Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Outside Commentaries

Virginia Eyes Monetary Reform

The New York Sun published an editorial this week looking at proposed legislation in Virginia that would examine the viability of a metal-backed monetary standard. If the federal government doesn’t understand the importance of real money, maybe the states will take up the banner.

“It’s starting to look like Virginia could yet emerge in a leading role among the states in respect of monetary reform. The lower chamber of its general assembly has passed a bill to underwrite a study of the feasibility of a monetary unit based on a metallic standard. It is one of a number of states that are reaching deep into the Constitution of the United States to protect themselves in an era when the value of the dollars issued by the federal government is collapsing.”

Posted in Outside Commentaries

Comments Off on Virginia Eyes Monetary Reform

The Challenges of Gold Production

Check out the latest issue of The Alchemist, published by the London Bullion Market Association. A reprinted speech by Jamie Sokalsky, CEO of Barrick Gold Corporation, one of the largest gold mining companies in the world, takes an in-depth look at international gold production and the bullish future for the yellow metal.

“I think there are a huge number of factors that ultimately have changed the way we are going to see mine production going forward, in particular gold mine production. In the years that this conference has been going, we have seen so many changes – the gold price going up, but also many changes with respect to the challenges that gold-mining companies face. As everybody knows, gold has been in a bull market for a number of years. In my view, that shows no signs of reversing.”

Posted in Outside Commentaries

Comments Off on The Challenges of Gold Production

Argentina Prepares for Hyperinflation

The Argentinian government has frozen super market prices for the next two months in a misguided attempt to stop inflation. A new commentary on Zero Hedge compares Argentina’s financial decline to the state of affairs in developed countries around the world. Are you prepared for sudden hyperinflation?

“Up until now, Argentina’s descent into a hyperinflationary basket case, with a crashing currency and loss of outside funding was relatively moderate and controlled. All this is about to change. Today, in a futile attempt to halt inflation, the government of Cristina Kirchner announced a two-month price freeze on supermarket products. The price freeze applies to every product in all of the nation’s largest supermarkets — a group including Walmart, Carrefour, Coto, Jumbo, Disco and other large chains. The companies’ trade group, representing 70 percent of the Argentine supermarket sector, reached the accord with Commerce Secretary Guillermo Moreno, the government’s news agency Telam reported. As AP reports, ‘The commerce ministry wants consumers to keep receipts and complain to a hotline about any price hikes they see before April 1.'”

Read the Full Article Here

Posted in Outside Commentaries

Comments Off on Argentina Prepares for Hyperinflation

Gold and the Future of Reserve Currencies

A recent video by the World Gold Council reviews a report on the future of the global economy published by the Official Monetary and Financial Institutions Forum. The report examines the important role China’s currency will play in creating a multi-currency reserve system, and thus why gold will remain an important asset.

“Whether the world moves into full crisis with the end of the euro, or whether we have a recovery, or whether we experience something in between: all paths lead to towards a multi-currency system, in which gold’s role is likely to become more significant.”

Posted in Outside Commentaries

Comments Off on Gold and the Future of Reserve Currencies

Platinum Group Metals Long-Term Outlook

In light of the recent spikes in the price of platinum and palladium, it might be worthwhile checking out CPM Group’s 2012 Platinum Group Metals Long-Term Outlook Report, released earlier this month. The report is a comprehensive study of the long-term fundamentals of PGMs, looking forward to 2022.

“Over the next ten years CPM Group expects PGM prices to increase at a strong pace. Platinum and palladium prices may break historical record nominal highs to test unprecedented levels. Investors have played an important role in the PGM markets for decades. In the past decade, however…the investor base has been expanding, and many more investors are participating in the PGM markets.”

Posted in Outside Commentaries

Comments Off on Platinum Group Metals Long-Term Outlook

Doug Casey Advocates Gold on INN (Video)

Andrew Topf of the Investing News Network interviewed Doug Casey this week. Casey spoke about everything from the rising price of gold and China’s economy, to Germany’s gold repatriation and other metals investments:

“These governments all over the world have committed themselves to printing up trillions and trillions more currency units. So even though gold is not at the bargain levels it was in 2002, I think that it’s eventually going to be a bubble. People are going to panic into gold from fear, from greed, from prudence. So I think it’s going much higher…I think that in the future gold is going to be used internationally, and hopefully domestically, as day-to-day money again.”

Posted in Interviews, Outside Commentaries, Videos

Comments Off on Doug Casey Advocates Gold on INN (Video)

4 Little Known Facts About Gold Investing

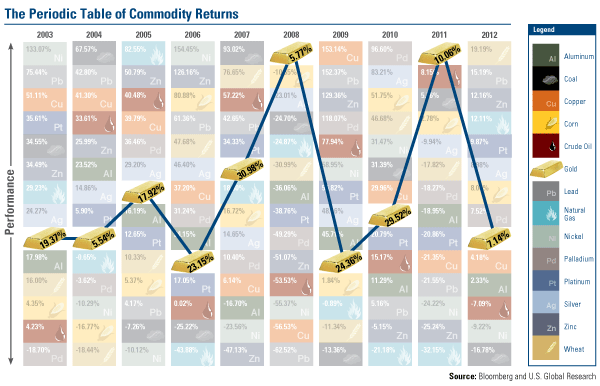

Frank Holmes, a Seeking Alpha analyst, published an interesting commentary today, examining some under-reported bullish facts about gold in relation to other commodities and the stock market:

“While the precious metal did not shoot the lights out in 2012, gold’s bull rally goes on. It ended the year up 7 percent, making it a phenomenal 12th year in a row that gold rose in value. In a special gold bar version of the Periodic Table below, you can easily see gold’s rotation among the commodities from year to year.

What’s fascinating is the three-year rising pattern relative to other commodities that emerges when you focus on the bars. Over the past 10 years, gold has risen in position compared with the others for three years in a row, then fallen in relative position in the fourth year before repeating the cycle. Will it follow the same pattern and be in the top half of the Periodic Table in 2013?”

Posted in Outside Commentaries

Comments Off on 4 Little Known Facts About Gold Investing

Doug Casey & Max Keiser Talk Currency War (Video)

Doug Casey appeared on Russia Today’s Keiser Report last week and had a wide-ranging conversation about the worldwide currency crisis and the strong case for gold. Casey observed:

“[Central banks] should be nervous [about Germany’s gold repatriation], because the assets of most central banks in the world are the paper currencies of other central banks, mainly the Federal Reserve…There’s no reason at all why they should trust that. So eventually they are going to start trading all that paper for gold.”

Doug Casey’s appearance begins at 15:40:

Posted in Interviews, Outside Commentaries, Videos

Comments Off on Doug Casey & Max Keiser Talk Currency War (Video)

Silver Supply and Demand

News hit today that the US Mint is already out of stock of 2013 silver bullion coins. Due to unprecedented investor demand, they won’t have more coins for sale until the end of the month. Kind of gets you wondering just how much silver is in the world today. Check out this entertaining info-graphic from Visual Capitalist:

Posted in Outside Commentaries

Comments Off on Silver Supply and Demand

Ron Paul: Gold is Always Money (Video)

Ron Paul spoke with Bloomberg television last week about the escalating currency war and the dangers of centrally planned economies: