Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Peter’s Commentaries

The Eastern Lust for Gold

Peter Schiff’s final Gold Letter of 2013 is now available. Peter explores the most important precious metals trend of the year – the transfer of physical gold from West to East. Jeff Clark examines the correction in the gold price and explains why investors should not be throwing in the towel on the biggest gold bull market on record. Meanwhile, Lampoon the System pops the misconception that Janet Yellen is capable of anticipating any sort of major asset bubble.

“Having replaced savings with debt on both the national and individual levels, I think it’s well past time for Westerners to take a few lessons from our creditors in the East. Many Americans consider gold a “barbarous relic,” but in Asia, the yellow metal remains the bedrock of individual savings plans. This means that either greater than half of the world’s population are barbarians, or they’ve held onto an important tradition that our culture has forgotten.”

Continue Reading Peter Schiff’s Gold Letter

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries

Comments Off on The Eastern Lust for Gold

The Fed Is Bluffing: No Exit Strategy Exists (Audio)

Chris Waltzek interviewed Peter Schiff on GoldSeek radio last week. Peter spoke at length about the mainstream misconception that the US economic recovery has been successful thanks to monetary stimulus and that the rest of the world needs to follow the same strategy. Eventually, Peter argues, the market will have to wake up to the fact that the Fed can never and will never end quantitative easing. That’s when investors will stop ignoring gold and the price will rise.

“It’s not a genuine economic recovery that is sustainable. They have created a phony recovery that needs ever increasing doses of QE to continue. So if they want to stop it from imploding, they’re going to need more QE. But they can’t admit that…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries

Comments Off on The Fed Is Bluffing: No Exit Strategy Exists (Audio)

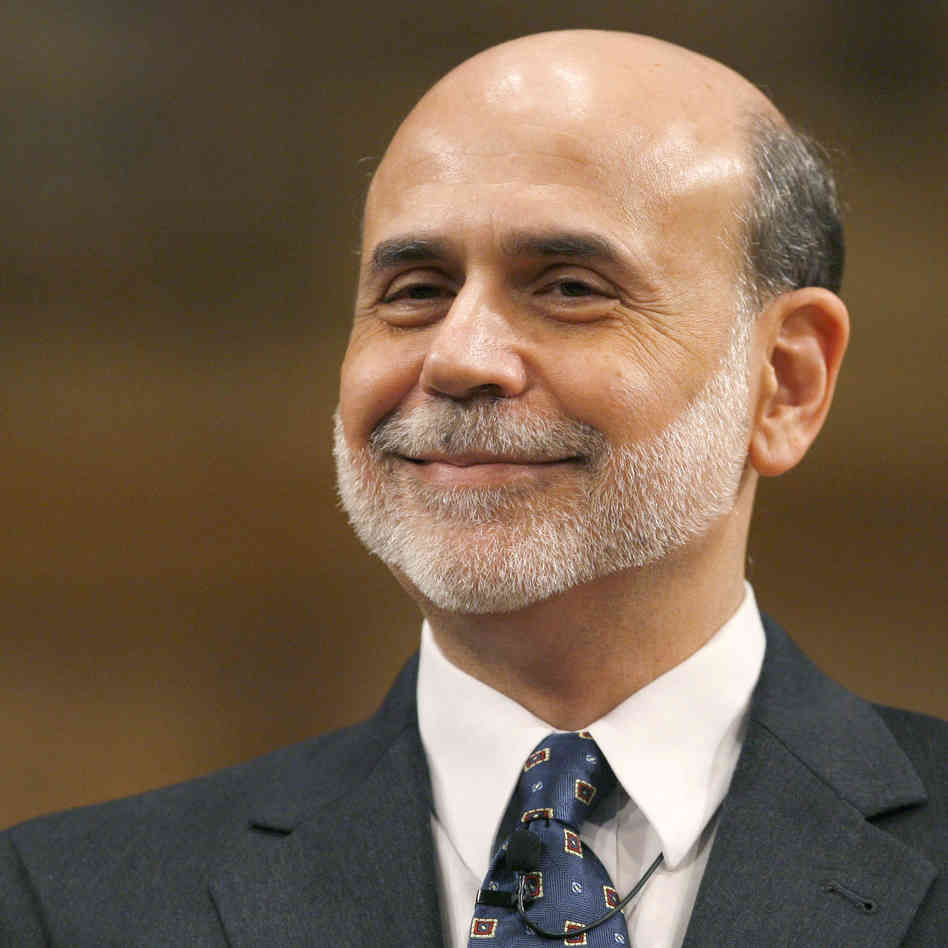

Ben’s Rocket to Nowhere

Peter Schiff released a new commentary yesterday, demolishing Ben Bernanke’s metaphor that likens quantitative easing to the first stage of a rocket being shot into space. Unlike a rocket that can jettison its spent fuel tanks, the economy is going to be dragged down by the lingering effects of QE for years to come.

“Herd mentality can be as frustrating as it is inexplicable. Once a crowd starts moving, momentum can be all that matters and clear signs and warnings are often totally ignored. Financial markets are currently following this pattern with respect to the unshakable belief that the Federal Reserve is ready, willing, and most importantly, able, to immediately execute a wind down of its quantitative easing program. Although the release last week of the minutes of the Fed’s last policy meeting did not contain a shred of hard information about the certainty or timing of a “tapering” campaign, most observers read into it definitive proof that the Fed would jump into action by December or March at the latest. The herd is blissfully unaware that the Fed may not be able to reverse, or even slow, the course of QE without immediately sending the economy back into recession.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries

1 Comment

As Fed Only Talks Taper, China Prepares to Do It (Video)

In his new video blog post, Peter Schiff shares his opinion on the Federal Reserve’s latest press release. He points out that the media has completely misinterpreted the Fed’s message – the FOMC minutes contain no assurance that a December tapering of QE is likely. Peter goes on to talk in depth about how China’s potential exit strategy from its foreign currency reserves will affect the US dollar and the price of gold.

“The truth is, if China means what it says, the Fed is going to have to back up the truck. I mean, not just not taper, but they are going to have to significantly increase the amount of monthly QE that they do in order to pick up China’s slack. That’s what is going to happen in 2014.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries, Videos

1 Comment

Bitcoin vs. Gold (Video)

For More Information on Investing in Gold

Call 1-888-GOLD-160 (1-888-465-3160)

Talk now to a Precious Metals Specialist who will be happy to answer your questions.

Request a Callback

Click Here and a Specialist will call you back at your convenience.

Chat Online

Click Here to chat with a Specialist right from your web browser.

Summary: In his latest video, Peter Schiff shares his thoughts on the bitcoin mania that is sweeping the world. After rising from less than $20 to more than $600 in one year, many investors are wondering if bitcoin might be worth the risk. Early adopters pitch bitcoin as “gold 2.0” – a digital currency that cannot be manipulated like fiat money. Bitcoins are even “mined,” similar to physical gold and silver. However, Peter explains why bitcoins still fail as a substitute for gold and strongly urges investors to avoid this risky new currency. Bitcoin could very well have already hit its top, but Peter is confident gold is still well below its future record highs.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries, Videos

29 Comments

Paul Craig Roberts: The Dollar’s Dark Future (Video)

Earlier this month, Paul Craig Roberts was interviewed by Greg Hunter of USAWatchdog about the perils faced by the US dollar as the world’s reserve currency. Roberts is a former Assistant Treasury Secretary and believes it is likely that there will be a major dollar crisis sooner than later. Roberts talks about the strong global demand for physical gold that continues even while international demand for US dollars shrinks. Like Peter Schiff, Roberts believes that the Fed has no safe way to end its monetary stimulus without triggering a major crisis and explains his position in depth in this extended interview.

“In the last few months, both China and Japan have sold off some Treasuries, some $40 billion between them. This is not a huge sum, but it does show that they’re ceasing to accumulate them. And there’s also been reports that China is accumulating very large quantities of gold. So this does show that the dollar may have a limited life as the supreme currency.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries, Videos

Comments Off on Paul Craig Roberts: The Dollar’s Dark Future (Video)

Janet Yellen’s Mission Impossible

Peter Schiff’s latest commentary grapples with the challenges Janet Yellen will face as the new Federal Reserve Chairman in 2014. Contrary to popular opinion, Peter believes that Yellen will actually increase QE sometime next year. If Peter’s prediction is correct, physical precious metals could see an impressive comeback.

“Most market watchers expect that Janet Yellen will grapple with two major tasks once she takes the helm at the Federal Reserve in 2014: deciding on the appropriate timing and intensity of the Fed’s quantitative easing taper strategy, and unwinding the Fed’s enormous $4 trillion balance sheet (without creating huge losses in the value of its portfolio). In reality both assignments are far more difficult than just about anyone understands or admits.

Unlike just about every other economist, I knew that the Fed would not taper in September because the economy is still fundamentally addicted to stimulus. The signs of recovery that have caused investors and politicians to bubble with enthusiasm are just QE in disguise. Take away the QE and the economy would likely tilt back into an even more severe recession than the one we experienced before QE1 was launched.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries

Comments Off on Janet Yellen’s Mission Impossible

Gold: Hold It or Fold It?

The November 2013 edition of Peter Schiff’s Gold Letter is now available. This month, Peter explains the economic bluffing strategy of the US government and how it is disrupting Wall Street’s ability to understand the long-term case for gold. After Peter defends gold’s prospects, Jeff Clark of Casey Research has a commentary on silver’s bright future. Lampoon the System uses George Orwell to take a crack at Obama’s propaganda, and we explain how to invest in physical gold and silver with retirement funds.

“It’s starting to feel like we are part of a giant poker game against the US government, whose hand is the true condition of the American economy. The government has become so good at bluffing that most people feel compelled to watch how the biggest players in the game react to determine their own investment strategy.

Unfortunately, this past month revealed that even pros like Goldman Sachs have no idea what sort of hand Washington is really hiding.”

Continue Reading Peter Schiff’s Gold Letter

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries

Comments Off on Gold: Hold It or Fold It?

Dump the Fed and Return to Gold Standard (Audio)

This weekend, Peter Schiff spoke with SGT Report about the big picture problems facing the United States and its economy. The discussion focused on the successful free market history of America and how far the country has deviated from the vision of the founding fathers. Towards the end, Peter elaborates on the end of the US dollar as the world’s reserve currency, the role a gold standard could play in fixing the economy, and why there is no longer a need for the Federal Reserve.

“Given the advancement in technology that exists today, a lot of the reasons that we needed a Fed are obsolete today. We really don’t need the Fed, because of the computers and telephone systems and the internet… I think the US economy can function extremely well on a gold standard with no Federal Reserve, and that’s what we should do. That would be ideal.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Peter's Commentaries

Comments Off on Dump the Fed and Return to Gold Standard (Audio)

They Bravely Chickened Out

In his latest commentary, Peter Schiff blasts Congress for the feeble budget agreement made this week. It’s becoming obvious that Washington has no intention of addressing the financial calamities that lie before us until it is too late. Make sure you’re prepared when it comes time to abandon ship!

Read the Full Commentary Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!