Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Outside Commentaries

Silver Tech News from the Silver Institute

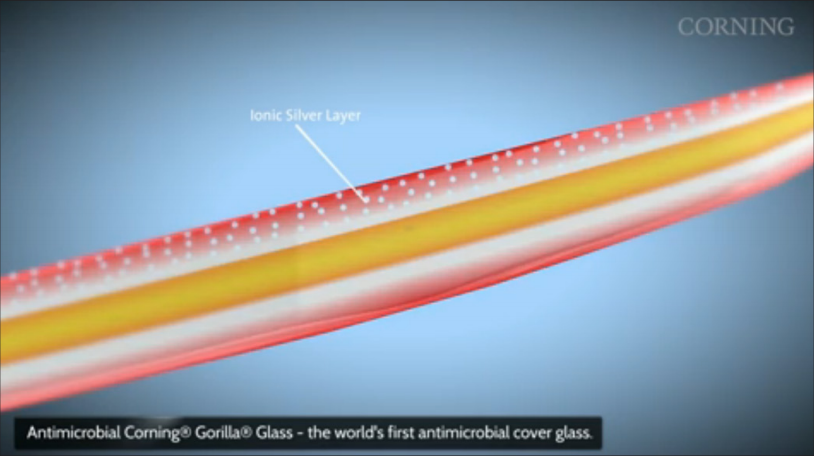

The Silver Institute has released its February Silver News, jam-packed with stories on the latest developments in silver technology. This issue includes an interview with an industry insider about the recent American Eagle coin shortage, as well as articles about silver in hard drives, spark plugs, and the Gorilla Glass used on smartphones.

“‘Corning’s Antimicrobial Gorilla Glass inhibits the growth of algae, mold, mildew, fungi, and bacteria because of its built-in antimicrobial property, which is intrinsic to the glass and effective for the lifetime of a device,’ said James R. Steiner, Senior Vice President and General Manager of Corning Specialty Materials, in a prepared statement for CES 2014. He added: ‘This innovation combines best-in-class antimicrobial function without compromising Gorilla Glass properties. Our specialty glass provides an excellent substrate for engineering antimicrobial and other functional attributes to help expand the capabilities of our Corning Gorilla Glass and address the needs of new markets.'”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines, Outside Commentaries

2 Comments

Mt. Gox Proves Bitcoin Is Far from a Sure Thing

Bloomberg View published an insightful commentary that spells out some of the inherent risks of bitcoin. In light of the meltdown of the bitcoin exchange Mt. Gox this week, investors should think twice before moving their dollars into this very unpredictable new currency. Peter Schiff warned of problems like this not long ago and encouraged clients to stick with the oldest and most reliable forms of money – gold and silver.

“The Mt. Gox failure highlights some of the major drawbacks of Bitcoin.

The first is that, as with old-fashioned gold coins, thefts are nearly impossible to trace. In this respect, Bitcoins are inferior to plain old dollar bills, which at least have serial numbers that can be monitored and tracked. Of course, if you’re trying to keep government eyes off your transactions, untraceable currency has its advantages. But most of us don’t do transactions that the government much cares about, so the fear of theft outweighs the benefits of anonymity.

The second is that there is, as yet, no currency exchange like the ones we use for regular currency — backed by large institutions that can be sued if things go wrong. Again, there are advantages to this for the underground economy. But for folks in the regular old economy, that’s a problem. It’s hard to get enthusiastic about saving in a system where hundreds of thousands of dollars can disappear overnight, leaving you with no recourse. Not every Bitcoin exchange is Mt. Gox. But for ordinary folks, it can be hard to tell the difference, which is going to make them a little jittery about buying Bitcoins.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

2 Comments

2013: The Year of the Gold Consumer (Video)

This week, the World Gold Council released its Gold Demand Trends report for the full year of 2013. Marcus Grubb, the Managing Director of Investment Strategy for the WGC, summarizes the report and reminds us that gold’s strong fundamentals will continue to drive long-term demand for the metal.

Download the Gold Demand Trends Report Here

“Global investment in bars and coins in 2013 reached 1,654 [metric] tons, a rise of 28% compared to 2012, and the highest figure since the World Gold Council’s data series began in 1992.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on 2013: The Year of the Gold Consumer (Video)

New Poll: Americans Know They’re Screwed

A new poll by McClatchy-Marist reveals that Americans are increasingly aware of the inequality of the US economic system. Further, they don’t think it’s getting any better. They expect the next generation to be worse off than they are, and the majority doesn’t think the government’s policies are helping.

“‘The poll really explains why people are feeling on the sidelines and so despondent,’ said Lee Miringoff, the director of the Marist Institute for Public Opinion in New York.

Polling has found that most people are wary of whether Washington can assist, but the new survey has constituents questioning whether any part of the American system can be a big help.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on New Poll: Americans Know They’re Screwed

Rickards: Look for Taper Pause by Mid-Year (Video)

Yahoo’s Daily Ticker asked Jim Rickards what his impressions were of Janet Yellen’s first press conference. Like Peter Schiff, Rickards sees the Federal Reserve as an incompetent economic forecaster and expects that Yellen will be forced to at least stop the taper by the middle of the year.

“My point is, the Fed has a terrible forecasting record. They don’t see bubbles. They’re always surprised. And as far as continuity is concerned – continuity to me means, they’ve been making it up for the past five years, they’re going to keep making it up.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

Comments Off on Rickards: Look for Taper Pause by Mid-Year (Video)

Central Banks Are in Deep $@#%

Famed economist Marc Faber gave an interview to The Australian Financial Review and had no compunctions about tearing into the horrible policies of central banks around the world. Like Peter Schiff, Faber doesn’t see any real tightening happening in the near future.

“Central bankers are completely insane… These are people who are professors, academics who never worked a single day in their life in an ordinary job. Because money printing doesn’t help ordinary people . . . it helps asset prices… My sense is that central banks are unlikely to tighten because they’re in such deep shit already and they will continue to print.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Central Banks Are in Deep $@#%

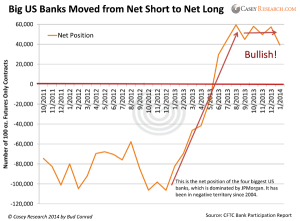

Gold Is Now On Sale

If you haven’t yet checked out Peter Schiff’s latest Gold Letter, take the time to do so this weekend. It includes an excellent piece by Bud Conrad of Casey Research explaining some of the technical reasons that gold is a great buy right now.

“Gold has been in a downturn for more than two years now, resulting in the lowest investor sentiment in a long while. Hardcore goldbugs find no explanation in the big-picture financial numbers of government deficits and money creation, which should be supportive to gold. I have an explanation for why gold has been down – and why that is about to reverse itself. I’m convinced that now is the best time to invest in gold again.”

Continue Reading Full Commentary

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Gold Is Now On Sale

Gold’s Long-Term Upside Potential

The Gold Report spoke with Adrian Day about the ridiculous amount of government debt that will ensure the gold market remains on an uphill trajectory for years to come.

The Gold Report: Where are we in the current gold cycle?

Adrian Day: Over the last 250 years, the shortest cycle on record was the 1970s, just over 10 years. Typically, gold upcycles have lasted close to 40 years. On that basis, we aren’t even halfway through the current gold upcycle.

TGR: So last year’s price collapse did not indicate the end of the gold upcycle?

AD: Significant corrections in long, secular bull markets are typical. Gold, from top to bottom, has declined 37% in this particular cycle. If you look back to the upcycle of the 1970s, 1975–1976 saw a midcycle correction of 47%. But that was right before gold went up eightfold to more than $800/ounce ($800/oz).

Where are we now? It would be optimistic to assume a V-shaped recovery, but gold has bottomed, and over the next 12 months we are likely to see a slow, if uneven, recovery. The typical recovery comes from a long midcycle correction. We should reach $1,550–1,650/oz in 2014 or early next year, and then gold will start to accelerate. Some gold stocks could recover a lot quicker in expectation of higher prices.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

Comments Off on Gold’s Long-Term Upside Potential

The Many Flaws of Janet Yellen

The Darien Times published a concise but insightful article by Jim Rickards on the flaws of Janet Yellen’s approach to central planning. Rickards argues that the problems stem from the Federal Reserve’s dual mandate to manage US employment in addition to price stability.

“The original sin with regard to Fed powers was the Humphrey-Hawkins Full Employment Act of 1978 signed by President Carter. This created the “dual mandate” which allowed the Fed to consider employment as well as price stability in setting policy. The dual mandate allows the Fed to manage the U.S. jobs market and, by extension, the economy as a whole, instead of confining itself to straightforward liquidity operations. Janet Yellen, the incoming Fed chairwoman, is a strong advocate of the dual mandate and has emphasized employment targets in the setting of Fed policy. Through the dual mandate and her embrace of it, and using the dollar’s unique role as leverage, she is a de facto central planner for the world.

Like all central planners, she will fail. Yellen’s greatest deficiency is that she does not use practical rules. Instead she uses esoteric economic models that do not correspond to reality.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Many Flaws of Janet Yellen

Fed Incapable of Predicting Recessions

A MarketWatch commentary has analyzed the Federal Reserve’s transcripts from the 2008 recession and found that it is grossly incompetent at predicting and understanding recessions. There doesn’t seem to be any good reasons to expect that the Fed has improved its market diagnostic skills. What does that mean for investors today? Don’t trust the official hype – the economy is doing a lot worse than Yellen’s Fed claims.

Read the Full Commentary Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!