Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Outside Commentaries

The Silver Institute’s June Silver News

Stay up-to-date on the latest advances in the silver industry with The Silver Institute’s bi-monthly Silver News. The latest issue, released this week, includes some fascinating articles on the new uses of the anti-bacterial properties of silver.

“Low doses of silver can enhance the germ-fighting abilities of antibiotic drugs, even those drugs that have become less effective after decades of overprescribing has caused some microbes to become resistant, according to a team of researchers led by Jim Collins of the Wyss Institute for Biologically Inspired Engineering at Harvard University.

They showed that not only does the addition of silver make some antibiotic drugs up to 1,000 times more effective, but silver has also made at least one drug-resistant bacterium surrender to antibiotics once again.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on The Silver Institute’s June Silver News

Is Gold Really Worth $40,000 Per Ounce?

In a new commentary on Forbes, Todd Ganos steps back and looks at gold’s recent volatility through the lens of the yellow metal’s traditional role: gold as stable, incorruptible money.

“Recently, there has been quite a bit of volatility in the dollar price of gold. It certainly can’t be that the fundamental value of the United States dollar is experiencing wide swings. We don’t see the dollar price of bacon or bread or a car wildly gyrating. But, given that gold is money, in a sort of cross-currency context, the prices of bacon, bread, and a car ARE wildly gyrating . . . relative to gold. Of course, history would suggest to us that the price of bacon, bread, a car, gold or most anything should be stable relative to each other over the long run. So, it would seem that the recent price swings in gold are driven by speculation as opposed to fundamentals.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on Is Gold Really Worth $40,000 Per Ounce?

Jim Rickards: Buy Gold, Not Stocks (Video)

Yesterday on CNBC, Jim Rickards had a short debate with Lee Munson about whether gold or stocks are a better buy right now. Like Peter Schiff, Rickards has faith in gold’s strong fundamentals and knows that gold has been and always will be inherently valuable as real money.

“Fundamentally, the case [for gold] hasn’t changed. It has to do with Fed money printing and instability in the international monetary system… [The Fed] needs to drive nominal GDP, they need negative real rates, they need more inflation, or else [US] debt will be un-payable. And that’s good for gold.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts:@SchiffBlog

Posted in Interviews, Outside Commentaries, Videos

Comments Off on Jim Rickards: Buy Gold, Not Stocks (Video)

Indians Keep Buying Gold in Off Season

Indians aren’t deterred by a slump in the gold price. Even in their gold “off season,” Indian jewelry and gold stores continue to sell the yellow metal unabated. Read all about it in The Financial Times:

“Neither finance minister P Chidambaram, nor the fear of a bad investment is deterring people from buying gold. In fact, the sharp dip in prices has only brought more customers to jewellers though some are waiting for gold to slip even more.

Dismissing the minister’s plea to refrain from buying gold for the next few months, people are giving in to the lure of the yellow metal. ‘This is off-season for us but sales continue to be normal,’ said Alok Bhattacharya, store manager of B.C.Sen Jewellers in Gurgaon. With a few months to go before the onset of the wedding season, when gold sales gain momentum, sales should be mostly stagnant now. ‘Some people are unaware of the dip in gold prices and the possibility of a further dip (which could lead them to postpone purchases). So, our sales have not been affected,’ said Ajay Bali, store manager of Tanishq, Gurgaon.”

Continue Reading the Full Article

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts:@SchiffBlog

Posted in Daily Gold Headlines, Outside Commentaries

2 Comments

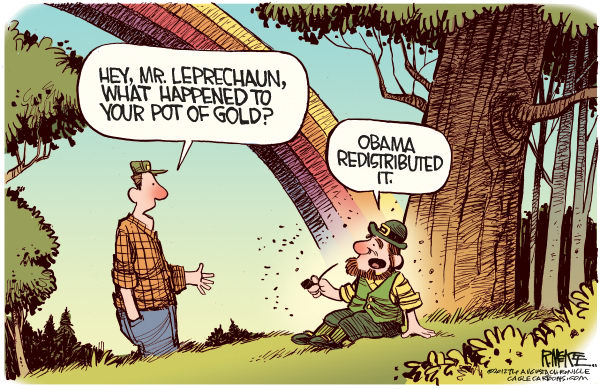

Redistribution Woes

Looks like this leprechaun only had fiat cash – real gold and silver can’t be redistributed. TGIF!

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on Redistribution Woes

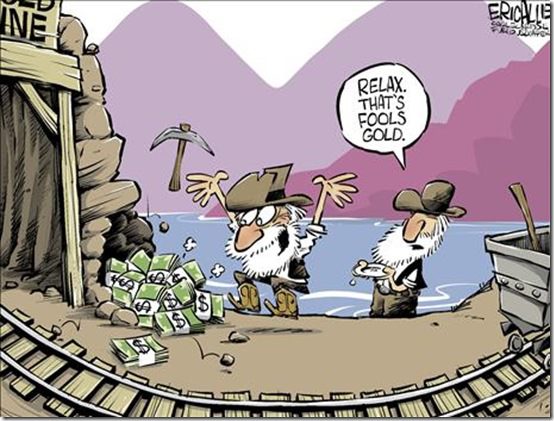

Don’t Fall for Fool’s Gold

A little humor to brighten up your Friday.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on Don’t Fall for Fool’s Gold

A New Asian and Global Gold Hub (Video)

Enjoy this CNBC interview with Mark Smallwood, Head of Wealth Planning at Deutsche Asset & Wealth Management, APAC. Smallwood discusses Deutsche Bank’s recent announcement that it will be opening a new gold vault in Singapore with a 200-ton capacity. With Singapore recently announcing that it would remove government sales tax on gold and precious metals, Smallwood stressed the important role this new vault plays in turning Singapore into a regional and global hub for trading gold. Combine this with the recent news that the London Metals Exchange has talked about moving to Hong Kong and you might start to wonder how long before all the real money ends up in the East.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Outside Commentaries, Videos

Comments Off on A New Asian and Global Gold Hub (Video)

Jim Rickards: Currency War Simulation (Video)

Enjoy this fascinating video in which Jim Rickards narrates a possible storyline of an international currency war crisis. Take note of how important a role gold plays in the escalation of economic hostilities and ask yourself if you’d rather be stuck owning precious metals or fiat currency.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries, Videos

1 Comment

Jim Rogers on Madness at the Fed (Video)

This week on CNN Money, investor Jim Rogers had a friendly debate with University of Pennsylvania Professor Jeremy Siegel about the true cause of the booming stock market. Rogers, like Peter Schiff, knows the Fed’s money printing is the only thing supporting this so-called bull market.

“This [bull market] is because of money printing… This is the Federal Reserve and the central bank in Japan and the central bank in England and the central bank in Europe printing staggering amounts of money. This is unprecedented. Never in world history has every major central bank printed money at the same time and desperately tried to debase their currency.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Outside Commentaries, Videos

Comments Off on Jim Rogers on Madness at the Fed (Video)

Phony Government Statistics and Gold’s Role in the Coming Crisis

John Williams, founder of ShadowStats.com, published an excellent commentary with Casey Research last week. Williams compares his truthful, adjusted economic data with the nominal data that the US government points to as signs of recovery. He paints a very clear picture of how close we are to another dramatic economic crisis and emphasizes the importance silver and gold will play in protecting investors from the inevitable inflation and collapse of the dollar.

Read the Full Commentary Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog