Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: May 2014

Yellenisms – Don’t Worry, Be Happy!

Peter Schiff isn’t the only one skeptical of the Federal Reserve’s cheery forecasts for the US economy. A new commentary at MarketWatch takes a critical look at Janet Yellen’s testimony to the Joint Economic Committee this week. A lot of what Yellen says is simply nonsense, and it doesn’t take a genius to point out all the contradictions.

“Federal Reserve Chair Janet Yellen did a masterful job navigating the political shoals of the Joint Economic Committee yesterday. She told liberal Vermont Sen. Bernie Sanders (I-VT) that she shared his concern about the Koch brothers and inequality, and conservative Indiana Sen. Dan Coats (R-IN) that Congress needed to act soon to reduce long-term budget deficits.

But her testimony, and the discussion that followed it, raised a host of serious questions about the role of the Federal Reserve in this sluggish economy. As Chair Kevin Brady (R-TX) told Yellen, her “don’t worry, be happy” monetary message might not work. From what I heard, there were at least six issues on which she spoke that made no sense. I’ll call them Yellenisms.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Yellenisms – Don’t Worry, Be Happy!

Today’s Key Gold Headlines – 5/8/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 5/8/14

And the Band Played On

Peter Schiff’s new commentary from Euro Pacific Capital looks under the surface of the US economic data released in the past week. It should come as no surprise that the mainstream media has focused on the positive numbers that support the narrative of a US recovery, while quietly brushing any contradictory figures under the rug.

“After three months of consistently disappointing jobs numbers, the markets were as keyed up for a good jobs report as a long suffering sailor awaiting shore leave in a tropical port. The just released April jobs report, which claimed that 288,000 jobs were created in the U.S. during the month, provided the apparent good news. However, you don’t have to go too far beneath the surface to find some troubling trends within the data. But even this minor excavation was too much for the media cheerleaders and Wall Street pitchmen to handle.

The dominant narrative held that the prior reports had been so weak because the unusually cold weather (the 10th snowiest in the past 50 years) had prevented consumers from venturing outside to make purchases or employers from hiring workers. Time and again the winter was blamed for the disappointing jobs reports that came in over the 1st quarter. As a result, the consensus of economists predicted a rebound in April with 215,000 net new non-farm jobs. The 288,000 figure that greeted the markets last week – which helped bring down the unemployment rate to a post-crash low of just 6.3% – confirmed the weather hypothesis.

In reality, the desperation in which these tenuous data straws were grasped is a testament to our chronic economic weakness…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries

Comments Off on And the Band Played On

Today’s Key Gold Headlines – 5/7/14

- China Gold Consumption Rises in First Quarter, Wall Street Journal

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 5/7/14

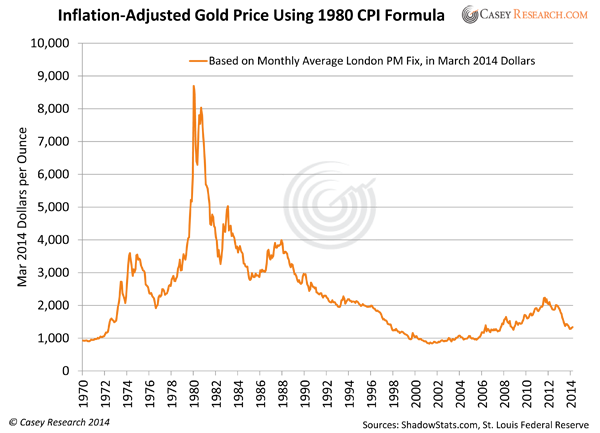

Did Gold Really Peak in 2011?

Jeff Clark’s new commentary at Casey Research takes a look at a misleading chart that has been making the rounds. It purports to show that when you take inflation into account, gold matched its 1980 peak back in 2011. Gold bears look at this as proof that the bull market is over. Not so fast! Clark explains why this chart and the data underlying it are unreliable. The truth is that gold still has a long way to go before matching its 1980 peak.

“Using the 1980 formula, the monthly average price of gold for January 1980 would be the equivalent of $8,598.80 today. The actual peak—$850 on January 21, 1980—isn’t shown in the chart, but it would equate to a whopping $10,823.70 today.

The Shadow Stats chart paints a completely different picture than the first chart. The current CPI formula grossly dilutes just how much inflation has occurred over the past 34 years. It’s so misleading that investment decisions based on it—like whether to buy or sell gold—could wreak havoc on a portfolio.

This could easily be the end of the discussion, but there are many more reasons to believe that the gold price has not peaked for the current bull cycle…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Did Gold Really Peak in 2011?

Today’s Key Gold Headlines – 5/6/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 5/6/14

Warm Weather, Cold Economy (Video)

Have you bought into the hype that the US economy is recovering? Last week’s jobs numbers were supposedly positive, obscuring the underlying reality of a struggling economy. In his latest video blog post, Peter Schiff picks apart the economic data from last week to reveal that not everything is as rosy as the Federal Reserve would like us to believe.

“The fact that we’re hitting 4-year lows against the pound shows you how much confidence currency traders have in the Fed’s forecast. Meanwhile, look at the price of gold, hit a 3-week high today… If I’m correct on what the Fed is going to do, if I’m correct about the real state of the US economy, gold is not just going to rise, it’s going to take off.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Peter's Commentaries, Videos

Comments Off on Warm Weather, Cold Economy (Video)

Today’s Key Gold Headlines – 5/5/14

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 5/5/14

Watch Out for a Major Market Correction (Video)

Renowned investor Marc Faber spoke with CNBC this week about the over optimism surrounding the US stock market. Faber thinks this is the wrong time to get into US stocks and warns of an inevitable correction. While Faber talks about emerging markets as good investments, don’t forget that this is also a great time to buy into physical gold and silver at very cheap prices.

“I believe it is too late to buy the US stock market… It should be clear to anyone. When prices are low… for stocks and interest rates are very high… then the expected returns are also very high. Whereas, when interest rates are zero… what is your expected return over the next ten years? … In general, individual investors have excessively optimistic expectations about their future returns. “

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Watch Out for a Major Market Correction (Video)

Get Your Gold Now – Collapse Will Be Sudden (Video)

Jim Rickards, author of Currency Wars and The Death of Money, gave a long and entertaining interview to Hedgeye TV this week. Rickards talked in-depth about the failures of Keynesian monetary policy. Like Peter Schiff, he believes that the Federal Reserve will not be able to successfully taper quantitative easing. Most importantly, Rickards emphasized how quickly the international monetary system will collapse, though exactly what will trigger that collapse is hard to identify. One of your best protections is hard assets, but make sure you buy your gold while you still have the chance!

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!