Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: September 2013

Today’s Key Gold Headlines – 9/10/13

- Silver Shines as White Gold Loses Sheen in Europe, Economic Times

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 9/10/13

Today’s Key Gold Headlines – 9/9/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 9/9/13

Wake Up! Gold and Silver Likely Bottomed, Headed Higher (Audio)

Peter Schiff was interviewed on Gold Seek Radio yesterday. Chris Waltzek spoke with him about how the conflict with Syria might affect gold prices and the great potential silver has as the economic “recovery” fails to develop. They ended with a conversation about the importance of a gold standard and the possibility of a massive short squeeze in the gold and silver futures market.

“I don’t think it even matters if the Fed tapers or not. I think the price of gold goes up either way. If we do get a taper, I think it’s already factored in and it’s ‘buy the rumor, sell the fact.’ If we don’t get the taper, then we get an even bigger rally. And my bet is that the Fed is going to be looking for an excuse not to taper, but ultimately to increase the amount of QE. Maybe if we start a war in Syria, that might be cover for the Fed to hold off.”

Listen to the Full Interview Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews

Comments Off on Wake Up! Gold and Silver Likely Bottomed, Headed Higher (Audio)

Today’s Key Gold Headlines – 9/6/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 9/6/13

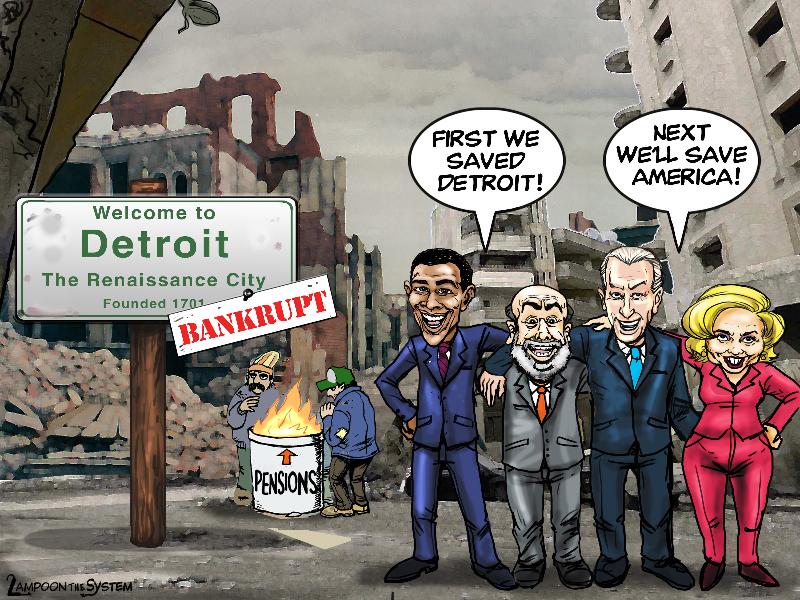

The Road to Ruin

Here’s a little humor to brighten up a lackluster day in the precious metals markets. Let’s just hope this economic “salvation” doesn’t find its way to a city near you anytime soon!

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Road to Ruin

Today’s Key Gold Headlines – 9/5/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

1 Comment

Marc Faber: Physical Gold Headed to New Highs

Hard Asset Investor interviewed Marc Faber last week to get his opinion of where the stock market and gold price are headed. Unsurprisingly, the publisher of the Gloom, Doom & Boom Report thinks the stock market is preparing for a large correction and gold is destined for an epic bull rally. Most importantly, he emphasized that investors should buy physical gold – not paper gold assets.

“We have had a meaningful correction [in gold]. From $1,921 in September 2011 to less than $1,200 at the bottom is a fairly large correction. But in longer-term bull markets, these kinds of corrections do occur. We had a 40-50 percent correction in 1987 in equity markets. But the bull market lasted until the year 2000.

Looking at the fundamentals, looking at how debt will continue to increase and how central banks will continue their monetization not only in the U.S. but on a worldwide scale, I assume the price of gold will trend higher. Most likely we’ve seen the lows below $1,200.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

Comments Off on Marc Faber: Physical Gold Headed to New Highs

Today’s Key Gold Headlines – 9/4/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 9/4/13

Off to the Races

Peter Schiff’s September Gold Letter has been released, and it is worth noting that this will be its final edition. Stay tuned for the launch of Peter Schiff’s Gold Video Dispatch in October.

This month, Peter explains how the groundwork has been laid for an exciting autumn season in the physical precious metals market. If you’ve been waiting to buy gold, now might be the perfect time! You’ll also find an eye-opening commentary from Charles Hugh Smith and Lampoon the System’s latest jibe at the jokers who “saved” Detroit.

“Summer is traditionally a slow season for precious metals, but this summer started with a rout. In the last week of June, gold and silver hit 2-year lows of $1,192 and $18.61 respectively.

Fortunately, after staggering along the lows, the precious metals are off to the races once more – with gold rallying more than 18% and silver 28%. This remarkable performance continues even in the face of the Fed’s sustained tapering threats.

The exhaustion of short-sellers paired with insatiable global physical demand has positioned gold for an exciting conclusion to a volatile year.”

Continue Reading Peter Schiff’s Gold Letter

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Posted in Peter's Commentaries

Comments Off on Off to the Races

Gold Will Rally Whether or Not Fed Tapers (Video)

In his video blog post from Friday, Peter Schiff dissects the latest jobs report numbers and explains how the misleading data proves that the Fed’s quantitative easing isn’t working. Whether they blame Syria or disappointing economic data, Peter expects the Fed to make excuses to continue its stimulus. He spells out why physical gold will perform well no matter what happens.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!