Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Outside Commentaries

Mihir Dange: People Want to Own Physical Gold (Video)

In an interview on Bloomberg TV this week, Mihir Dange spoke about the unusual “backwardation” of the gold futures market happening right now and what that means for physical gold demand. If you want to learn more about what the gold futures market can tell us about physical gold, read this month’s Gold Letter.

“What that means right now is that there’s heavy demand for the physical, with the trading so cheap. China reported in the first half of the year they had 50% increase in consumption of gold… Our office tried to buy physical gold when it got down right around $1200 to $1250. It’s been 8 weeks, we still haven’t received our order of physical gold… There’s a huge run on physical right now. You’re seeing the prices now rally, you’re seeing people want to be involved in physical.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Outside Commentaries, Videos

Comments Off on Mihir Dange: People Want to Own Physical Gold (Video)

Don’t Trust the Government, Gold Still Inflation Hedge

In his latest article at Forbes, Jack Adamo analyzes the history of government inflation statistics and why gold is still an excellent hedge in spite of the popular narrative that inflation is “under control.”

“The other problem I find with the inflation-to-gold ratio analysis is this: We are truly in unknown territory with the U.S. and world money supply. In 2008, when the Fed geared up its printing press, the entire balance sheet of the Federal Reserve, accumulated in its 95 year existence, was $1 trillion. For the last several years, it has been growing its balance sheet $1 trillion per year.

The only reason we don’t see rampant inflation is that the velocity of money is so low. If the economy ever picks up for real, watch out. Fortunately, or unfortunately, depending on how you look at it, there seems to be no immediate threat of that.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on Don’t Trust the Government, Gold Still Inflation Hedge

Futures Markets Signal Gold Ready to Erupt

Read Peter Schiff’s latest Gold Letter, with an insightful commentary from Precious Metals Specialist Dickson Buchanan on gold backwardation, a negative GOFO rate, and what they mean for physical gold investment.

“With gold recouping some losses in its most recent trading sessions, many are asking whether or not the bottom has finally formed for the yellow metal. Most of these gains have been simply chalked up to short-covering and dovish remarks by Bernanke during the recent Federal Open Market Committee meetings; however, there are some key indicators for gold which are overshadowed by the media hubbub. Two of them in particular are important to understand, because they reveal a renewed investment demand for physical gold over paper gold or fiat currencies.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries, Peter's Commentaries

Comments Off on Futures Markets Signal Gold Ready to Erupt

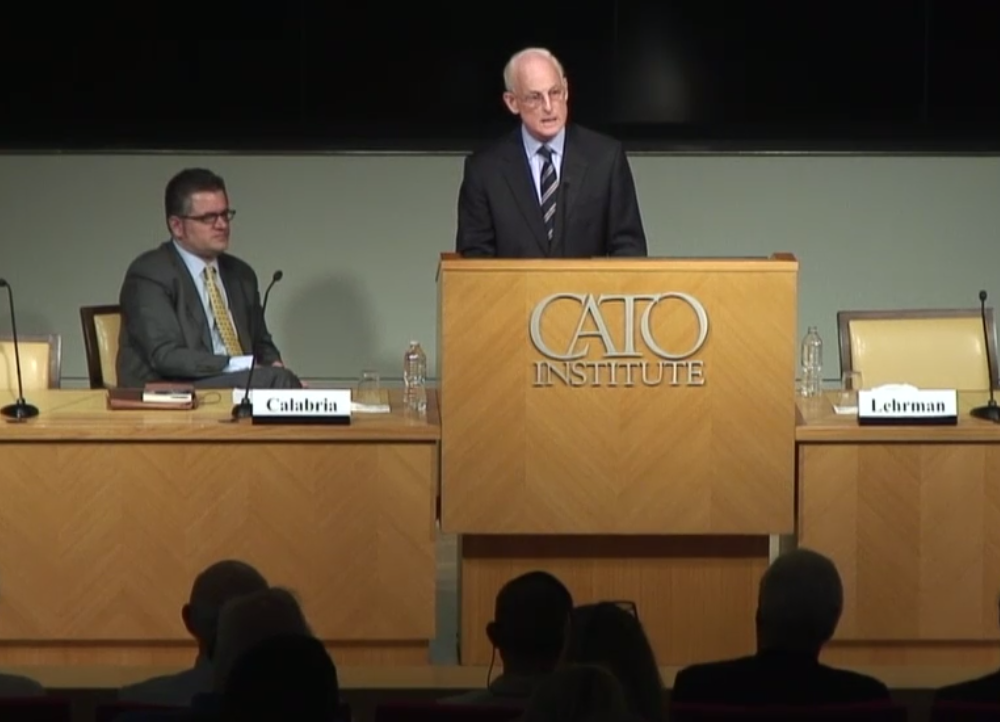

Lewis Lehrman: The Rise and Fall of Real Money (Video)

Lewis E. Lehrman, author of the new book, Money, Gold, and History, spoke at the Cato Institute last month about the history of central banking and the destruction of the gold standard. Lehrman’s lengthy talk is a great introduction to the rise and fall of real money. His new book includes 40 years of essays on the classical gold standard.

“Working people have also discovered that the credit worthy liquid financial class with access to cheap money at the Fed and at the banks has enriched itself not only by bailout subsidies, but by cheap financing derived from its symbiotic dependence on the Federal Reserve System. This [is] a fundamental cause of the rising inequality of wealth in America.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries, Videos

Comments Off on Lewis Lehrman: The Rise and Fall of Real Money (Video)

World Gold Council on Fundamental Gold Investing (Video)

Bob Alderman, Managing Director for the World Gold Council, speaks about the enduring value of gold and the yellow metal’s current role in a long-term investment strategy.

“The case for owning gold is a simple supply and demand story, [and] it has always been that way. What’s changed over the past several months is that there is clearly a supply situation where it may be constrained. And from a demand perspective around the world, including here in the United States, there is certainly increased demand for both physical gold, as well as jewelry.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries, Videos

3 Comments

World Gold Council’s Gold Investor, Third Edition

The third issue of the World Gold Council’s 2013 Gold Investor was released today. The newsletter covers the latest news and research from the WGC, including an interesting examination of the seven primary factors that influence gold’s performance and place in a portfolio.

“To some investors, gold seems arcane: a non-productive asset that is simply extracted and stored. To many others, gold plays an important role as a store of wealth and portfolio risk management vehicle. To most, a key challenge is finding an appropriate framework of reference: what gold does, what it does not do, how and why it responds to various economic environments.”

Download the Full Gold Investor Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on World Gold Council’s Gold Investor, Third Edition

Jim Rickards: The Fed Is Just Wrong About Recovery (Audio)

Enjoy this excellent audio interview with Jim Rickards, author of Currency Wars, on the Korelin Economics Report. Rickards dissects the Fed’s forecasting record and explains why quantitative easing is destroying the economy.

“The Fed’s forecasting record has been abysmal. The Fed has been wrong four out of the last four years in terms of their growth projections… They’ve been wrong by a lot. Sometimes they project 3 1/2 to 4% growth and it comes in around 2%. Sometimes they lower the forecast to 3% and it comes in at 1.5%. So you shouldn’t put any stock in the Fed’s forecast at all. In fact, as a guide, you should kind of assume the opposite or at least a lot worse than what the Fed is saying. You have to look at the fundamental economy, [which] is in terrible shape.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Outside Commentaries

Comments Off on Jim Rickards: The Fed Is Just Wrong About Recovery (Audio)

Bernanke Admits To Congress: We Are Printing Money, Just ‘Not Literally’

Forbes published an excellent summary of Ben Bernanke’s congressional testimony this week, highlighting the Fed Chairman’s ridiculous flip-flopping as he answered questions with whatever story suited his needs – one minute the economy is recovering, the next it isn’t doing so hot.

“In his semi-annual testimony before the House Committee on Financial Services, Fed Chairman Ben Bernanke was very clear about how the central bank engages in quantitative easing. We are printing money, just not literally, the Chairman told policymakers, while contradicting himself regarding recent record highs in stock markets, first attributing them both to the strength of the economy and the impacts of monetary policy. The market didn’t seem to care, rallying tepidly upon the release of the prepared remarks and remaining range-bound through most of the session.

‘Where does the Fed get the money to buy [assets],’ Congressman Keith Rothfus asked the Chairman. ‘Do you create the reserves,’ he queried in a follow up, receiving a simple ‘yes’ from Bernanke. And finally, the money shot: are you printing money? ‘Not literally,’ the Fed Chairman surprisingly responded.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on Bernanke Admits To Congress: We Are Printing Money, Just ‘Not Literally’

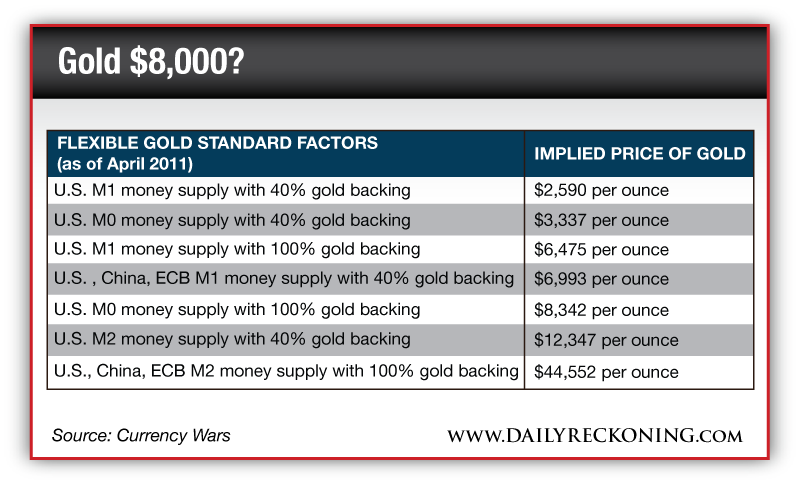

Jim Rickards: Your Personal Gold Standard

Jim Rickards, author of Currency Wars, published an interesting article over at The Daily Reckoning about why you don’t need to wait for central banks to adopt a gold standard before adopting your own.

“There isn’t a central bank in the world that wants to go back to a gold standard. But that’s not the point. The point is whether they will have to.

I’ve had conversations with several of the Federal Reserve Bank presidents. When you ask them point-blank, “Is there a theoretical limit to the Fed’s balance sheet?” they say no. They say there are policy reasons to make it higher or lower, but that there’s no limit to the amount of money you can print.

That is completely wrong. That’s what they say; that’s how they think; and that’s how they act. But in their heart of hearts, some people at the Fed know it’s wrong. Luckily, people can vote with their feet.

I always tell people who say we’re not on the gold standard that, in a way, we are. You can put yourself on a personal gold standard just by buying gold. In other words, if you think that the value of paper money will be in some jeopardy, or confidence in paper money may be lost, one way to protect yourself is by buying gold, and there’s nothing stopping you.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

3 Comments

Santelli Riled by Bogus Government Inflation Stats (Video)

Rick Santelli blew his top this week on CNBC as he got exasperated with a discussion about the eventual tapering of quantitative easing. A lot of people are getting tired of the same old story that tapering is just around the corner, only to find that a new set of data indicates it’s just not a good time yet.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog