Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Outside Commentaries

Jim Grant: Gold Is a Bet against Fiat Money (Video)

Enjoy this interesting CNBC interview with Jim Grant in which he analyzes the ambiguous statements coming out of the Fed this week. He doesn’t think the Fed is likely to unwind QE anytime soon, and that this experiment in unprecedented money printing will likely end in disaster. However, Grant does point out that gold is the perfect hedge against a collapsing currency.

“[Gold is] money. It certainly is a hedge against unscripted outcomes of monetary affairs. It is an investment in the tendency of government issued paper money to depreciate in value. It’s an investment in that…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Outside Commentaries, Videos

1 Comment

Doug Casey on Gold Conspiracies and Fluctuations

The Daily Bell published an extensive interview with Doug Casey of Casey Research last weekend. Casey expounds on gold in depth, including a lengthy dissection of gold price manipulation theories. He then moves on to talk about the dollar, the euro, and the state of the global economy in general.

“I’m not concerned about gold being down because markets fluctuate. And considering that gold’s been in a bull market for a dozen years, I’m very unconcerned about the fact that it’s come off. All the fundamentals that underlie the bull market are still in place…

Personally, I’m no longer dealing in gold in the futures markets, but I do buy gold almost every month and sometimes significant quantities of it. I don’t see gold as a trading vehicle, but rather as the only financial asset that’s not simultaneous”

Click Here to Read the Full Interview

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Outside Commentaries

Comments Off on Doug Casey on Gold Conspiracies and Fluctuations

The Disconnect Between Paper and Physical Gold

There’s still time to read this month’s Gold Letter, which contains a fascinating commentary by Bud Conrad at Casey Research in which he explains the difference between the paper and physical gold markets and their influence on the recent turmoil in the price of the yellow metal.

“Previously, there was little difference between the physical and paper markets for gold. Yes, there were premiums and delivery charges, but everybody regarded the futures market as the base quote. I believe this is changing; people don’t trust the paper market as they used to.

Instead of capitulating to fear of greater losses, the demand for physical gold has hit new records. The US Mint sold a record 63,500 ounces – a whopping 2 tonnes – of gold on April 17 alone, bringing the total sales for the month to 147,000 ounces; that’s more than the previous two months combined. Indian markets, which are more oriented to physical metal, now have a premium of US$150 over the futures price in Chicago. Demand at coin dealers has increased as the price has dropped. And premiums are much bigger than they were as recently as a week ago.”

Continue Reading the Full Commentary

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on The Disconnect Between Paper and Physical Gold

Silver Institute’s April Silver News

The Silver Institute made their April 2013 Newsletter available online. The publication has a handful of interesting articles about the latest technology in the silver industry, as well as new silver investment products on the market. Here’s a few of the highlights:

- Q&A about the future of nanosilver with Rosalind Volpe, Executive Director of the Silver Nanotechnology Working Group.

- Sunshine Minting, Inc. (SMI), is incorporating a sophisticated security

feature into its 10 and 1-ounce bars and rounds, and plans to include

it in other sizes as well. - An explanation and history of the London Silver Fix.

Click Here to Read the April 2013 Silver News

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines, Outside Commentaries

Comments Off on Silver Institute’s April Silver News

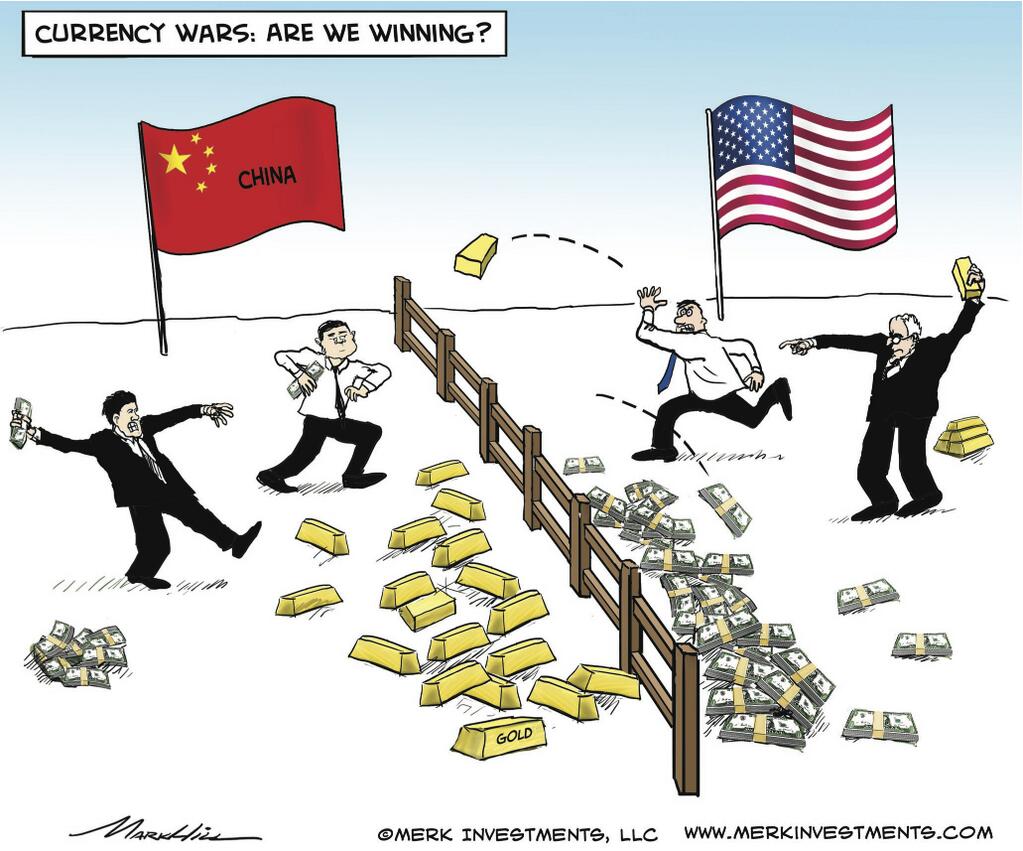

US vs. China – Who Is Winning the Currency War?

Gold bars might leave a big bruise, but who is really hurt by the ongoing trend of Eastern countries ditching their US dollar reserves in favor of gold? Enjoy.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

1 Comment

Gold Bull Market Is Very Much Intact (Video)

Marcus Grubb, managing director of investment at the World Gold Council, spoke with Yahoo! Finance’s Lauren Lyster about the long-term outlook for gold and the recent price correction. Grubb emphasized that gold is still considered a long-term safe haven asset, whether or not investors consider the global economy to be improving.

“What you’ve seen is a decoupling of the physical gold market and the paper market, driven by futures. What drove the sale of gold around the middle of April was a very big short-sale in the futures market in New York… I think what we’ve seen after this fall in gold is a very song recovery in physical demand all around the world… We don’t give gold forecasts at the World Gold Council, but we feel that the bull market is very much intact.”

Click Here to Watch the Video Interview

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Outside Commentaries, Videos

Comments Off on Gold Bull Market Is Very Much Intact (Video)

Comex Physical Gold Supplies Head East

Thanks to gold’s recent price correction and rebound, there has been an explosion of physical precious metals sales around the world. From tiny vendors in Asia to the US Mint, dealers everywhere are struggling to meet demand and manage supplies. The latest, and perhaps most telling, story along these lines came out this week: the gold holdings of CME Group’s COMEX warehouses have dropped to five-year lows. Much of the demand is attributed to Eastern investors looking to avoid the soaring premiums across Asia. All of this ties nicely into Peter Schiff’s latest commentary about the movement of wealth and gold from debtor Western nations to the creditor emerging markets in the East. Read about the Great Gold Redemption in the latest Gold Letter.

“Physical gold stocks held at CME Group’s Comex warehouses in New York have dropped to a near-five year low in a further sign that gold’s price crash unleashed a frenzy of demand as investors scramble to buy bars and coins.

U.S. gold stocks, comprised of 100-troy ounce COMEX gold bars, have fallen almost 30 percent since February, as dealers have switched to selling into the burgeoning Asian market, where prices and demand are higher than in New York.

But the pace of the outflows from vaults has accelerated since bullion’s historic sell-off, falling more than 7 percent last week for its biggest weekly drop since 2005.

Analysts say the sudden recent surge is further evidence of pent-up demand for coins and bar, particularly from China and India, caused by the slump in prices. Investors also appear to prefer to hold physical metal rather than futures, traders said.”

Continue Reading the Full Reuters Article

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Daily Gold Headlines, Outside Commentaries

Comments Off on Comex Physical Gold Supplies Head East

Gold Standard Debate Goes Mainstream

In a Forbes op/ed released today, Ralph Benko examines the growing popularity and mainstream acceptance of the gold standard “debate.” Economists who once derided the practicality of a gold standard are recognizing the importance of a serious discussion about returning to a sound money system.

“Whether one supports it or opposes it, the gold standard no longer is seen by most serious thinkers as fringe. It no longer is dismissible merely by invoking shibboleths like “barbarous relic” or “cross of gold.” Facts are stubborn things, as John Adams once observed. Facts are much more stubborn than mere mockery.

There are reasons for the turnaround in the gold standard’s reputation. Rigorous thinkers such as analysts from the Bank of England, in its December 2011 Financial Security Paper No. 13, “Reform of the International Monetary and Financial System, have assessed the performance of the fiduciary dollar standard and found it deeply inferior to the actual performance of both the gold and of the (before it inevitably, due to an inherent latent defect, collapsed) gold-exchange standard. Now, after 12 years of “Dark Ages” economic growth rates, the incumbent monetary policy elites are beginning to appear slightly desperate to justify their prestige and attendant privileges.”

Continue Reading Full Commentary

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

1 Comment

Essential Reading: World Gold Council’s “Gold Investor”

The World Gold Council has just released the latest edition of their Gold Investor, an in-depth report on the state of the gold market in the first quarter of 2013. It includes an explanation of the gold downturn, answers common misconceptions about gold’s role in the global economy, and demonstrates why gold is an essential part of any investment portfolio.

“Short term factors including market momentum and the concentrated sell-off following analysts’ downward gold price forecast revisions along with Cyprus’ gold sales contagion could put pressure on gold prices in the near future. However, we consider that many of the fundamental drivers that have supported gold’s 12-year trajectory are still well in place. Data suggests that some investors in developed markets are betting on a swift economic recovery, and while economic data may seem encouraging in the US, many of the underlying issues that financial markets face are still relevant: countries face high level of debt while monetary policies have yet to unwind. At the same time, gold’s fate does not rely only on uncertainty and malaise in developed markets. Gold’s performance is also linked to their long-term economic expansion. There is consensus that emerging market economies will continue growing. Most economists agree that emerging markets will continue to grow and surpass developed market economies by 2020 in term of GDP. Finally, the US dollar will likely remain a crucial component of the monetary system, but may have to make room for others. As central banks diversify their foreign reserves, gold will continue to be one of the most relevant assets.”

Download and Read the Full Gold Investor Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries

Comments Off on Essential Reading: World Gold Council’s “Gold Investor”

Ron Paul on Gold’s Volatility and Enduring Value

Forbes just published an exclusive interview with Ron Paul, conducted by Kitco News. Paul spoke about how precious metals investors shouldn’t get caught up watching the short-term trends in gold. Instead, he keeps an eye on the failing purchasing power of the dollar.

Read the Full Interview Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog