Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Outside Commentaries

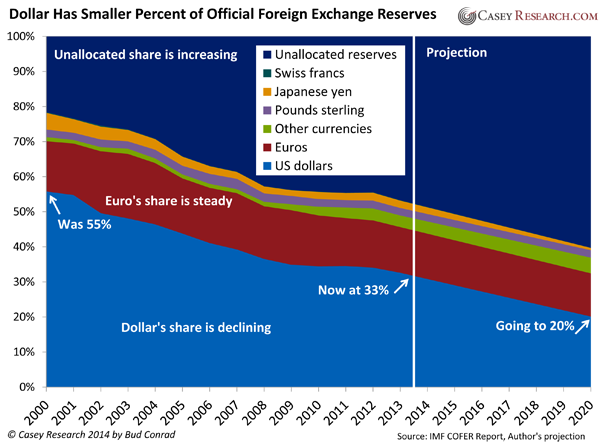

The Dollar’s Days Are Numbered

Bud Conrad’s latest commentary at Casey Research looks closely at the decline of the US dollar as the world’s reserve currency.

“After World War II, the dollar became the world’s preeminent currency. Convertible to gold at $35 an ounce, it was the backbone of international trade. Foreign central banks used it to back their own currencies.

Nixon removed the dollar’s convertibility to gold in 1971, rendering its value dependent on prudent management by its issuer. That issuer, of course, is the Federal Reserve—which conjures dollars into existence to support the US government’s spending habit.

The Fed has issued a lot of dollars since 1971, and even more since the financial crisis of 2008—thanks to Washington’s exploding debt levels. And it’s only going to get worse, as even the Congressional Budget Office (CBO) admits in its own forecasts.

What’s more, CBO debt estimates are notoriously overoptimistic; so while they are daunting, reality will likely be worse.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Dollar’s Days Are Numbered

Robbing Savers to Bail Out Bankers

A new opinion piece at MarketWatch rips into the corrupt policies of the Federal Reserve. Al Lewis cites recent analysis that estimates the Fed’s inflationary policies have cost American savers more than $750 billion since the 2008 financial crisis. Last year alone, savers lost more than $120 billion in purchasing power. What’s one of the best ways to protect your savings? Physical gold and silver.

“Our financial system is so corrupt you might say that a fish rots from the Fed.

How else can one describe a regime that punishes savers and rewards borrowers and speculators for years on end? Our central bank is essentially taking billions of dollars a year from average Americans, who are still struggling to get by in a bombed-out economy, and it is giving it — yes, giving it — to the very banks that helped cause the 2008 financial crisis in the first place.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Robbing Savers to Bail Out Bankers

Hungry for Gold?

As Western financial media continues to downplay the importance of gold investment, Asian demand for the metal remains strong. China may have surpassed India as the world’s largest gold consumer last year, but Indians are still desperate to find ways around their government’s strict import tariffs on the yellow metal.

It’s no surprise that Indian gold smuggling has skyrocketed in the past year, but here is one of the most unusual stories we’ve yet heard. An Indian man had twelve gold bars surgically removed from his stomach this past week. It gives a whole new meaning to the old phrase, “You can’t eat money!” If only Americans were this committed to their gold consumption…

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Hungry for Gold?

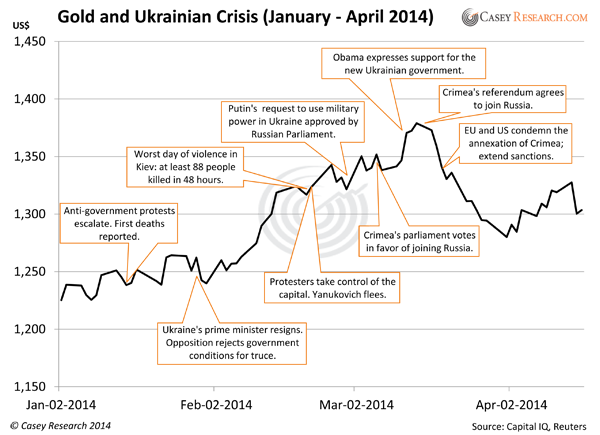

A Crisis vs THE Crisis

In a new commentary from Casey Research, Laurynas Vegys looks at how the crises in Syria and Ukraine affected the price of gold. Vegys then argues that the most concerning crisis isn’t overseas – it’s the unprecedented levels of US government debt. Sure, gold may respond to volatile international conflicts, but true disaster awaits those Americans who are over-invested in the US dollar.

“This ever-growing mountain—volcano—of government debt is long-term, systemic, and extremely difficult to alter trend. Unlike the crises in Ukraine and Syria (at least, so far), it’s here to stay for the foreseeable future. While some investors have grown accustomed to this government-created phenomenon and no longer regard it as dangerous as outright military conflict, make no mistake—in the mid- to long-term, it’s just as dangerous to your wealth and standard of living.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on A Crisis vs THE Crisis

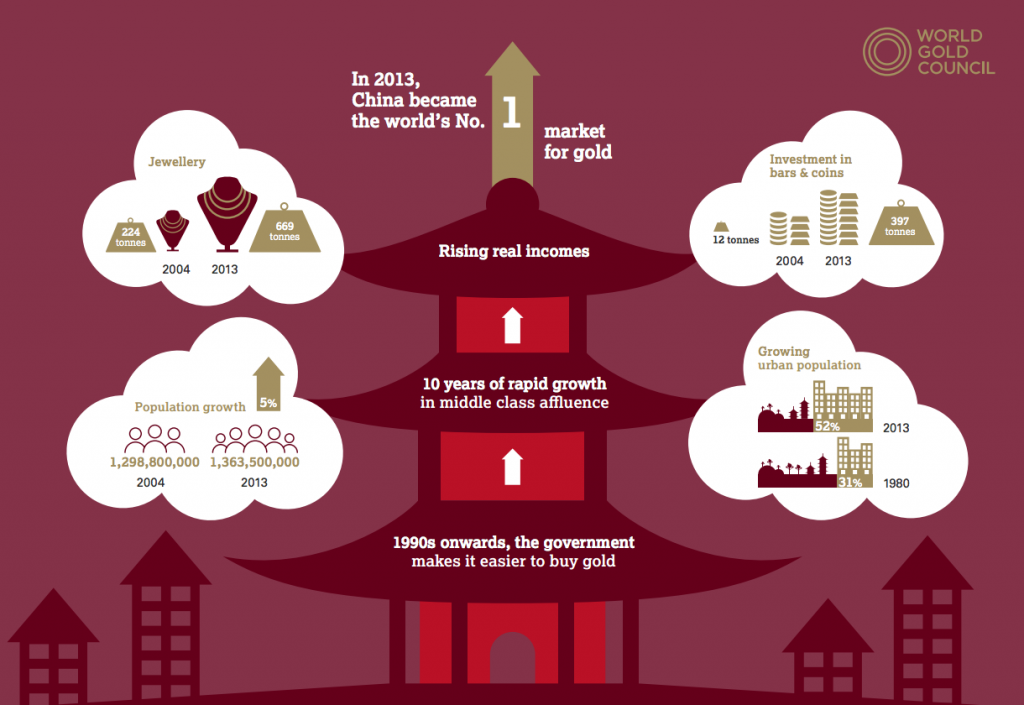

The Future of Chinese Gold Demand

One of the biggest precious metals stories over the past year has been the astounding physical gold demand from Asia, particularly China. The World Gold Council has just released a major report on the history and future of consumer gold demand in China.

“Chinese gold demand in 2013 was exceptional. Jewellery buyers and investors in bullion products took full advantage of the rapid and sizeable fall in local gold prices. They set the bar at a very high level – private sector demand for jewellery, investment and gold used in industrial applications hit a record 1,132 tonnes (t).

We expect 2014 to be a year of consolidation. The sudden price drop in 2013 meant some Chinese consumers brought forward jewellery and bar purchases, which may limit growth in demand in 2014. Expansion by the trade is also expected to slow, particularly in terms of additional manufacturing capacity. However, the lower domestic gold price should support purchases by consumers, especially of 24 carat jewellery. Over the medium term physical gold demand is likely to see further growth driven by a number of factors, including…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Future of Chinese Gold Demand

A Glimpse into India’s Gold Culture (Audio)

Extremely high government tariffs are blamed for the slump in Indian gold demand in 2013, which allowed China to surpass India as the world’s largest gold consumer. However, there has recently been talk of easing India’s gold import tariffs, which might trigger another surge in demand for the yellow metal. Even National Public Radio has taken notice of India’s love of gold. This story, from NPR’s Morning Edition, takes a look at the vital role the yellow metal plays in the culture as a form of wealth preservation, particularly for women. Wouldn’t it be nice if Westerners had such a implicit understanding of the value of real money?

“Her stockpile of gold earrings, rings, necklaces, and hairpins is lavish but also reflects the centrality of gold in an Indian woman’s life. It’s given for pregnancies; at births; when a baby first eats solid food. It’s engrained in the cultural lexicon.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on A Glimpse into India’s Gold Culture (Audio)

Look Out for Crash Like ’87 – Only Worse (Video)

On CNBC yesterday, Marc Faber laughed out loud at the idea that investors have confidence in the Federal Reserve continuing its quantitative easing tapering. More likely, he argued, they will increase the stimulus. He also said that he wouldn’t be surprised if the S&P dropped 20-30% in 2014 and that a 1987-style crash is possible in the next twelve months. Precious metals are one of the few segments of the market that Faber thinks are undervalued right now.

“I think the market is very slowly waking up to the fact that the Federal Reserve is a clueless organization. They have no idea what they’re doing. And so the confidence level of investors is diminishing… How much can the Bureau of Labor Statistics lie about the true cost of living increases in the United States and elsewhere?… Food prices are going up, energy prices are up, health care costs are up.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

1 Comment

Prepare for a Dollar Doomsday (Video)

Jim Rickards, author of Currency Wars and The Death of Money, spoke with Bloomberg TV this week about how the Federal Reserve’s interest rate suppression is manipulating every market in the world. Want to preserve your wealth in the coming dollar collapse? Buy gold and hard assets, says Jim.

“The Fed’s insolvent… the insiders will tell you that privately, they won’t say it publicly… The ultimate backing of the dollar is confidence… Money is a perpetual non-interest bearing note issued by an insolvent central bank. How long can that go on for until people walk away from it?”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries, Videos

Comments Off on Prepare for a Dollar Doomsday (Video)

US Economy Is in the Eye of a Storm

The Daily Bell recently interviewed Doug Casey about “The Continuing Debasement of Money, Language and Banking in the Modern Age.” Casey talks not just about the evils of our central banking system, but also the fundamental case for gold and the end of Western civilization as we know it.

“I don’t see a real recovery until they stop debasing the currency, radically cut government spending and taxation and eliminate most regulation. In other words, cease doing the things that caused this depression. And that’s not going to happen until there’s a collapse of the current order…

I expect that we’ll go out of the eye of the storm this year; it’s overdue, actually. The analogy I like to use is that the leading edge of the storm was in 2007, now we’re in the eye of the hurricane, and when we move into the trailing edge it’s going to be much, much worse and last much, much longer than it was in the leading edge.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

Comments Off on US Economy Is in the Eye of a Storm

Gold Levels the Investment Playing Field (Audio)

The BBC interviewed Marcus Grubb, the Managing Director for Investment at the World Gold Council (WGC), about the growing demand for gold in China. Earlier this month, the WGC released a new in-depth research report that showed gold demand in China would increase another 25% by 2017. Grubb explains why gold is such an essential asset not only to the Chinese, but to any investor who wants to avoid the risks of speculative investments and currency debasement.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!