Jeff Clark’s new commentary at Casey Research takes a look at a misleading chart that has been making the rounds. It purports to show that when you take inflation into account, gold matched its 1980 peak back in 2011. Gold bears look at this as proof that the bull market is over. Not so fast! Clark explains why this chart and the data underlying it are unreliable. The truth is that gold still has a long way to go before matching its 1980 peak.

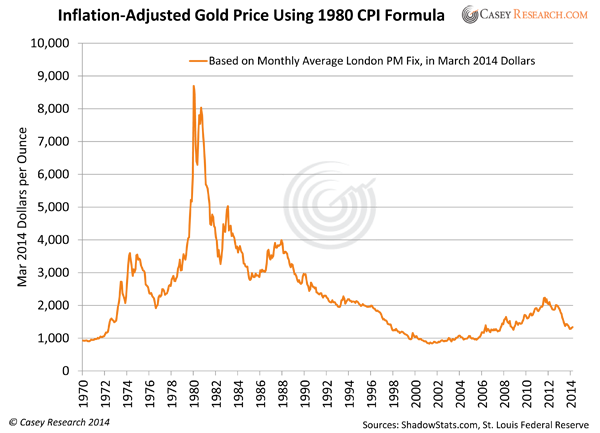

“Using the 1980 formula, the monthly average price of gold for January 1980 would be the equivalent of $8,598.80 today. The actual peak—$850 on January 21, 1980—isn’t shown in the chart, but it would equate to a whopping $10,823.70 today.

The Shadow Stats chart paints a completely different picture than the first chart. The current CPI formula grossly dilutes just how much inflation has occurred over the past 34 years. It’s so misleading that investment decisions based on it—like whether to buy or sell gold—could wreak havoc on a portfolio.

This could easily be the end of the discussion, but there are many more reasons to believe that the gold price has not peaked for the current bull cycle…”

Read the Full Piece Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Did Gold Really Peak in 2011?

Jeff Clark’s new commentary at Casey Research takes a look at a misleading chart that has been making the rounds. It purports to show that when you take inflation into account, gold matched its 1980 peak back in 2011. Gold bears look at this as proof that the bull market is over. Not so fast! Clark explains why this chart and the data underlying it are unreliable. The truth is that gold still has a long way to go before matching its 1980 peak.

Read the Full Piece Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!