Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Peter’s Commentaries

Meet “Lowflation”: Deflation’s Scary Pal

In a new commentary, Peter Schiff tears into the bogus new concept of “lowflation” and the misunderstanding that inflation actually stimulates economic growth. In reality, inflation benefits indebted governments and over-leveraged Wall Street speculators while cutting into the savings of retirees and savers. Of course, we know that gold and silver are two types of wealth that cannot be inflated by over-zealous central banks.

“In recent years a good part of the monetary debate has become a simple war of words, with much of the conflict focused on the definition for the word “inflation.” Whereas economists up until the 1960’s or 1970’s mostly defined inflation as an expansion of the money supply, the vast majority now see it as simply rising prices. Since then the “experts” have gone further and devised variations on the word “inflation” (such as “deflation,” “disinflation,” and “stagflation”). And while past central banking policy usually focused on “inflation fighting,” now bankers talk about “inflation ceilings” and more recently “inflation targets”. The latest front in this campaign came this week when Bloomberg News unveiled a brand new word: “lowflation” which it defines as a situation where prices are rising, but not fast enough to offer the economic benefits that are apparently delivered by higher inflation. Although the article was printed on April Fool’s Day, sadly I do not believe it was meant as a joke.

Up until now, the inflation advocates have focused their arguments almost exclusively on the apparent dangers of “deflation,” which they define as falling prices. Despite reams of evidence that show how an economy can thrive when prices fall, there is now a nearly universal belief that deflation is an economic poison that works its mischief by convincing consumers to delay purchases.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries

Comments Off on Meet “Lowflation”: Deflation’s Scary Pal

The Stealth Rally: Gold Under the Radar

The April 2014 Gold Letter was released today. In his new commentary, Peter Schiff examines gold’s stealth rally this year, explaining why investors are wrong to dismiss the best-performing asset of 2014. The latest article from Jeff Clark of Casey Research points out how people rush to gold during inflationary times. Our FAQ explains the price differences between products produced by public versus private mints. Lampoon the System’s comic reminds us that in spite of warmer weather, Yellen’s Federal Reserve can’t do a thing for the US economy.

“So far, 2014 has been a paradoxical year for gold. Many investors aren’t even aware that it has rallied more than 7%. On the rare occasion that the financial media mentions the yellow metal, it is only in the context of comparing the recent rise to last year’s decline.

In spite of this overwhelming negative sentiment, gold is experiencing a stealth rally as one of the best performing assets of the year. Let’s look at some important metrics of the most under-valued sector in this market.”

Continue Reading the Full Gold Letter Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries

Comments Off on The Stealth Rally: Gold Under the Radar

How to Prepare for a Fed U-Turn

ETF.com interviewed Peter Schiff about the impending dollar collapse and how investors can prepare for a reversal of the Fed’s tapering.

“Gold’s going to be a primary beneficiary [of a taper reversal]. Gold is real money, so it’s not just a substitute like these currencies are. I think the demand for gold and other commodities will explode when the Fed has to admit the truth. If you look at the Fed’s track record on the economy, particularly since the days leading up to the financial crisis and subsequent, the Fed has always gotten the economy wrong by a long shot.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries

Comments Off on How to Prepare for a Fed U-Turn

Don’t Wait for Yellen to Pause Taper to Buy Gold (Audio)

Kerry Lutz of the Financial Survival Network interviewed Peter Schiff about Janet Yellen and the likelihood that she will eventually pause and reverse quantitative easing. It will be very bullish for gold when the Federal Reserve is forced to admit that the US economy isn’t improving.

“I think we’re just getting started in this [gold] bull market. The catalyst is going to be when Janet Yellen has to fess up. She comes clean and announces the pause. She doesn’t even have to announce that she’s ratcheting up the QE, just that she’s pausing with the taper… The minute they do that, it’s a green light to buy [gold]… But I wouldn’t wait for that… I would be buying in advance. A lot of people are going to be surprised by that announcement and they will buy gold.”

Listen to the Full Interview Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries

Comments Off on Don’t Wait for Yellen to Pause Taper to Buy Gold (Audio)

Yellen Is Driving the Economy Over a Cliff (Video)

In his latest video blog post, Peter Schiff analyzes Janet Yellen’s first press conference as Federal Reserve Chairman. Peter argues that either the Fed is clueless about how poor the economy really is, or they are bluffing. Either way, Yellen has more or less guaranteed that inflation is here to stay, which is great for gold investors.

“Quantitative easing [is] not the training wheels. Quantitative easing is the only wheels on this economic bike. That is why the Fed cannot take them off. They might bluff about taking them off, maybe they’ll let a little air out of the tires temporarily… But they are going to abort this [tapering] mission. They are going to quickly pump air back into those tires to keep this economic bike rolling forward… Where is this bike headed? The bike is going to go over a cliff.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries, Videos

Comments Off on Yellen Is Driving the Economy Over a Cliff (Video)

Gold’s Rise Has Nothing to Do with Crimea (Video)

Yahoo! Breakout interviewed Peter Schiff this morning about gold reaching a nearly 6-month high in the context of political unrest between Russia, Ukraine, and Crimea. Crimea is just a distraction, Peter argued, and the market is going to be in for a rude awakening when they realize gold’s strong fundamentals haven’t changed in years. Peter also shares his own forecast for gold in the coming year.

“Gold is not going up any faster since the Russians moved into Crimea than before. But I think the bears on gold want to attribute the rise to Crimea so they can dismiss the significance of that rise. The real reason gold is going up is because of inflation, is because the Fed has no way out of QE, the US economy is slipping back into recession…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries, Videos

Comments Off on Gold’s Rise Has Nothing to Do with Crimea (Video)

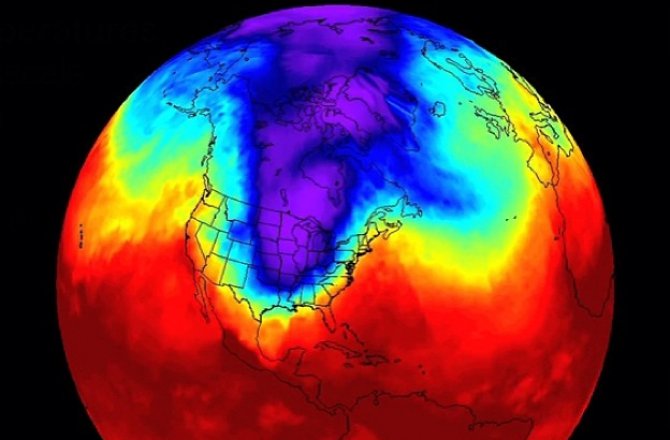

Weather or Not?

In his latest commentary, Peter Schiff pokes holes in the theory that the polar vortex and exceptionally cold winter is solely responsible for the poor economic data of the past several months. Peter argues that economists and the media are blowing a lot of hot… er, cold air to convince the public that the economy is doing better than it really is.

“Everyone agrees that the winter just now winding down (hopefully) has been brutal for most Americans. And while it’s easy to conclude that the Polar Vortex has been responsible for an excess of school shutdowns and ice related traffic snarls, it’s much harder to conclude that it’s responsible for the economic vortex that appears to have swallowed the American economy over the past three months. But this hasn’t stopped economists, Fed officials, and media analysts from making this unequivocal assertion. In reality the weather is not what’s ailing us. It’s just the latest straw being grasped at by those who believe that the phony recovery engineered by the Fed is real and lasting. The April thaw is not far off. Unfortunately the economy is likely to stay frozen for some time to come.

Over the past few weeks, I have seen just about every weak piece of economic news being blamed on the weather. First it was lackluster retail sales that were chalked up to consumers being unable or unwilling to make it to the mall. (This managed to ignore the fact that online sales were similarly weak – which would be unexpected for a nation of snowed in consumers). Then came the weak auto sales that were ascribed to similarly holed up potential car buyers. However, this ignores that while GM and Chrysler sales were way down, sales for luxury cars like BMW, Mercedes and Maserati, surged to record high levels (more on that later). No one offered a reason why wealthier motorists were able to brave the cold. A number of other data points, such as lower GDP, productivity, ISM and factory orders were also ascribed to the elements.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries

Comments Off on Weather or Not?

Gold Scams Revisited

The March 2014 Gold Letter is now available. In his commentary, Peter Schiff announces the release of his newly updated Classic Gold Scams special report and reexamines some common gold scams that investors would be wise to avoid. An essay by Alasdair Macleod reviews the major gold stories of 2013 that laid the foundation for a strong 2014 for the yellow metal. Plus, Lampoon the System imagines central bankers participating in the Olympics, our FAQ looks at gold bars versus coins, and we finish up with important gold news from February.

“Before Bear Stearns and Lehman collapsed, the market for physical gold was limited to a relatively small group of investors who understood the havoc inflation was wreaking on our savings and the US markets. As the financial crisis took hold, a flood of new and inexperienced buyers entered the market, creating an opportunity for unscrupulous metals dealers to swindle their way to massive profits. This is what drove me to launch my very own gold dealer, Euro Pacific Precious Metals, to provide a safe alternative for those who were taking my advice to diversify into sound money. In our first year of business, I released Classic Gold Scams and How to Avoid Getting Ripped Off, a free report that has saved countless investors from losing their shirts.

Fast forward several years and the markets look like a film on repeat. We are once again building toward a massive financial crisis – one that will make 2008 seem like the good old days. Unfortunately, the majority of investors are once again playing the US markets and shunning gold. I encourage my readers to consider diversifying into precious metals now, while the market is still distracted. To this end, and in preparation for the inevitable mad rush when conventional investors again flock to safety, I have updated and re-released my Classic Gold Scams report to help newcomers learn how to buy gold and silver the right way.”

Read the Full Gold Letter Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Featured, Peter's Commentaries

1 Comment

In Terms of Gold, Market Headed Back Down (Video)

In his latest video blog post, Peter Schiff analyzes the latest economic data and the overwhelming negative sentiment against gold. Picking apart some anti-gold headlines from Forbes and The Wall Street Journal, Peter counters the gold naysayers and explains why they’re completely misinterpreting the fundamental condition of the US economy.

“But rather than the price of gold collapsing to meet the expectations of the price of gold stocks, I think the reverse is going to happen… I think the price of gold stocks will soar to catch up to the price of gold… If you look at the price of stocks relative to gold this year, we have resumed our down trend. And so even though the stock market is now heading higher in terms of dollars, it is now headed lower in terms of gold. And that is a trend that I am convinced will continue.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries, Videos

Comments Off on In Terms of Gold, Market Headed Back Down (Video)

In the US Economy, Even Good News Is Bad (Video)

In his latest video blog post, Peter Schiff addresses the weak non-farm payroll numbers announced on Friday and what they tell us about the true condition of the US economy. Peter believes that jobs numbers are going to keep getting worse as spring continues and that the Federal Reserve will be forced to pause and then reverse its quantitative easing. This will be extremely bullish for gold and bearish for the dollar.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!