Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Outside Commentaries

2014 Supply Crunch Means Higher Gold Price

In his latest piece with Casey Research, Jeff Clark lays out the main factors that might lead to a gold shortage in 2014. The trends Clark cites have been apparent for several years, but 2014 might be the year that Western purchasers of gold really start to notice the squeeze.

“If you’re like me, you’ve bought gold due to the money printing policies of most developed countries and the effect those policies will have on the future purchasing power of our paper money. Probably also because there’s no viable way for governments to escape the consequences of all the debt they’ve piled up. And maybe because politicians can’t be trusted to formulate a realistic strategy to avoid any number of monetary, fiscal, or economic crises going forward.

These are valid, core reasons to hold gold in a portfolio at this point in time. But a new trend is under way, and someday soon it will be just as much a driving force for gold prices as anything else: a good old-fashioned supply crunch.

A few metals analysts have mentioned it, but it escapes many and certainly is off the radar of the mainstream financial media. But unless several critical factors reverse course, a supply shortage is on the way with clear implications for the price of gold.

The following four factors are combining to diminish gold supply. While we’ve touched on some of them before, put together they’re creating a perfect storm that will, sooner or later, impact the gold market in several powerful ways. As these forces gather steam, you’ll want to make sure you’ve already built a substantial position in physical bullion.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

1 Comment

Santelli & Stockman: Budget Deal Is a Joke (Video)

As usual, the mainstream news has been looking at the US budget deal through rose-colored glasses. In this short video, Rick Santelli and David Stockman tear apart the bi-partisan budget “solution,” noting that it’s just another game of kick-the-can.

“There’s not a chance anything will be done about the fiscal equation, which is festering, until 2017. And if you get around to addressing it, you can’t have an impact until 2018 or 2019. Now who thinks we can wait that long? We have $17 trillion of debt now… It will be $21 trillion after the next presidential election.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

Comments Off on Santelli & Stockman: Budget Deal Is a Joke (Video)

$20K Gold Is Still to Come

Casey Research published an interview with economist, professor, and financial advisor, Krassimir Petrov, who is a long-term precious metals bull, like Peter Schiff. While Petrov believes gold’s correction is ongoing (meaning it remains a great time to buy), he argues that this is just a temporary setback in a huge bull market that will last much longer than mainstream analysts predict.

“First, I do expect that the stock market is going to lose significant value over the next five to ten years. Second, I believe that real estate is still grossly overvalued; as interest rates eventually rise, real estate will fall hard—overall, it will not hold value well. Third, I also believe that bonds are extremely overvalued and that yields are extremely low. I expect interest rates to begin to rise and bond prices to fall, so I strongly discourage investors from staying in bonds. Finally, I expect that governments will continue to inflate, even though it doesn’t work, and that currencies will devalue.

I strongly encourage investors to stay out of all four of these asset classes. Investors should be staying well diversified in commodities. They shouldn’t ignore food—agriculture. They shouldn’t ignore energy. But their portfolios should be dominated by precious metals.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

Comments Off on $20K Gold Is Still to Come

Gold Remains the Best Insurance against Economic Uncertainty

This week, in a commentary published by The Telegraph, John Ficenec defended gold’s history as the ultimate safe haven asset, arguing that the fundamentals for the yellow metal remain sound even if the price correction has spooked speculative investors. Long-term physical gold bulls continue to hoard the yellow metal to protect themselves from the inflationary money-printing of the world’s central banks.

“The market price of gold may have fallen during the year, but hoarding of the precious metal by central banks and private individuals is approaching record levels.

In trading terms, it has been a tough year for the yellow metal. The price of gold has fallen 28pc during the past 12 months. However, the fundamentals, characteristics and attractions of gold are undiminished because we remain in times of extreme intervention by governments around the world, the outcome of which is completely unknown.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Gold Remains the Best Insurance against Economic Uncertainty

Time for Gold Bugs to Admit Defeat?

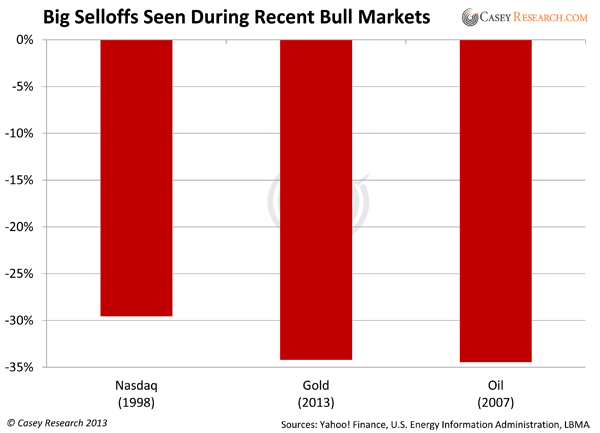

Don’t forget to read Peter Schiff’s Gold Letter released this week. It includes a persuasive commentary from Jeff Clark, who argues that the correction in the gold market over the past year is just a temporary set back in a larger bull market.

“Gold’s price has fallen by more than a third since its 2011 high. The downturn exceeds the 2008 waterfall sell-off. Many technical analysts are saying that the ‘damage’ on the charts is too great for gold to recover. The rout is so bad that even hardened goldbugs have grown quiet lately.

Is it time for gold investors to admit defeat?”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Time for Gold Bugs to Admit Defeat?

Economy Will Collapse Without QE (Video)

Last week, Grant Williams gave a presentation on the long-term effects of quantitative easing on the health of the global, and particularly Western, economy. Peter Schiff has been warning about the same problem for years and offers the same advice as Williams: avoid the US dollar, stock market, and bond market and prepare for the biggest crash in living history.

“When you look beyond the horizon, quantitative easing is and will continue to be, the single biggest influence on every investment decisions you’re going to be making. Possibly for the next several years… The US economy is simply not strong enough to survive without massive stimulus… Just about every government in the Western world is essentially bankrupt.”

The video below is just a portion of his speech. Click here to watch the full 1/2 hour presentation.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Economy Will Collapse Without QE (Video)

Ex Fed Governor: What Is QE Really Doing for Americans? (Video)

Kevin Warsh is a former member of the Federal Reserve’s Board of Governors. In an interview on CNBC yesterday, Warsh slams the Federal Reserve for their poor economic models and horrible track record of economic predictions. He goes on to point out that the Fed’s stimulus program does nothing for Main Street and is really just a stimulus program for those with big balance sheets on Wall Street. More and more mainstream economists are following in the footsteps of Peter Schiff and beginning to question the value of the Fed’s stimulus programs.

“The reality is, QE policy favors those with big balance sheets. They favor those with risk appetites. They favor those with access to free money. And real people that are living off their income statements, that have W2 income, they’re still looking around and saying, ‘What is Fed policy doing for me?’”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

Comments Off on Ex Fed Governor: What Is QE Really Doing for Americans? (Video)

David Stockman: Fed Has Taken Itself Hostage (Video)

Fox Business’ Neil Cavuto spoke with Ronald Reagan’s former budget director, David Stockman, about the rising stock market and taper talk from the Federal Reserve. Stockman, like Peter Schiff, sees bubbles forming throughout the economy and blames the easy money policies of the Federal Reserve. Like Peter, Stockman warns of a massive crash that investors should be preparing for.

“I say it’s [2007], [2008] all over again. Party time. We have bubbles breaking out everywhere and almost a repeat patter… We’re in the fourth bubble created by the Fed with easy money and printing press expansion in this century… This is the biggest one yet.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries, Videos

1 Comment

Strong Q3 Global Gold Demand (Video)

The World Gold Council released their latest Gold Demand Trends for the 3rd quarter of 2013. The report goes into detail about world gold demand in the investment, consumer, central bank, and technology sectors. Gold Demand Trends is available as a free download, and Marcus Grubb, the World Gold Council’s managing director for investment, gives a video presentation summarizing the report’s key findings.

“82% of consumers in India and China believe that over the next five years, the price of gold will increase or be stable… Bar and coin demand grew 6% globally, compared to the same period in 2012. Year-to-date, demand for bars and coins has grown by a remarkable 36%. Turning to central banks, gold demand remained steady at 93 [metric] tons, with this period being the 11th consecutive quarter in which they have been net purchasers of gold… The figures for Q3 reinforce gold’s continued strength, diversity, and enduring appeal. They suggest that in what has been a challenging year, the market is returning to balance.”

Watch the Video & Download Gold Demand Trends Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Strong Q3 Global Gold Demand (Video)

QE Will Never End; Precious Metals Severely Depressed (Video)

Marc Faber, publisher of The Gloom, Boom & Doom Report, broke the news to CNBC that the Federal Reserve will never completely end QE and that the stimulus is likely to become larger in the coming years. Later in the interview, Faber indicates that now is the time to get into precious metals like gold and silver, because the prices are extremely depressed.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!