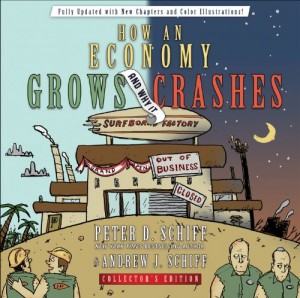

In late December of last year, Peter Schiff and his brother Andrew released a new and expanded version of their illustrated economic fable How an Economy Grows and Why it Crashes. Since the debut of the original version of the book in 2010, people across the world have told them that the book’s simplicity, humor, and straightforward story-telling have given them a better understanding of real economics.

But since they always thought that it could be even bigger and better, they have come out with How an Economy Grows – Collector’s Edition. Twice the size of the original, with colorized illustrations and new chapters on the European Debt Crisis and the Federal Reserve’s Quantitative Easing, this is a great book to share with friends and family to further their economic education.

Learn More About the Book Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

New Collector’s Edition of How An Economy Grows and Why It Crashes

In late December of last year, Peter Schiff and his brother Andrew released a new and expanded version of their illustrated economic fable How an Economy Grows and Why it Crashes. Since the debut of the original version of the book in 2010, people across the world have told them that the book’s simplicity, humor, and straightforward story-telling have given them a better understanding of real economics.

But since they always thought that it could be even bigger and better, they have come out with How an Economy Grows – Collector’s Edition. Twice the size of the original, with colorized illustrations and new chapters on the European Debt Crisis and the Federal Reserve’s Quantitative Easing, this is a great book to share with friends and family to further their economic education.

Learn More About the Book Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!