which gold is viewed and owned around the globe.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines, Outside Commentaries

Comments Off on Surging Gold Bullion Demand as Wealth Heads East

Davidowitz: US Economy Is Collapsing (Video)

Howard Davidowitz, an expert retail analyst, spoke with Yahoo! Finance about Walmart’s poor earnings report and what it indicates for the rest of the US economy.

“The economy is in a state of collapse… I think there’s a 50% chance we’ll be in a recession next year… That’s after spending $7 trillion dollars, printing trillions, and announcing we were brilliant to have done it… We’re in the tank, and by the way, our debt never goes away… We’ve spent all the money, we’ve borrowed all the money, and we’re in the tank…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Outside Commentaries, Videos

Comments Off on Davidowitz: US Economy Is Collapsing (Video)

A Roadmap to $3,000 Gold & $100 Silver

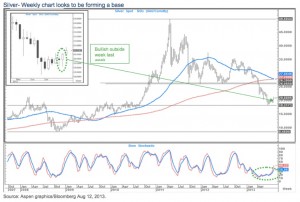

King World News published an interview with Citibank analyst Tom Fitzpatrick this week, outlining the technical reasons for why gold and silver may be setting up for a big rally in the near future. If Fitzpatrick is right, silver could lead the rally to record highs.

“Our bias has been that even though the down-move came a little bit deeper than expected, it was still a corrective move within the overall broad-based uptrend. And the recent action in the silver market has really started to support that.

Silver did a perfect 76.4% retracement of the entire 2008 to 2011 move. Last week silver had a ‘positive outside week,’ closing at the highs of the move effectively (see chart below). This strongly suggests that silver may push to the topside.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on A Roadmap to $3,000 Gold & $100 Silver

The Road to Ruin

Here’s a little humor to brighten up a lackluster day in the precious metals markets. Let’s just hope this economic “salvation” doesn’t find its way to a city near you anytime soon!

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!