Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Peter’s Commentaries

Off to the Races

Peter Schiff’s September Gold Letter has been released, and it is worth noting that this will be its final edition. Stay tuned for the launch of Peter Schiff’s Gold Video Dispatch in October.

This month, Peter explains how the groundwork has been laid for an exciting autumn season in the physical precious metals market. If you’ve been waiting to buy gold, now might be the perfect time! You’ll also find an eye-opening commentary from Charles Hugh Smith and Lampoon the System’s latest jibe at the jokers who “saved” Detroit.

“Summer is traditionally a slow season for precious metals, but this summer started with a rout. In the last week of June, gold and silver hit 2-year lows of $1,192 and $18.61 respectively.

Fortunately, after staggering along the lows, the precious metals are off to the races once more – with gold rallying more than 18% and silver 28%. This remarkable performance continues even in the face of the Fed’s sustained tapering threats.

The exhaustion of short-sellers paired with insatiable global physical demand has positioned gold for an exciting conclusion to a volatile year.”

Continue Reading Peter Schiff’s Gold Letter

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Peter's Commentaries

Comments Off on Off to the Races

The GDP Distractor

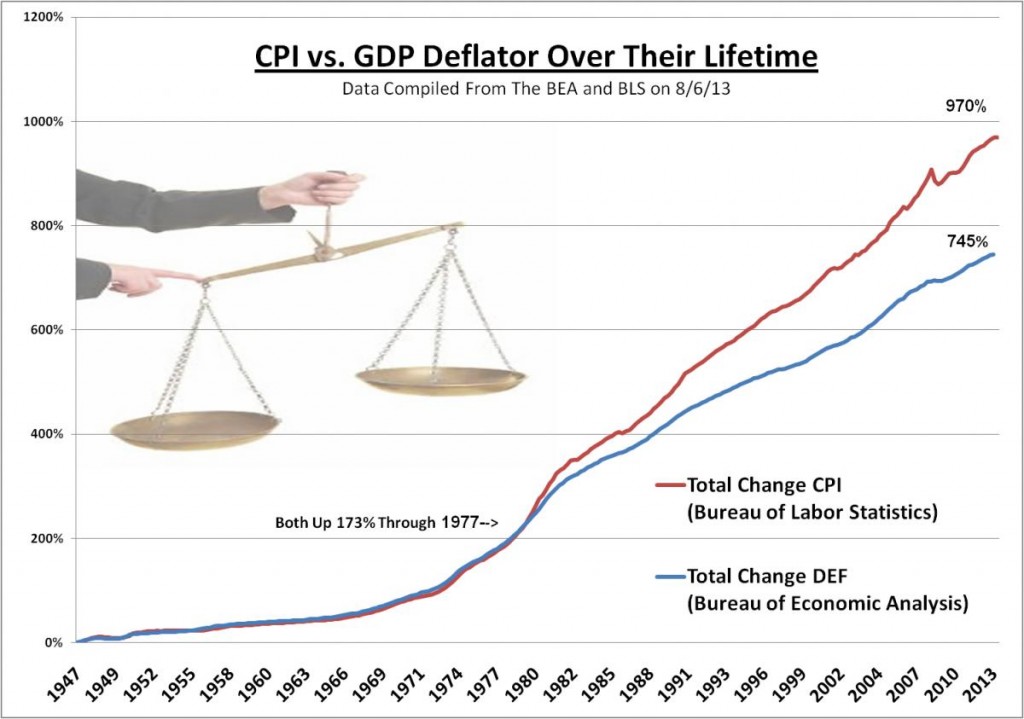

In his latest commentary, Peter Schiff explains the difference between the CPI and the GDP deflator as measurements of inflation. He then shows how the two measurements have increasingly diverged from each other over the years, suggesting that American economic growth as measured by GDP is not nearly as robust as the government would like us to believe.

“Albert Einstein, a man who knew a thing or two about celestial mechanics, supposedly once called compound interest “the most powerful force in the universe.” While the remark was likely meant to be funny (astrophysicists can be hilarious), it sheds light on the often overlooked fact that small changes, over time, can yield enormous results. Over eons, small creeks can carve large canyons through solid rock. The same phenomenon may be at work in our economy. A minor, but persistent under bias in the inflation gauge used in the Gross Domestic Product (GDP) may have created a wildly distorted picture of our economic health.

It would be impossible to measure the economy without “backing out,” inflation. That is why economists are very careful to separate GDP reports into two categories: “nominal” (which are not adjusted for inflation), and real (which are). Only the real reports matter. The big question then becomes, how do we measure inflation? Just as I reported last week with respect to the biases baked into the government’s GDP revisions, the devil is in the details.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Peter's Commentaries

1 Comment

Futures Markets Signal Gold Ready to Erupt

Read Peter Schiff’s latest Gold Letter, with an insightful commentary from Precious Metals Specialist Dickson Buchanan on gold backwardation, a negative GOFO rate, and what they mean for physical gold investment.

“With gold recouping some losses in its most recent trading sessions, many are asking whether or not the bottom has finally formed for the yellow metal. Most of these gains have been simply chalked up to short-covering and dovish remarks by Bernanke during the recent Federal Open Market Committee meetings; however, there are some key indicators for gold which are overshadowed by the media hubbub. Two of them in particular are important to understand, because they reveal a renewed investment demand for physical gold over paper gold or fiat currencies.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Outside Commentaries, Peter's Commentaries

Comments Off on Futures Markets Signal Gold Ready to Erupt

What Doesn’t Kill Gold Makes It Stronger

Peter Schiff’s latest gold letter came out this morning, with an article by Jeff Clark of Casey Research on the booming solar power demand in China and its implications for physical silver. Precious Metals Specialist Dickson Buchanan examines some technical indicators for the health of physical precious metals, while Peter’s commentary takes a look at the recent action in gold futures.

“I’ve been emphasizing for months that the current correction in the gold price is a result of speculative money fleeing the market and not any reflection of gold’s long-term fundamentals. Unfortunately, there is so much money to be made (and lost) by day trading that my cautions have once again fallen on deaf ears.

Well, it looks like the so-called “technicals” are starting to support my theory, and so this month I’m going to depart from my typical discussion of market fundamentals and take a look at the COMEX gold futures market. It turns out that the same paper markets that helped drive the price of gold down are beginning to run into the hard reality of physical gold demand; their reversal may push gold to new highs.”

Continue Reading Peter Schiff’s Gold Letter

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Peter's Commentaries

Comments Off on What Doesn’t Kill Gold Makes It Stronger

US Is Destroying Its Middle Class (Video)

In an excerpt from his radio show on Wednesday, Peter Schiff looks at the latest international data on median household incomes. It may surprise you that America is not anywhere close to #1, despite being known as the land of prosperity and opportunity.

“[Obama’s] got a new concept, ‘the middle out’. He wants to grow the economy from the middle class out… This is the economic cart before the horse. We don’t have a strong economy because we have a strong middle class; we have a strong middle class because we have a strong economy… The reason the middle class is shrinking is because you destroyed the incentives for people to create wealth and to employ people. It’s because of the policies that were targeted at the so-called rich. That’s why the middle class is disappearing.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Peter's Commentaries, Videos

Comments Off on US Is Destroying Its Middle Class (Video)

Peter Schiff: The Dollar Is Going to Collapse Before the Market (Audio)

Tekoa Da Silva of Bull Market Thinking interviewed Peter Schiff last week about the ugly reality that faces the economy when the Fed’s quantitative easing backfires.

“[The Fed] pretends that there is an exit strategy, knowing that exit is impossible. They just have to maintain the pretense as long as they can before the market figures out the true predicament that they’re in. Now they talk about tapering in the future but they can’t taper right now. If the economy is strong enough for tapering, why wait four months, why wait six months? Why not just do it? It’s kind of like the guy who is overweight, and he constantly tells you he is going on a diet but he’s going to start next month. Why don’t you start right now? It’s easy to talk about something you’re going to do in the future. What’s hard is to actually do something in the present. No matter what Ben Bernanke says, between now and the time when he’s supposed to taper, he will come up with an excuse why he can’t. I think he already knows this.”

Listen to the Audio Interview Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Interviews, Peter's Commentaries

Comments Off on Peter Schiff: The Dollar Is Going to Collapse Before the Market (Audio)

Peter Schiff on Detroit and Bernanke’s Gold Ignorance (Video)

In his most recent video blog, Peter Schiff explains how the bankruptcy of Detroit is a microcosm of the what is happening on a larger scale with the entire US. He also explains how frightening it is that Ben Bernanke admitted that he doesn’t understand gold.

“[Bernanke is] the head of a central bank. Gold is a monetary asset. Central banks hold gold as reserves… How can our chief central banker admit that he doesn’t understand gold? … It’s kind of like a coal miner having no idea what that canary is doing in a coal mine. Maybe the canary drops dead and the coal miner [says], ‘What’s up with that canary?’ And then just going about his day… If he doesn’t get out of that mine, he’s going to die too! … Gold tells you if your monetary policy is correct.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Peter's Commentaries, Videos

Comments Off on Peter Schiff on Detroit and Bernanke’s Gold Ignorance (Video)

Bernanke Doesn’t Understand the Great Depression (Video)

If you missed Ben Bernanke’s testimony last week, you can listen to Peter Schiff tear apart the lies of the Fed Chairman in this short video from The Peter Schiff Show.

“[Bernanke] doesn’t see any difference between normal monetary policy and the quantitative easing that he’s doing now, these extraordinary measures? He said, ‘I don’t think so’ in answer to the question, ‘Are your monetary policies causing credit to be misplaced?’ I don’t think so? That is the direct intent of the policy. He implemented the policy to bring interest rates down to a level below their natural rate. He is trying to influence interest rates and direct the flow of credit to housing and government and away from other sectors.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Peter's Commentaries, Videos

Comments Off on Bernanke Doesn’t Understand the Great Depression (Video)

The Powerful Case for Silver

Peter Schiff released a special new research report last week, The Powerful Case for Silver. In his latest commentary, Peter summarizes the report’s major arguments for why silver is an essential part of a diversified precious metals portfolio.

“I am a well-known ‘gold bug’ because of my strongly voiced opinion that gold has been one of the best assets for protecting yourself from the US dollar’s prolonged decline.

Lately, the precious metals have taken a beating, and I’ve been called to defend gold’s future prospects in the media countless times. While I am confident that gold will rebound with a vengeance before long, I think investors are potentially missing an even greater opportunity in that other monetary metal: silver.

To address this oversight, I have compiled a special report called The Powerful Case for Silver, which is available at www.schiffsilver.com. This 14-page report report contains in-depth analysis of what I believe to be the strongest arguments for owning the white metal. What follows is a general overview of the key arguments I make in the report.”

Continue Reading the Full Commentary

OR

Download The Powerful Case for Silver Now

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Peter's Commentaries

Comments Off on The Powerful Case for Silver

Gold Will Rally Whether or Not Fed Tapers (Video)

In his video blog post from Friday, Peter Schiff dissects the latest jobs report numbers and explains how the misleading data proves that the Fed’s quantitative easing isn’t working. Whether they blame Syria or disappointing economic data, Peter expects the Fed to make excuses to continue its stimulus. He spells out why physical gold will perform well no matter what happens.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!